Make a Europe splash with Aussie cash

PORTFOLIO POINT: Europe is more than a good holiday destination at the moment … it’s also worth considering as an investment haven and hedging opportunity.

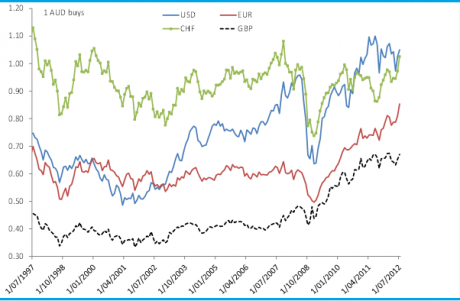

It’s an unfortunate aspect of public discussion that a strong currency seems to be viewed negatively. Especially with the $A at or near records against so many global currencies.

Chart 1: $A against selected major currencies

This is a regrettable attitude, not only because the assumptions for the economy more generally are false (Dutch disease etc), but also because the reality for the domestic investor is quite different. A strong unit in truth provides valuable opportunities for wealth accumulation, portfolio diversification and hedging.

The latter point may appear counterintuitive given currency risks inherent in a globally diversified portfolio. Indeed I can appreciate that exchange rate volatility makes some investors nervous. It makes me nervous too, but I think the current global macroeconomic backdrop puts Australian investors in a unique position enjoyed by few in the world. If framed correctly the currency risks for us are much lower than what it would otherwise appear.

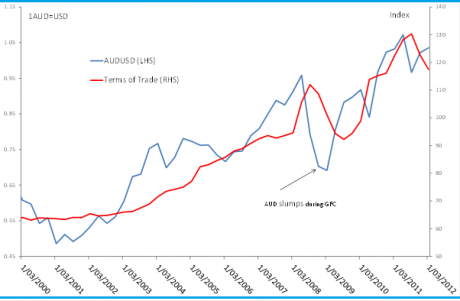

To see this, consider the factors that drive the $A higher at any given point. Fundamentally we know the terms of trade is a key driver and the correlation between that and the $US (or the trade weighted index) is generally pretty good.

Chart 2: Terms of Trade and the $A

Furthermore, we know also that interest rate differentials are a factor and Australia certainly has that in its favour compared to nearly all the major economies.

Then, of course, there is sentiment which incorporates things like the trade balance (which used to be much more important before the days of financial deregulation), public debt and other factors. Currently, the $A is increasingly being seen as a safe haven and a better store of value given the superior state of our finances and the fact we are not printing money. Consequently, a number of central banks have announced they will either add to or increase their holdings of Australian dollars.

Now consider the outlook, or rather the movement of the $A under the three possible scenarios that might emerge.

- Things deteriorate;

- We plod along;

- Things improve.

Under each scenario the most likely path for the $A on a three to five-year view is down. So let’s go through each in a little more detail to see why.

Things deteriorate. Pick your reason – a flare-up in Europe, slowdown in China or a combination of the two. The catalyst doesn’t matter as the only difference will be magnitude. But under the more extreme example of another crisis sparked by Europe, we only need to look back to the GFC to see what happened to the $A.

It collapsed, hitting a low of 60 US cents and averaged 73 US cents for much for the next year. The direction would be the same under any combination though, and there are four reasons for this.

The RBA would cut rates and relatively, we have more rates to cut. The huge yield differential we have would be eliminated.

The terms of trade would decline sharply.

Our public finances would deteriorate; the government would become more heavily indebted. Budget deficits would increase, growth slow and sentiment toward the $A as a safe haven would fall.

If it didn’t the RBA would intervene to weaken the $A. Already the political pressure is there to do just that, and the central bank itself has hinted they might do this if currency moves diverged too much from fundamentals.

The world plods along. Under this scenario it’s “same old” basically. No material change in anything and the $A would remain volatile, fluctuating as it has done on a reasonably wide range from say 95 US cents to 110 cents. In the end, we either revert to scenario A or C.

Things improve. In the final example, it is true to say that the terms of trade would rise, the budget deficit would improve and the $A would likely appreciate – initially. Eventually though, and it might be five years from now, the major central banks will have to hike rates in response to the improved global environment. That is a fact, and when they do the $A will come down. So even in this scenario the medium- long-term view for the $A is down after an initial appreciation.

In sum then, with the $A where it is, and given the extreme nature of global settings at the moment, the risks of a rapid and sustained domestic currency appreciation are much reduced. Not eliminated, but significantly reduced – especially considering the broad consensus that the $A is already overvalued. It is much more likely then, under any scenario, that the medium-term outlook is for a weaker $A.

Taking an equities path

Now it’s true to say that investors in the domestic market will obviously gain some advantage or gain some form of hedge by investing in domestic stocks with a high proportion of their income derived from abroad. Our miners fit into this category and I’m obviously bullish on our miners. But for different reasons that I’ve outlined elsewhere, not because of the $A outlook.

However, the main implication from my analysis above is that it is a very opportune moment for domestic investors to either gain, or lift, their exposure to global equities and not just be confined to the domestic scene. The unique global backdrop provides ample opportunity to find stocks that offer significant value. Think about it. You gain exposure to the global recovery story, which has significant upside and is the greater probability, while limiting your downside (given the $A would slump) in the less likely adverse scenario, like a hedge if you will.

Within that I would target big, brand-name, globally diversified stocks that pay a high dividend. Preferably on the European bourses. This covers you on the good chance that the world economy just plods along with growth. You take the dividend, timing your exit from any investment when the $A is near the bottom of its trading range.

The Eurozone, Switzerland, Britain and even and some of the Nordic countries are a perfect place to start your search. European stocks are generally underperforming their US counterparts and given the blanket of fear that hangs over Europe and all things European, there is generally better value to be found. Or thought of another way, there is less downside should things deteriorate given much of the plausible downside has already been priced.

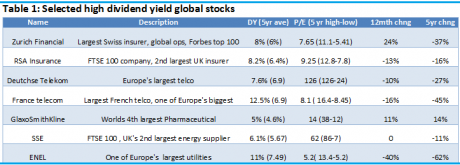

As an example, take a look at the list of stocks below. Now these are not stock recommendations, they are merely examples of the type of stocks that are worth a look. They are all very large, well-known established global players. Moreover they pay a fantastic dividend which has been comparatively stable.

Table 1: Selected high dividend yield global stocks

Within that, some are expensive (in local currency terms, but less so in $A terms), Deutchse Telekom comes to mind, and some have high debt (ENEL and SSE). But remember many of these companies reside in capital intensive industries and so have high debt as a rule.

It is the quality of that capital investment and the underlying earnings strength that is the key in selecting those stocks. ENEL, for instance, has a high return on equity and a high return on investment. Others, like Zurich Financial and RSA, don’t have high debt. Obviously an in-depth analysis of each stock is beyond the scope of this note. But the above table does highlight what can be found; it is food for thought and the unique global backdrop makes a very compelling case.

So in summary, we have a European market that has a lot of very bad news already priced, an $A at or near records to most European currencies, with only downside on a three to five-year view.

All of this only adds to the very attractive case that can be made already, for some of these high dividend yield paying stocks.

Some things to keep in mind if you are keen to explore this option though. Get tax advice, speak to a specialist and do your research. Issues to consider are franking credits, or the lack of, and withholding tax in some jurisdictions. Know the risks. If you do all of the above, investing globally isn’t so scary and is probably even less risky given the position of the $A.