Low rates have a high price tag for first home buyers

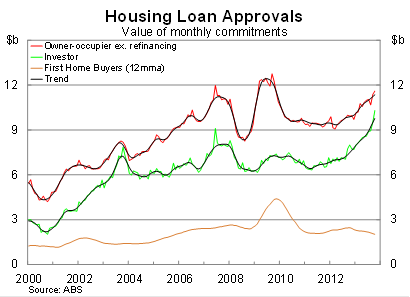

The value of housing loan approvals continued its upward trajectory in October, particularly for investors. But for first home buyers, it was an entirely different story: their activity has never been weaker.

With mortgage rates so low, it is no surprise that lending is on the rise. However, low interest rates and rising house prices have created two situations that do not bode well for the housing market: limited first home buyer activity and increasing speculation.

The number of loan approvals for owner-occupiers, excluding refinancing, rose by 2 per cent in October to be almost 17 per cent higher over the year. By comparison, loan approvals to investors are up by 29 per cent over the year to October, continuing to be the major driver of the housing market.

It is a very different story for first home buyers. Recent surges in house prices, particularly in Sydney, appear to have effectively priced them out of the market. Despite the historically low mortgage rates offered by lenders, most first home buyers simply do not have the deposit or capacity to buy a home at current prices. Alternatively they are simply showing a bit of common sense and refusing to leverage up to their eyeballs during uncertain times.

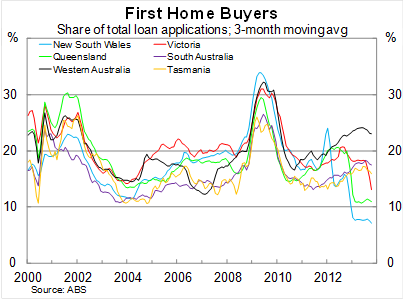

The value of loan approvals to first home buyers is around 22 per cent lower over the year, making up just 12 per cent of all approvals. First home buyer activity is at a historically low level in New South Wales and Queensland, while in Victoria activity has fallen sharply over the past three months.

By comparison, first home buyers are still fairly active in Western Australia. This largely reflects that their state economy is still stronger than the east coast, but also that dwelling price growth has not been particularly strong out west in recent years.

There is no reason to think that first home buyers will change their behaviour in the near term. I’m more pessimistic than many on the outlook for house prices, but even I acknowledge that prices will continue to rise in the first half of 2014.

Housing will not become any more affordable in the near term and that will keep first home buyers on the sidelines. This is a group that is already set to suffer disproportionately from slow employment and wage growth as the non-mining sector attempts to rebound. This is not a group that will be taking big risks and certainly not one that will be looking to borrow heavily.

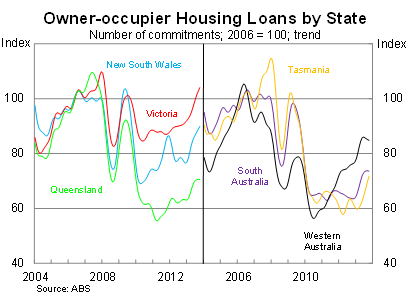

For owner-occupiers, the pace of loan approval growth has slowed in a number of states on a trend basis, including in Western Australia. The Perth housing market has been the second strongest so far this year behind Sydney, so this is potentially an interesting development and one worth keeping an eye on.

Owner-occupier loan approvals are strongest in New South Wales and Victoria. However, obviously the investor data is of more interest at the moment. We do not know the state breakdown for investors until Friday. Given that nationwide investor loan approvals rose by 8.2 per cent in October, I expect strong growth across most states, particularly in New South Wales.

It is clear that low interest rates have gained some traction in the Australian housing market. However, this has resulted in two undesirable developments. First, first home buyers are effectively priced out of the market in most states; and second, speculation and investor activity has become a major driver of price developments.

Under these circumstances, price growth is unsustainable. Eventually the market will run out of owner-occupiers looking to upgrade or downgrade, which will leave investors simply speculating among themselves. The reality is that first home buyers are an integral part of sustainable house price growth. As long as they remain on the sidelines, I will remain pessimistic about the outlook for prices.