Lies, damn lies and GDP growth data

New research by the Reserve Bank of Australia suggests that quarterly volatility in growth may often, in fact, reflect measurement error rather than changing economic conditions. By utilising information from Australia's three measures of GDP, it is possible to generate a measure of growth that is both less volatile and more indicative of underlying activity.

It might seem counter-intuitive, but Australia has three different measures of domestic activity -- based on expenditure, income and production. Conceptually, each measure should be identical since one person's spending is another person's income but measurement error often means that each measure provides a very different interpretation of economic conditions.

The expenditure measure of GDP is probably the one that most readers are familiar with. It is comprised of expenditure from households, businesses and the government plus net exports and the change in inventories.

The income and production measures of real GDP are similarly straightforward. The income measure captures the income from labour and capital services plus indirect taxes and subsides; while the production measure estimates the value of final goods produced less the value of intermediate goods utilised in production.

By convention, the Australian Bureau of Statistics takes the average of the three measures to determine real GDP in a particularly quarter -- that's the estimate you'll read in Business Spectator or see on the news.

But does it make sense to give each measure an equal weight in the average? Might one measure provide more information than the others or be less prone to revisions?

These are key questions since estimates of growth help to frame economic decision-making. Previous research by the RBA, for example, indicates that the production measure of GDP “tends to be revised less than the other two measures and is as reliable in real time as GDP (A).”

That research provides a fairly compelling case for taking a more statistical approach to GDP measurement and provides the basis of a new research paper by the RBA, A State-space Approach to Australian GDP Measurement.

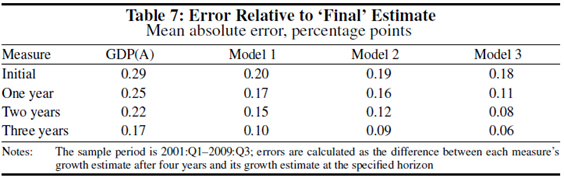

By utilising the available information -- and taking advantage of correlated errors in the existing measures -- the RBA is able to derive a measure of real GDP that is less volatile than the GDP (A) approach and provides a better indication of underlying activity in the Australian economy.

The paper derives three models. The first assumes that “shocks to GDP and the measurement errors are independent of each other.” The second allows correlation between shocks to GDP and measurement errors. Finally, the third model introduces the quarterly change in the unemployment rate as an additional explanatory variable.

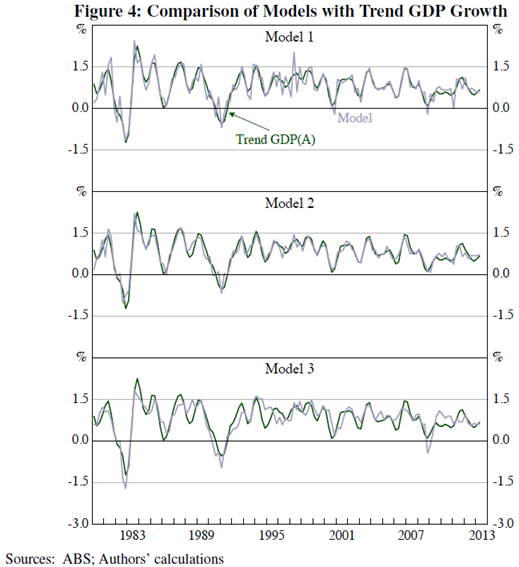

The results from the three models, and a comparison against GDP (A) quarterly trend growth, are contained in the graph below. The trend measure of GDP is smoother than the model approach but it has one key disadvantage: it suffers from end-point problems.

The ABS applies a Henderson trend that relies on both past and future observations, for real time observations -- the end point -- there are insufficient observations available to produce an effective trend measure. As a result, real-time trend estimates from the ABS are subject to significant revision when new data is received.

As a result, the real advantage of the model isn't so much its history as its real-time estimates, which the RBA considers more accurate than even the ABS' trend estimates. That might not sound like much but considering the recent real-time performance of key ABS indicators, such information would be valuable to not only key decision-makers but also financial markets.

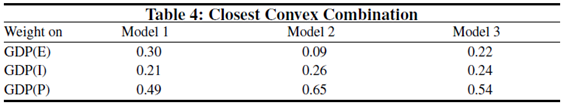

Some of the discussion above might appear complex and reading through the research paper it can be quite dense. Luckily, the authors were generous enough to provide weights for each measure of GDP that would allow writers such as myself or market participants to approximate the RBA's estimates of Australian economic growth. Those weights are contained in the table below.

By taking a more sophisticated approach the RBA has managed to create a superior measure of Australian real GDP. If utilised, the model would help support RBA decision-making and help the market identify turning-points in real-time rather than months after the fact.

A key takeaway is that the production measure of GDP provides the most information on economic conditions and economists and traders should bear this in mind when they consider the economic outlook. The Australian economy is not as volatile as commonly believed and trend estimates – while more useful, also have problems estimating growth in real-time.