LICs: Premiums and discounts

Summary: Listed investment companies (LICs) usually trade at a premium/discount to their net tangible assets (NTA). There's more to it though.

Key take-out: How premiums/discounts can catch out LIC investors, and other reliable measures to depend on.

Making a solid return on a listed investment company (LIC) requires more than buying at a discount to its net tangible assets (NTA).

In fact, buying at a discount won't guarantee a return anyway.

This is just one of several things that investors should take into consideration before investing in a LIC.

Similar to how exchange traded products and managed funds focus on certain corners of the market, actively managed LICs employ specific strategies. The majority of these LICs are long all their holdings, although there are a few that deploy a long/short strategy.

Of the 10 largest IPOs last year, six were listed investment companies or listed investment trusts. Australian holdings held by LICs were reduced in the 12 months to the end of April, from 84 per cent to 72 per cent. On the contrary, there was an increase in global assets held by local LICs, from 15 per cent to 25 per cent of total portfolio holdings.

Some pay a much higher yield than ASX 200 stocks (though don't be fooled by dividends).

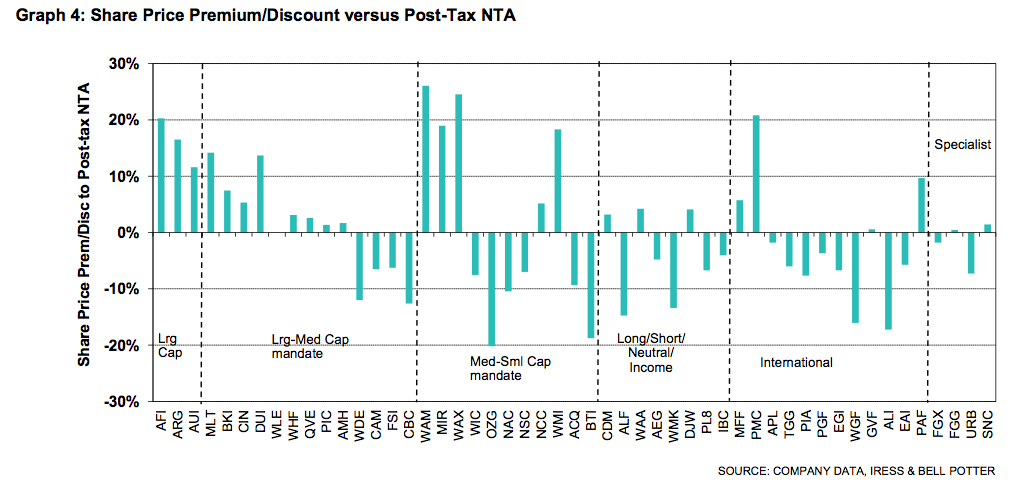

LICs will trade at a premium or discount to their NTA. But rather than looking at this per se, Bell Potter LIC analyst Nathan Umapathy says looking at a LIC's own historical average is more important because mean reversion usually comes into effect, although this works best for LICs with long track records.

He uses Djerriwarrh Investments as an example, a LIC that's trading at a slight premium now, but has traditionally traded at a double-digit premium on a one-year through to 10-year basis.

Why the discount?

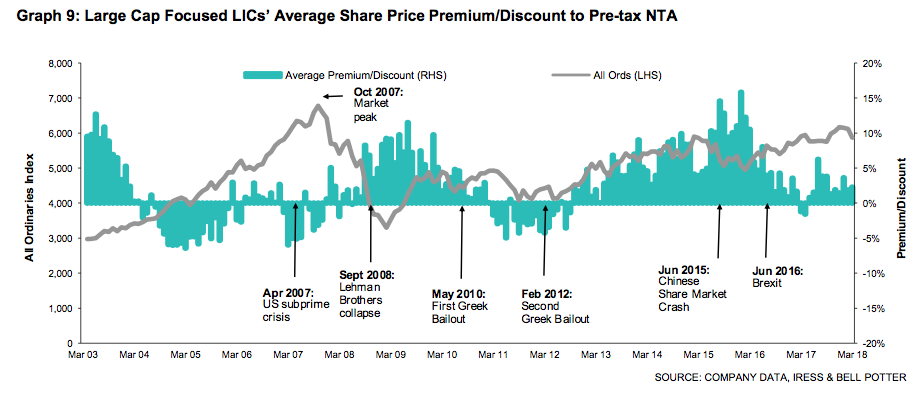

Small LICs generally trade at a larger discount to pre-tax NTA, averaging an 8.4 per cent discount over the last eight years to the end of December 2017. Compare that to large LICs that traded at a 3.5 per cent premium over the same period.

(March 2018 data)

Some believe smaller LICs, like small companies, fare best during periods of market expansion. Something to consider with smaller LICs though is they are more susceptible to swinging from a premium to a discount because of thinner trading volumes.

Broadly speaking, ongoing poor performance, or lack of track record and promotion, are key reasons that LICs trade at a discount. Other reasons, equally important, include little-to-no dividend stream, or a perceived inability to pay fully franked dividends in the future.

Traditionally, LICs that pay high dividends tend to trade at a premium.

And what if a LIC is trading at a very high premium, and not paying any dividends? Well, investing then mostly boils down to trust in the manager, or in a belief the underlying assets are at a turning point.

Apart from historical averages, it can be difficult to determine if the discount indicates danger or opportunity. Trading at a discount means a LIC is constrained in its ability to grow, and may resort to raising capital, diluting existing shareholdings. Discounts are also more attractive to activist investors.

Only a potential tailwind

A problem with making these investments based on ‘discounts' is LICs are only obligated to disclose their NTA at the end of each month. They have 14 days to disclose this information to the market. The rest of the time investors are placing trades without really knowing the underlying value of the NTA.

(March 2018 data)

Buying at a 15 per cent discount and selling at a 15 per cent premium would produce a net gain of 30 per cent. But that's ignoring positive or negative market movement.

LICs may appear ‘on sale' for investors to never receive that discount. It could pay off like a geared investment, however, this all depends on the direction of the underlying assets.

When the LIC fits

For these reasons, Umapathy believes investing in LICs that could capitalise on areas of the market you may not otherwise be able to access.

“Oftentimes it can be really difficult for individual investors to replicate a strategy of an institutional fund manager — that might be unlisted equities, the Asian market, or global exposure in general,” says Umapathy.

“An investor can use it as a building block. A lot of these managers, because they are big in size and more scalable than individual and retail clients, they can offer more sophisticated investment strategies.”

Beware of options

Something else worth considering is whether the LIC has listed with options attached to its shares, historically, a common structure.

Fortunately, Umapathy says it's becoming far less common for LICs to IPO like this, which is helping mitigate the premium problem. This way, the shares trade in line with their net asset value upon listing rather than at a slight premium.

Otherwise, an investor who buy shares in an options-fitted LIC in the first two years after its listing may actually lose out if the share price rises and initial investors exercise their options. On the other side of the equation, investors who bought into the LIC IPO but don't exercise their options would also see their holdings diluted.

“The thing about options, in the past they were introduced to incentivise investors during the LIC's IPO process,” explains Umapathy.

“A few of the larger LICs that have recently listed have done so without options attached, and what we have found is the removal of options has made things a lot cleaner for investors to get access into a LIC.”