LICs I'm watching: AMCIL and Mirabooka

Summary: AMCIL Ltd has shifted from the media investments portfolio it was in the early 2000s to become an LIC with the flexibility to invest across all sectors, and now provides exposure to undervalued opportunities in the medium term. Mirabooka Investments is an attractive way to get exposure to companies outside the ASX 50, but we want to invest at a fair price or better. |

Key take out: These two LICs will stay on our watch list, as they are trading at above what we consider the best value at present. |

Key beneficiaries: General investors. Category: Listed Investment Companies. |

Park your partners on a bench with a book – or in front of a TV with the footy on – because it is time to go window-shopping. Today we're browsing through the more boutique offerings of the biggest investment house in the land of LICs as we take a look at why Australian Foundation Investment Company's (AFI) siblings, AMCIL Limited and Mirrabooka Investments, are front and centre of my watch list.

The history lesson

AMCIL has an interesting background after it listed on the market in 2000 as Australia Media & Communications Investments Ltd. Its purpose was to invest in media and communication companies (you may have got that from the name) – think companies like Publishing & Broadcasting Limited, WA Newspapers Holdings, C&W Optus, News Corporation and Telstra Corporation.

In 2002, performance was in decline. The portfolio was dominated by Telstra and News Corp, which caused the share price to experience a period of sustained weakness. This resulted in AMCIL trading at a discount to net tangible assets that appeared increasingly difficult to overcome due to structural changes in the media and telecommunications sectors. The board decided it was in the best interests of shareholders to wind up the LIC.

Over a period of time the assets were sold down and capital was returned to shareholders. The wind up was halted in 2003 as a new proposal was issued to recapitalise AMCIL. New shares were issued and further capital was raised. The investment mandate was altered allowing the manager to invest in stocks from all sectors; it included participation in IPOs and also trading opportunities and the use of options and conservative levels of gearing when appropriate.

AMCIL today

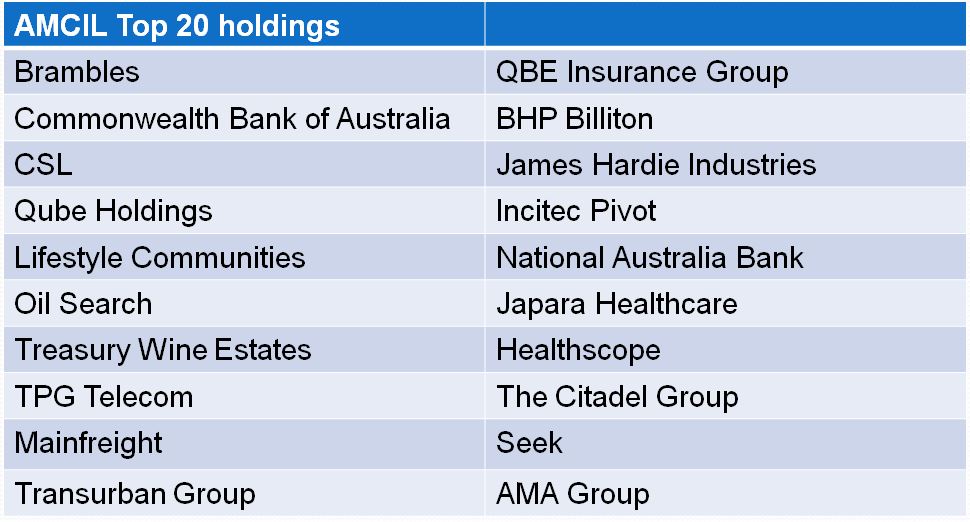

AMCIL now sets out to do what its much larger sibling, AFI, cannot. It looks to take advantage of investment opportunities that sit outside AFI's mandate and generate an index-unaware return for shareholders over the medium term. You could look at it as a combination of the best large cap ideas from AFIC and Mirrabooka.

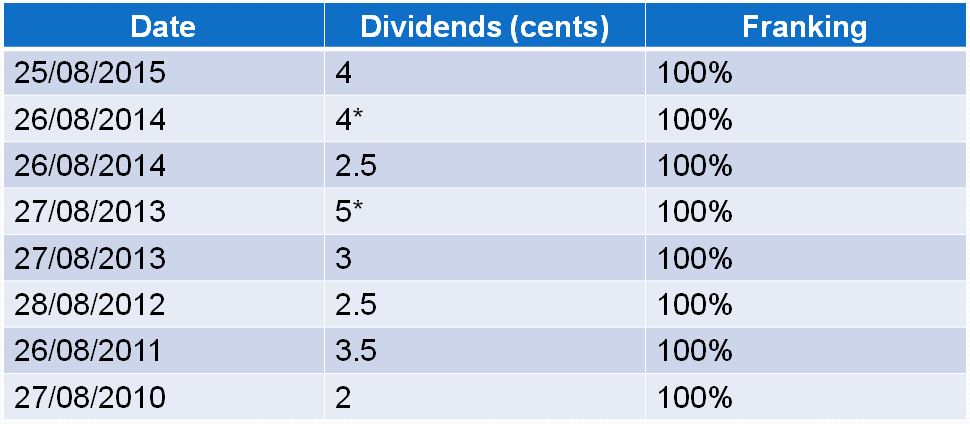

For those seeking income, AMCIL does pay fully franked dividends, however they only pay a final dividend. The LIC does not try to smooth out the dividend either. It will pay out all income and franking available from that year, and this is why the dividend amount does vary.

* For AMCIL's dividend history back to 2005, click here.

At the time of writing AMCIL's share price ($0.91) was sitting in line with the last reported pre-tax net tangible assets ($0.92). Due to the more active nature of the AMCIL portfolio, investors should pay more attention to the post tax figure of $0.86. When the gap closes, AMCIL would be a wise acquisition for those looking for a combination of small and large cap stocks actively managed by the longest running LIC house in the country.

Mirrabooka Investments Limited (MIR)

AMCILs stablemate, Mirrabooka Investments Limited (MIR), has a far less interesting history. Listed in 1999, Mirrabooka invests in companies outside of the ASX 50. The main focus is building a diversified portfolio of small to mid-cap companies with solid balance sheets and management teams that have a decent level of ownership.

Where AFI has investors covered for the large end of town, Mirrabooka has you covered for the emerging companies that hopefully will grow into tomorrow's large cap stocks. In the portfolio you will find companies such as Treasury Wine Estates (TWE), Vocus Communications (VOC) and Eureka's own growth portfolio holding AMA Group (AMA) and Qube Holdings (QUB) and Income Portfolio stock, Wellcom Group (WLL).

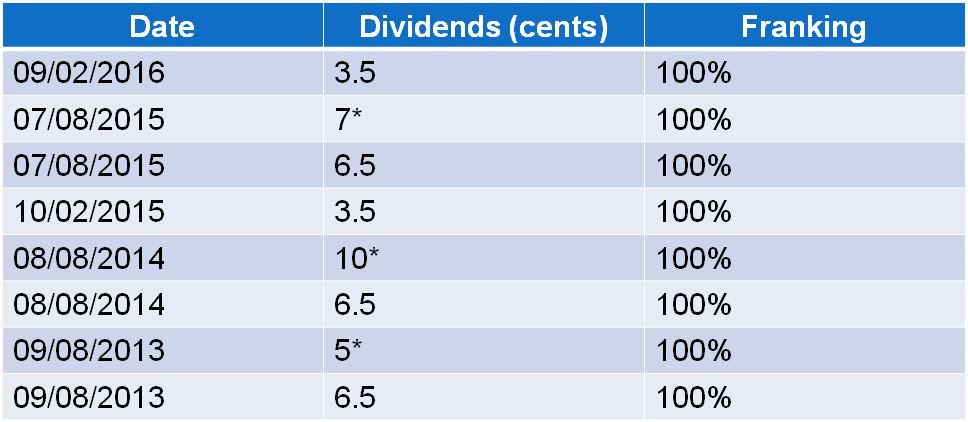

Payments of special dividends paid from capital gains on realised profits.

* For Mirrabooka's dividend history back to 2001, click here.

The biggest issue that investors face right now with Mirrabooka is the premium to net tangible assets the share price trades at. It's a victim of its own success. Since late 2012 the share price has traded at a premium to the value of the underlying portfolio. This says a lot for how Mirrabooka is viewed by investors given the spree of small cap LICs coming on to the market over that period of time.

Mirrabooka is an attractive LIC in our eyes but of course we want to invest at a fair price or even better. Right now the LIC is trading at post tax premium to NTA of 26.51 per cent, and while it is at those levels it will remain on our watchlist.