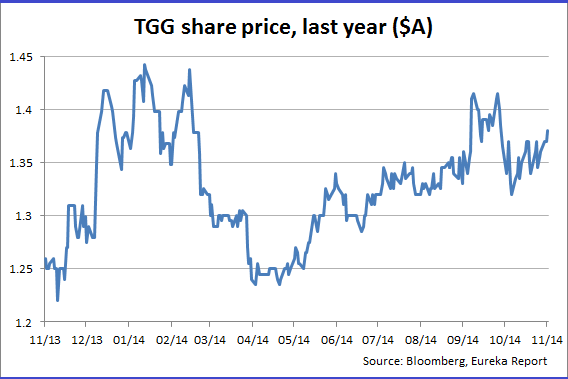

LIC spotlight: Templeton Global Growth Fund (TGG)

Summary: Templeton Global Growth Fund looks for stocks around the world that are priced at a severe discount to fair value, such as European banks during the 2012 European debt crisis. But the fund hopes to appeal to investors who are worried about risk by focusing on protecting investors' money during downturns. At present, the fund is taking advantage of a falling oil price to look for opportunities. |

Key take out: TGG takes the view that some good companies are bad investments – while some bad companies can even be good investments. |

Key beneficiaries: General Investors. Category: Shares. |

Over the coming weeks, Eureka Report will be running a series profiling a number of listed investment companies. Also referred to as closed-end funds, LICs are managed funds that can bought and sold on the ASX like shares. LICs have a limited amount of shares available and don't regularly issue new ones. This differs from exchange-traded funds, which are open-ended, meaning the size of the fund is not fixed.

Many investors say they are focused on value, but Templeton Global Growth Fund (TGG) takes a very specific approach to looking for valuable opportunities. “We can invest in almost any company around the world. It just has to be at a severe discount to what we think it's worth,” portfolio manager Peter Wilmshurst explains.

Peter Wilmshurst. Source: Franklin Templeton Investments.

The fund seeks the best opportunities, regardless of whether they are in emerging or developed markets and regardless of sector. Backed by the Franklin Templeton Investments group – a global fund manager with $140 billion under management – the Australian fund draws on the research of the organisation's 39 analysts around the world.

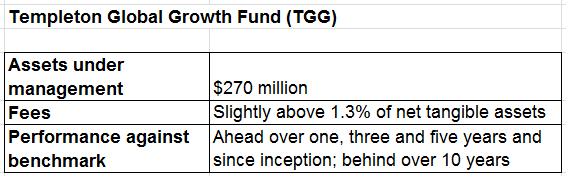

The fund, which has $270 million in assets under management, usually sells a stock once it reaches fair value. For good companies the fund sometimes waits for a slight premium, but does not wait for a stock to be overvalued. “Our fundamental principle is you buy a stock when it's undervalued and when it reaches fair value you're looking for the next undervalued name,” Wilmshurst says.

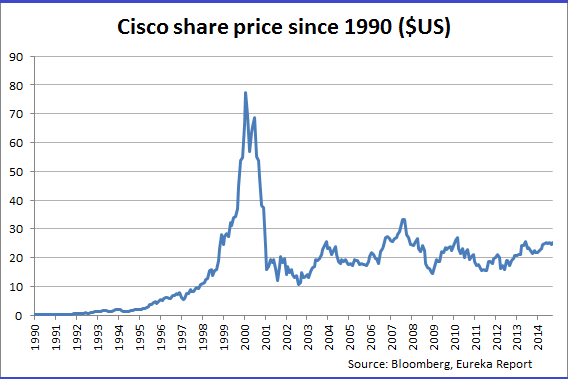

Wilmshurst's style differs from the value investing approach, in which investors focus on the quality of a company. “There are plenty of good companies out there that are bad investments,” he says. He cites the example of Nasdaq-listed IT firm Cisco, after its share price rose and fell in line with the dot-com boom and bust. Despite strong earnings growth, the stock has never come close to returning to the peak it reached in early 2000. “There's just times when the market has the wrong price and some of the best companies can be the worst investments because they're the ones that people get excited about.”

Wilmshurst even takes the view that a bad company can be a good investment. “We will at times buy companies we don't like in industries we don't love with management teams we don't admire… Because they're significantly undervalued.” According to Wilmshurst it would not make sense to fill a portfolio with such companies, but he says that selectively it can make sense.

“Would you potentially buy a company that was bankrupt? Lots of people react and say no. But if it's priced at a sufficient discount that if you pick two or three of them and one of them goes bankrupt and the other ones go up four or five fold that can still be a very good strategy,” he explains.

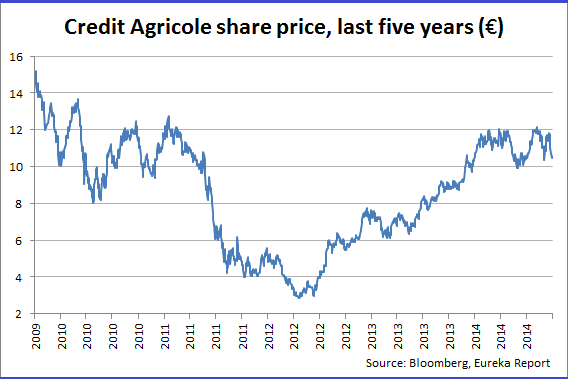

He lists European banks as an example, after the fund paid 25c to 50c on the dollar of book value for French, Italian and British banks during the European debt crisis in 2012. He points out that Credit Agricole's share price has tripled since TGG's purchase of the stock and is now trading at a 10% discount to book value. “With something like banks and the state of Europe we'll be vindicated when we're out the other side.”

Thinking conservatively?

Despite the purchase of European banks, the fund hopes to appeal to investors who are concerned about risk. “We have protected our investors' money better than average through downturns,” Wilmshurst says. “We might lag from time to time on some of the upcycles but on average we've done a better job in down or bear markets of outperforming there. We still outperform through the average bull market but not as strongly.”

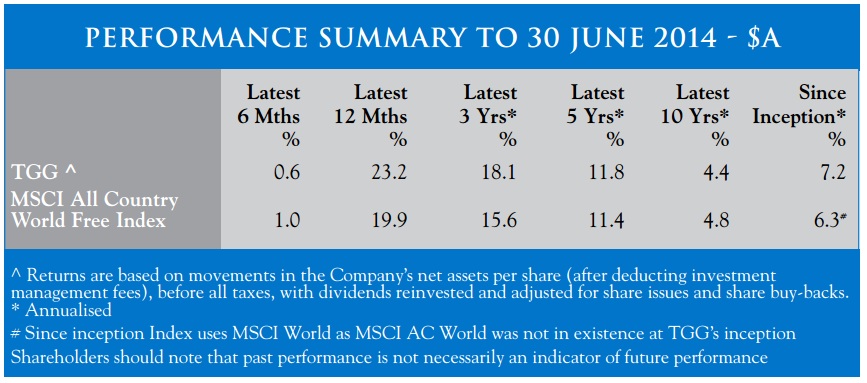

The following table shows the fund's performance over time against its benchmark – it has outperformed over one, three and five years and since inception, and is behind over 10 years.

Source: TGG annual report.

This strategy can lead to the fund sometimes being labelled “conservative”, but Wilmshurst says different commentators attach different meanings to such a label. “We're not conservative in the sense that we will, while being diligent about our research, be happy to invest in areas where others are scared,” he says. “I'd say that we are conservative in the way that we think about things when we think about what price are we willing to pay for a company.”

TGG's global focus makes it different to many other listed investment companies in Australia, Wilmshurst says, aside from offerings from fund managers like Platinum Asset Management and Magellan Financial Group.

The Templeton fund was established and listed on the ASX in 1987, but its parent company's oldest mutual fund was established 60 years ago. Wilmshurst also says the fund's active approach sets it apart from exchange-traded funds that in many cases take a passive approach, investing only in line with the index. But he says the fund shares some benefits of index investing, which is relatively tax- and cost-efficient.

“Our average turnover's only 20% per annum so we're pretty tax- and cost-efficient anyway.”

The fund's fees and expenses are slightly in excess of 1.3% of net tangible assets. Fees have been falling as the parent company has taken on some of the fund's admin work and the directors have reduced their fees. Wilmshurst says the fund is still working out what its base of cost will be given that the fund size has increased due to performance and a capital raising. He expects fees to continue to decline.

At present TGG is taking advantage of a falling oil price to look for opportunities. The fund owns some large, stable names – the likes of BP, Shell and Chevron – that have cashflow and dividends, if not stellar production growth. TGG also likes stocks with production growth, whether in US shale, Canadian oil sands or offshore deep water. Oil services companies are another focus, on the assumption that if oil production needs to either stay steady or increase despite better energy efficiency, there will be a demand for oil services to find new oil.

“With the pressure on the oil price there are now concerns that projects will be delayed, but that's giving us the opportunity to buy cyclical growth companies on what we think are significant discounts,” Wilmhurst says. “One of the companies we own is a drilling company. It hadn't traded below book for 20 years. It's now at 40% discount to book.” But he emphasises that these companies are only a small part of a diversified portfolio. “The fact that those three sectors are all quite different drivers hopefully works over time.”