LIC spotlight: Perpetual Equity Investment Company (PIC)

Summary: Fund manager Perpetual is launching a listed investment company that will focus on mid-cap stocks that require more research to get right than the largest names. The fund will hold both Australian and global shares and expects to pay a healthy dividend, given investors' search for yield. The fund does not yet have a track record, but other Perpetual funds have posted solid returns over the medium and long term. |

Key take out: This LIC is designed for SMSF investors, offering yield and diversification to those who are already well allocated when it comes to the big banks and miners. |

Key beneficiaries: General Investors. Category: Shares. |

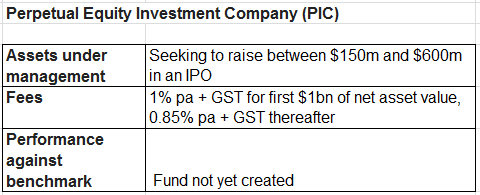

With self-managed super funds firmly in mind, well-known fund manager Perpetual is set to launch its first listed investment company. The group hopes to raise between $150 million and $600 million in an initial public offering that closes on November 28. And the new company will be designed to appeal to yield-hungry investors who are already well allocated when it comes to the top 10 stocks.

The fund, Perpetual Equity Investment Company Ltd (PIC), will focus on mid-cap stocks that require more research to get right than the big banks and miners. Portfolio manager Vince Pezzullo says investors can take advantage of Perpetual's research into companies of this size, given SMSFs are typically long financials and resources. “The SMSF investor can take advantage of the legwork we do. That portfolio will be complementary to what they own.”

The firm's analysts conduct more than 1000 meetings with company management every year to gain insight into companies' value. “We won't invest in a company we haven't met. And it usually takes a couple of meetings for us to feel comfortable.

“If we don't like Australian banks, we don't have to own them,” Pezzullo says. “I'm pretty sure I won't own any of them… It's not about the benchmark – it's more about the best ideas.”

PIC portfolio manager Vince Pezzullo. Source: Perpetual.

The fund will have between 50% and 100% of its holdings in Australian shares, with up to 25% in global equities and up to 25% in cash. Pezzullo says the global equity holdings will be another way for SMSFs, which often have a domestic focus, to diversify their portfolios. “Having some global [allocation], particularly in stocks uncorrelated to the market, adds protection and enhances returns.”

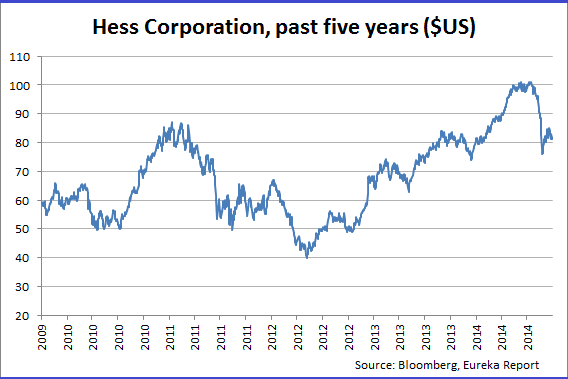

Investing in global companies also allows exposure to more specific businesses, he says, instead of the conglomerates in some sectors in Australia. Globally, it's possible to pick out one component of the resources or energy industry and invest in that. He uses the example of shale gas in North America. Perpetual bought into oil and gas producer Hess Corporation when it was “extremely cheap”, and watched the stock rise 50%.

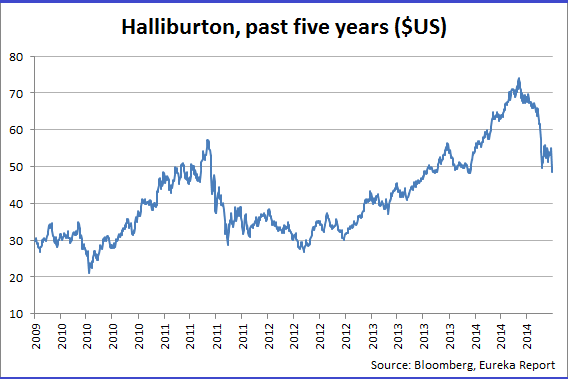

Perpetual's investment in energy services provider Halliburton, which owns technology for fracking, or drilling for shale gas, doubled. “You're buying the guys selling shovels to miners,” Pezzullo says, adding that investors don't have access to that sort of company in Australia.

Focusing on returns

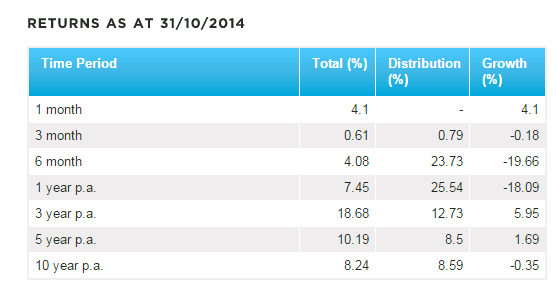

Although the fund doesn't have any runs on the board of its own yet, Pezzullo points to Perpetual's performance history. The Perpetual Industrial Share Fund has returned 15.3% annualised after fees per year for the 38 years to August 31, 2014.

Pezzullo says the LIC will be loosely based on a separately managed account he's been running for more than six years, which has compound returns of around 20% and has paid a fully franked dividend of 4.5% through that period. The SMA is benchmark unaware, holding one or two banks and no telcos.

Table 1: Perpetual Industrial Share Fund's performance history

As well as research, Pezzullo emphasises the importance of patience. Perpetual waits for companies to trade at a material discount to valuation before buying, arguing that this provides protection as all the bad news should be in the price. “You've got to be patient enough not to follow crowds and chase things,” he says. “You don't want to pay the wrong price for a stock… When people are excited and things trade above valuation it's best to sell because you could miss out on an undervalued opportunity.”

But he says when thinking about selling, it's important to consider whether or not there's a better opportunity waiting that could improve the portfolio. If a stock is overvalued, but the fundamentals of the business are still attractive, Perpetual might halve the position and take some profit, for example, depending on a company's prospects.

Investors' search for yield is front of mind for the Perpetual team, which expects the new LIC to pay a healthy dividend. The fund has not publicly stated its expected yield, but Pezzullo says it is illustrative that a lot of Perpetual funds have historically paid between 3.5% and 4.5%.

He says Perpetual is always assessing the dividend payments of companies it invests in – not simply to buy stocks with a high dividend yield, which can be fraught (see The best yield stocks post-correction), but to look for opportunities for companies to maintain and grow their dividends over time. Investors will be conscious that higher yields are on offer at the big banks and Telstra, but Perpetual says the fund's global focus slightly dampens the dividends received, as international equities don't share the Australian system of franking credits, while offering much-needed diversification.

Considering costs

PIC's prospectus says it will pay a management fee of 1% per annum plus GST for the first $1 billion of the portfolio's net asset value. If the fund grows larger than that, PIC will also pay a fee of 0.85% per annum plus GST for amounts over $1 billion. The fund won't pay a performance fee, intending that any outperformance will be returned to clients through dividends. Many Perpetual funds don't pay a performance fee, although some long/short funds do. Pezzullo has little patience with the suggestion that for fund managers to outperform, they must be paid a performance fee (see How Cadence outperforms). “We've generated performance irrespective of whether there's a performance fee.”

The fund is expected to be unhedged, although Pezzullo says he won't exclude the opportunity to hedge in the case of extreme movements in the Australian dollar, such as a fall to US50 cents. But he says even if the Australian dollar is at US65 cents, the correlation between our currency and equity market is quite high, so the market would likely be quite cheap, making it more cost-efficient to sell overseas stocks and bring the money home, rather than paying to hedge. “Every quarter you have to roll your hedge – it can cost quite a bit of money,” he says. “We treat things in a vanilla fashion. Keep it simple.”

Looking forward

Pezzullo's views on the sectors that look interesting at the moment may surprise. He says some domestic media companies look interesting, as there are stocks trading on reasonable earnings multiples and paying very good dividend yields. “They're hated for a reason – it's because no-one wants to buy them,” he says. He also thinks some domestic cyclicals are looking interesting, including in the construction space. Offshore, he sees value among US financial stocks and in other parts of the industrials market in North America.

Pezzullo expects LICs to grow over the next five years as the SMSF sector gathers pace. He points out that they are a very cost-effective way for fund managers to distribute product to investors. “Some established names in LIC land have done a fantastic job. We're bringing something different.”

The IPO offer is open now and will close on November 28, with a minimum subscription of $150m. PIC is set to start trading on the ASX on December 12.