LIC spotlight: Bailador Technology Investments (BTI)

Summary: Unlike many other LICs, Bailador invests in unlisted, expansion stage, high-growth technology companies. The founders expect new technology to keep creating new value, but know that investors are not always sure how to increase their exposure to tech stocks. The fund focuses on companies that were founded locally but have a global focus. |

Key take out: Performance has been strong in percentage terms but dividends are likely to be uneven, depending on the sale of stakes in unlisted investments. |

Key beneficiaries: General Investors. Category: Shares. |

Bailador Technology Investments (BTI) takes a different approach to the other listed investment companies profiled in our LIC spotlight series. (To read past profiles click here.) Many listed investment companies themselves invest in other companies which are listed on local or global stock exchanges. But Bailador invests in unlisted companies – specifically, information technology companies in the expansion phase.

The fund typically invests between $5 million and $10 million in companies that have been operating for three to five years and have several million dollars of revenue with opportunities for further growth.

“They're making money and can see an opportunity to rapidly grow if they can get some capital and additional help,” executive director Paul Wilson explains.

Bailador's staff join the companies' boards to help them grow. Wilson has a background in private equity, including serving as a director of CHAMP Private Equity, while co-founder and managing partner David Kirk is a former chief executive of Fairfax Media. (For the record, Bailador was a bull in Spain who killed a high-profile bullfighter in the 1920s.)

Paul Wilson. Source: Bailador.

Bailador is very clear about not investing in start-ups. “Start-ups are more risky than expansion capital,” Wilson says. But there have been few opportunities for individual investors to access companies at this stage of their development. Listed technology companies are available to individuals, while start-ups are available to high net worth investors. But Wilson says expansion capital is the most attractive part of the market, yet it hasn't traditionally been available to retail investors.

The fund has a focus on information technology, not the biotech or medical spaces, seeing it as a very attractive place to invest. “Technology is driving tremendous change across every industry, so there is a value shift taking place, and new value creation,” Wilson says.

He points to the solid returns across most major technology industries over the last five years, saying he expects this to continue over the long term. “It's certainly an area people are considering. We've seen an interest from investors in getting more exposure to technology but they're not sure how to do it.”

BTI currently has investments in three companies:

- Site Minder is a platform that helps hotels distribute their room inventory online to various booking sites. The group has more than 14,000 hotel subscribers, has been growing at a rate of 80% pa and sells into more than 100 countries.

- Standard Media Index tracks advertisers' dollar spend based on arrangements with major media buyers. They provide information to subscribers about the type of advertiser, medium and geographical location of ad spend. The business already earns 40% of its revenue from offshore and the chief executive has relocated to the US, the group's fastest growing market.

- Viocorp is a content management system for online video with corporate and government customers. For example, accounting and law firms can use it to distribute a training video that is not accessible to the general public, then see which staff have watched it. A lot of corporates start using Youtube and quickly realise they need a professional platform so their content is private and not displayed next to other unsavoury or distracting videos, Wilson says.

After raising $25 million in an initial public offering, Bailador intends to invest in three to five more businesses with similar criteria in 2015, which would mean its portfolio would comprise six to eight companies in a year's time, subject to selling any stakes and realising gains.

The group is considering more potential investments but will only invest after doing substantial research. Bailador also has some conditions, such as taking a seat on the board, and ensuring it has liquidity preference, which lowers the risk profile for investors.

Thinking locally and globally

Bailador is investing in companies that are founded in Australia and New Zealand, although their businesses have a global focus, and each of them earns at least 30% of their revenue from international markets. Focusing on global opportunities means the market size the companies can address is greater, so the ultimate size the companies may achieve is greater, Wilson says.

The fund has just listed on the ASX, after previously operating with backing from 36 high net worth investors. Its IPO price was $1.00 for one share and one option. The shares are currently trading around 93 cents, while the options are trading around 7.1 cents.

“One of the issues with the private vehicle is it tends to be closed-ended. You hold investments for a set period of time and return the money – and then you have to go and raise a new pool of money.” Wilson says the listed investment company structure will mean Bailador won't face time pressures to sell out of companies, and can hold some companies for longer and get further exposure to growth. For example, he says Bailador could have sold its holding in Site Minder a year ago for a return of 3.7 times when another investor took a stake, but preferred to hold on, expecting more value in future.

Having a publicly listed investment company structure also allows for a broader investor base. “Previously the average investment was just over $1 million. Not everyone has a lazy million lying around to put in. The LIC had a minimum investment at IPO of $2000.”

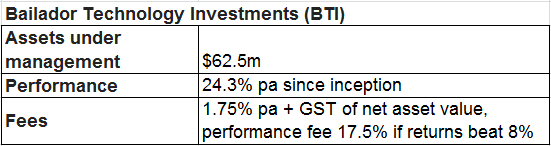

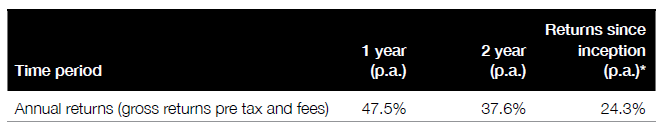

The fund's total assets under management are $62.5 million, including its investments and capital raised in the IPO. Fees are 1.75% per annum plus GST of net asset value, plus a performance fee of 17.5% if returns exceed 8%, based on a compound hurdle. Wilson points to the fund's performance track record, with returns of 24.3% annualised since inception about four years ago, although much of that increase comes from a rise in valuation of one company after US expansion capital fund Technology Crossover Ventures invested $33m a year ago. Wilson emphasises the importance of conservative valuations, as BTI continues to hold one investment at cost. The group only increases the valuation of its companies on the basis of third-party investment. “One of our main considerations is we don't want to be publishing valuations we don't beat when we sell the company. It's important we're seen to be prudent and overdeliver when we realise cash.”

Bailador's past performance. Source: Bailador prospectus.

Because of the nature of the fund's investment style, dividends are likely to be uneven. Bailador expects to return cash to shareholders, but will pay dividends when it realises gains on its investments, rather than offering a consistent percentage return per year. “When they come, dividends are looking to be very large – and franked,” Wilson says. Investors who hold the stock over a three- to five-year period should expect dividends, but there could be two payouts in one year and none in the next, for example, he says.

“We wouldn't expect there to be much trading in our shares until there's some portfolio revaluation,” Wilson says. “We think most of our shareholder base will be holding for the medium- to long-term. Until there's new news – and we've just been through a period of talking about it in the prospectus – we're expecting people to sit for a while.”