Last chance: Act now on Transition to Retirement plans

Summary: The Howard government's transition to retirement income streams (TRIS) look likely to be phased out soon. The arrangements, allowing those who reach their preservation age to access their super as an income stream while still working, would be removed through either a fixed end date, or a grandfathering arrangement. |

Key take out: If you are approaching preservation age, or have reached it and are considering starting a TRIS arrangement, investigate and implement this now. |

Key beneficiaries: Superannuation accountholders and SMSF trustees. Category: Superannuation. |

Income tax plans are one of the most effective personal tax management vehicles we've seen in Australia. Unfortunately, as the government searches for cost cutting tax reforms, the schemes are under pressure. In fact it is very likely they will be greatly scaled back or cut altogether in the months ahead. However, for smart investors there is still time to examine and – if it is appropriate – establish a plan that could be very rewarding.

How It Works

Transition to Retirement Income Streams (TRIS) were introduced by the Howard Government as a way of encouraging people to continue to work – possibly part time – past the age where they could access their superannuation. As a person worked past their superannuation preservation age, they would be allowed to access their superannuation as an income stream to supplement the money that they were earning. There were not too many restrictions on the income stream – basically each year you had to draw from your superannuation fund between the minimum pension amount (four per cent for people working around the age of 60) and an upper limit of 10 per cent. While you were still working, you were not able to take lump sum withdrawals from superannuation.

TRISs, however, have become a tool used primarily as a tax saving strategy for people once they pass their preservation age, with people drawing an income stream from superannuation and saving tax by making aggressive salary sacrifice contributions to superannuation.

The age of access

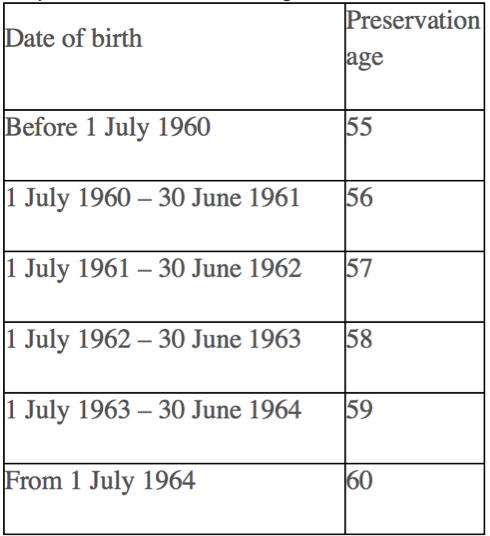

As the table below shows you can begin a TRIS at various ages, the youngest is 55 if you were born before 1960.

Table 1 – Superannuation Preservation Age

The tax effectiveness of a TRIS

There are three elements that make a TRIS particularly tax effective. The first is that a superannuation fund paying an income stream is no longer taxed at 15 per cent (with 10 per cent for discounted capital gains), it is now taxed at zero per cent. This generally increases super fund returns by about one per cent a year, so a $500,000 super fund would see an increase in after tax returns of around $5,000 a year.

The second is that often people combine a TRIS income stream with a salary sacrifice to superannuation. Rather than having income taxed at income tax rates (up to 45 per cent), it can be salary sacrificed up to a person's contributions limit and only taxed at 15 per cent. The income from the TRIS provides money to meet living expenses, allowing a greater salary sacrifice to superannuation.

The third element is that after the age of 60 all superannuation withdrawals are tax-free. This enhances the tax effectiveness of the TRIS strategy – although it should be noted that there can also be tax benefits from an income stream taken between the ages of 55 to 60.

If you are nearing or over your preservation age

If the Government were to remove access to the TRIS arrangement, there are at least two ways that it might happen. The first is that they might simply have an end date, and all TRIS arrangements in place at that end date would have to be converted back into superannuation accumulation funds.

The second way, which has been used for changes to tax/superannuation laws in the past, is that existing TRIS plans might be allowed to continue (‘Grandfathered'), while no new ones would be allowed to start.

An example of this style of change has been with Capital Gains Tax. When it was introduced in 1985, assets that had been bought before a set date (September 20 1985) kept their Capital Gains Tax free status, with assets purchased after that subject to Capital Gains Tax.

I think that the approach of allowing existing TRIS arrangements to continue, while not allowing new ones to start, is one that might be taken if they were to be removed. On this basis, it is important for anyone who can (or soon can) access a TRIS income stream based on his or her preservation age to think about starting one.

I often come across people who are aged 55 to 60 who are waiting until the tax free superannuation withdraws come in at age 60 to start their TRIS – this is the group that particularly needs to be aware that they might need to start a TRIS now, before any government move to restrict access to them.

The biggest risk would seem to be the risk that legislation required all TRIS be wound back to superannuation accumulation funds. This would not create significant costs for people if it had to be done.

Conclusion

One of the most powerful wealth creating strategies is the use of a TRIS with a salary sacrifice to superannuation while you are still working. This strategy has the potential to be wound back under the Government reform of superannuation. Given the possibility that changes may be “grandfathered”, anyone capable of starting a TRIS now should investigate whether it makes sense for them, and anyone close to their preservation age should investigate a TRIS, and be ready to move as quickly as they can once they are eligible.

Frequently Asked Questions about this Article…

A Transition to Retirement Income Stream (TRIS) is a financial arrangement that allows individuals who have reached their superannuation preservation age to access their super as an income stream while still working. This strategy was introduced to encourage people to continue working, possibly part-time, past the age where they could access their superannuation.

It's important to act now on Transition to Retirement plans because the government is considering phasing out TRIS arrangements. If you are nearing or have reached your preservation age, starting a TRIS now could allow you to benefit from its tax advantages before any potential legislative changes take effect.

A TRIS provides tax benefits in several ways. Firstly, the superannuation fund paying an income stream is taxed at zero percent, increasing fund returns. Secondly, combining a TRIS with salary sacrifice contributions allows income to be taxed at a lower rate of 15 percent instead of up to 45 percent. Lastly, after age 60, all superannuation withdrawals are tax-free, enhancing the strategy's tax effectiveness.

The government may either set a fixed end date for TRIS arrangements or allow existing ones to continue while preventing new ones from starting, a process known as 'grandfathering.' These changes are part of broader tax reform efforts and could significantly impact those planning to use TRIS for tax management.

Superannuation accountholders and SMSF trustees benefit the most from a TRIS strategy, especially those who are nearing or have reached their preservation age. This strategy is particularly advantageous for individuals looking to reduce their taxable income through salary sacrifice while still accessing an income stream from their super.

The preservation age for accessing a TRIS varies depending on your birth year. The youngest age to start a TRIS is 55 if you were born before 1960. It's important to know your preservation age to plan effectively for retirement income strategies.

Yes, you can still work while receiving a TRIS. The arrangement was designed to encourage continued employment, possibly part-time, while supplementing your income with superannuation funds. However, you cannot take lump sum withdrawals from your super while on a TRIS.

If you're close to your preservation age, it's crucial to investigate the benefits of starting a TRIS now. With potential government changes on the horizon, acting quickly could allow you to take advantage of the tax benefits and income stream before any restrictions are implemented.