Labour pains add to the RBA's challenges

The Australian labour market remained soft in November. It is just one of several issues the Reserve Bank of Australia will have to contend with when it next meets in February.

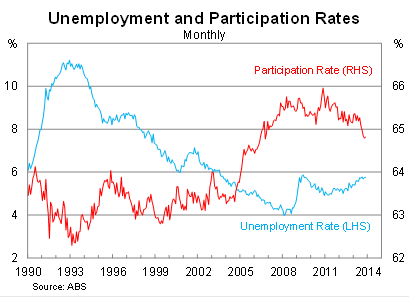

According to the Australian Bureau of Statistics, the unemployment rate rose to 5.8 per cent in November, from 5.7 per cent in October (though the rise is mostly due to rounding), to be only slightly below its peak during the global financial crisis.

However, the unemployment rate masks the real weakness in the labour market. The participation rate has fallen sharply since June, partly reflecting disgruntled workers but also the retirement of some baby boomers. It is 0.5 percentage points lower than in June. I estimate that had the participation rate instead been unchanged over that time, the unemployment rate would currently be around 6.4 per cent.

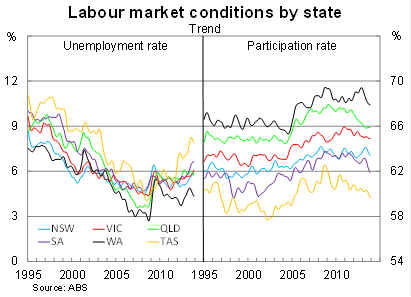

At the state level, the unemployment rate rose by 0.2 percentage points in both Victoria and South Australia in November. The unemployment rate in most of the other states was broadly unchanged, with the exception of Queensland (down 0.3 percentage points).

As the graph below shows, the decline in the participation rate has been fairly similar across the country, although the level of participation differs significantly. The two main factors behind the fall in participation, ageing population and deteriorating economic conditions, are largely present in each state – albeit to different extents.

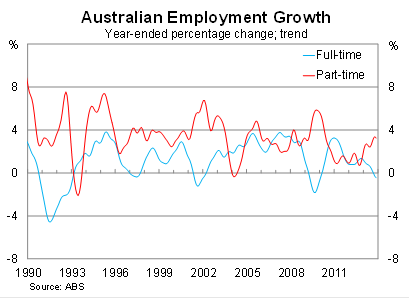

Employment rose by 21,000 in November, following a slight fall in October, but annual employment growth remains exceptionally weak. The monthly result is solid but to put it in perspective, total employment has basically not grown at all since February. In addition, aggregate hours worked on fell by 0.7 per cent in November and has declined in three of the last four months.

The ABS did report a pick-up in full-time employment in November but it still remains well down over the past year. All of the growth in employment in 2013 has been driven by the increasing casualisation of the Australian workforce.

The decline in full-time employment is particularly relevant given its correlation with recessions or economic slowdowns. Downturns also coincide with an increase in part-time employment, as people are willing to take on reduced hours or conditions to ensure job security. We are seeing both these trends now.

No one is talking about a recession just yet, but there is obvious potential for a downturn in activity. There is certainly sufficient uncertainty – timing of the Fed taper, housing market, ageing population, and the mining investment cliff – to be fairly pessimistic about the outlook for the jobs market.

Although measures of consumer sentiment and retail spending remain solid, the slowdown in employment points to a soft Australian economy in 2014 and perhaps longer, depending on the timing of the mining investment cliff.

If you want to take a glass half-full approach, there is some upside for the labour market. Construction employment should expand in 2014 as the rise in building approvals meets the construction stage. Employment in export-oriented sectors is set to expand, particularly if the Fed begins to taper sooner rather than later, thereby supporting investment and output.

The unknown is the timing of these boosts to employment and whether they will occur quickly enough to offset the current softness before it begins to drag down the broader economy.

I have been reasonably optimistic regarding the near-term prospects for the Australian economy, believing that the Fed taper would begin soon and that would help support the recovery in the non-mining sector.

I remain content with that view, but recognise that relying on the exchange rate is always fraught with danger. Few indicators are more difficult to forecast. The simple fact is that there remains considerable uncertainty in the economy right now and it is quite plausible for the economy to pick up or drop off significantly.

For the RBA, today’s result will not have come as a surprise given the unemployment rate is widely expected to trend upwards into 2014. But it is yet another in a long list of issues that will be a concern for the Reserve Bank.

Right now they face the difficult proposition of trying to boost employment, while trying to avoid irrational exuberance in the housing market. All the while they have the spectre of the Fed’s taper hanging over their head, which as I’ve said before makes it difficult for them to make any decision (RBA caution to cushion a Fed fallout, December 5). Perhaps they are lucky they don’t meet again until February 4.