Kiwi courage and Aussie apathy

Compare the following two statements, and see if you can guess who the speakers are, when they made these speeches, and what they announced in them:

“[We are] concerned about the rate at which house prices are increasing and the potential risks this poses to the financial system and the broader economy. Rapidly increasing house prices increase the likelihood and the potential impact of a significant fall in house prices at some point in the future. This is particularly the case in a market that is already widely considered to be over-valued.” (Speaker One).

“… Some commentators have taken the view that the property market dynamics are worrying. My own view, thus far, has been that some rise in housing prices is part of the normal cyclical dynamic, that it improves the incentive to build, and that a price rise reversing an earlier decline probably isn’t something to complain about too quickly. Moreover, credit growth, at between 4-5 per cent per annum to households, and less than that for business, does not suggest that rising leverage is so far feeding the price rise. Hence it has been a little too early to signal great concern.” (Speaker Two)

The former is Graeme Wheeler, the governor of New Zealand’s Reserve Bank, on August 20th, in a speech in which he announced the introduction of controls on Loan to Valuation Ratios.

The latter is Glenn Stevens, the governor of Australia’s Reserve Bank, more than three months later (October 29), in a speech in which he announced bugger all.

Figure 1: Banks getting back to their old tricks – St George advertising 95 per cent LVR loans, George St Sydney, November 2013

You might imagine that the house price and mortgage debt dynamics of these two countries are very different, since the same authority figures reached such different conclusions on whether they should take any action. You would be wrong. The similarities between Australia and New Zealand – on house prices, mortgage debt, and interest rates – far outweigh the differences.

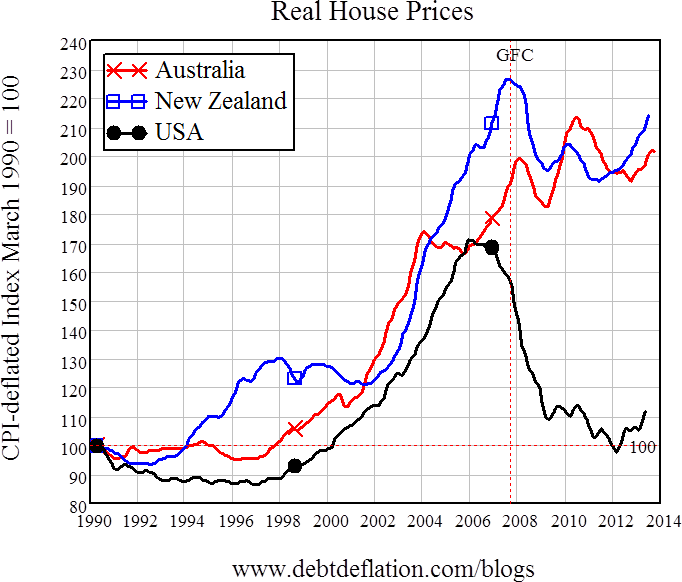

Real house prices in New Zealand are just over 2.1 times what they were in March 1990 (when the NZRB data series on house prices begins); in Australia they are just over twice as high (see Figure 1).

New Zealand prices peaked at almost 2.3 times 1990 levels just before the global financial crisis (which I date from August 2007), and then fell about 15 per cent over three years, but they have risen by about 12 per cent from that low two years ago. From the vantage point of the peak, today’s prices are 5.6 per cent lower, but still New Zealand’s governor is confident in calling a bubble.

Australian prices peaked at twice 1990 levels when the GFC hit, and then fell until the Rudd government’s First Home Vendors Boost restarted the Great Australian Housing Bubble. Prices then fell 10 per cent from the mid-2010 peak over the next two years, but have since risen about 5.5 per cent.

Figure 2: House prices either side of the Tasman since 1990, with the US for comparison

From the vantage point of the mid-2010 peak, today’s Australian prices are 5.4 per cent lower, and apparently on that basis, Australia’s governor doesn’t think there is a bubble. Frankly, that’s like saying that K2 isn’t a mountain because it’s shorter than Everest. Or that Everest isn’t a mountain because the distance from Camp VI to the summit is less than a thousand metres.

House prices in both countries are bubble prices: New Zealand’s governor has the courage to call it, while ours emulates “signs of froth in some markets” Alan Greenspan (speaking in May 2005) in only being able to see bubbles after they have burst.

Of course, you could argue that house prices in both Australia and New Zealand reflect the fundamentals, and you’d be right: fundamentally ridiculous levels of mortgage debt. Again, New Zealand’s governor calls a spade a spade on this front:

“House prices are high by international standards when compared to household disposable income and rents. Household debt, at 145 per cent of household income, is also high and, despite dipping during the recession, the percentage is rising again,” Graeme Wheeler said.

Glenn Stevens, on the other hand, doesn’t see a problem. So is Aussie mortgage debt much lower than Kiwi?

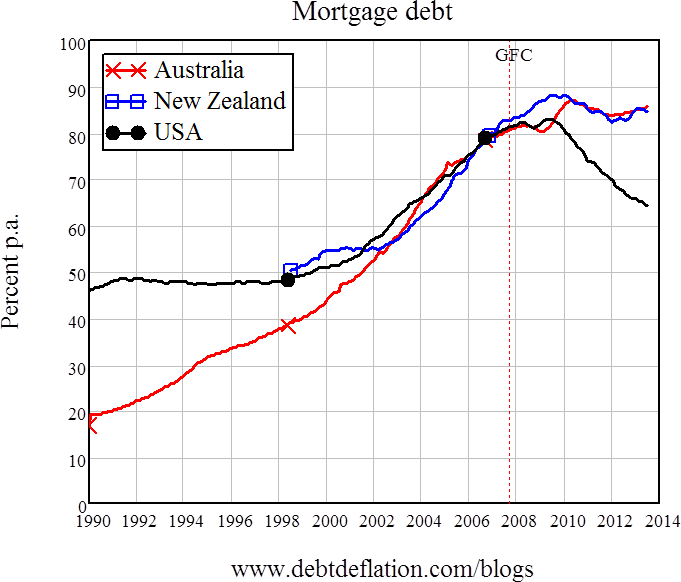

Figure 3: Mortgage debt either side of the Tasman, with the US for comparison

Err, no – it’s virtually identical. Mortgage debt peaked at 88 per cent of GDP in New Zealand in mid-2009, versus 87 per cent in Australia in mid-2010 (after the helping shove-up from the First Home Vendors Boost). Both then fell only marginally compared to GDP, and have since started to rise since 2012.

Stevens apparently sees no problem with current levels. So far as he and the Reserve Bank’s economists in general are concerned, interest rates have halved since the early 1990s, household debt has doubled, and so what’s the problem?

“The rough statistic that I have quoted many times was that the average rate of interest was about half; that meant you could service twice as big a debt. Guess what? That is exactly what occurred, and that had a very profound effect on asset values,” Stevens said in the Reserve Bank’s 2006 Annual Report Hearing in February 2007.

This is a typical neoclassical attitude: interest rates have halved, debt has doubled, so everything’s still in equilibrium. So no problem?

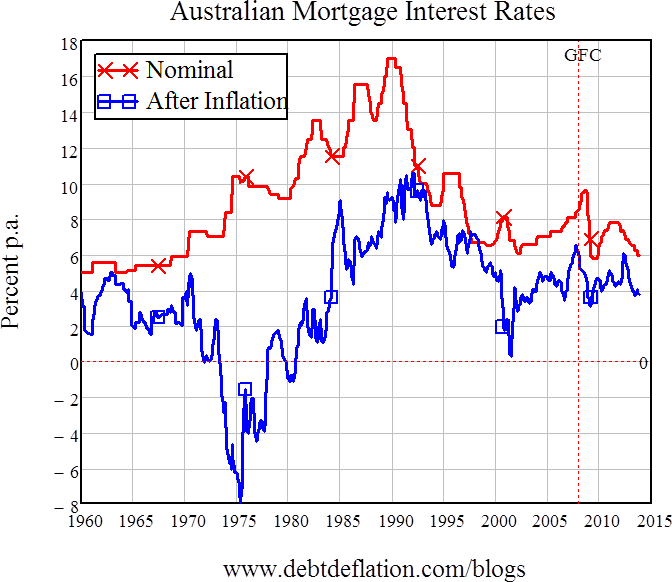

No, and firstly because this “rough statistic” is empirically false for household mortgages. Yes, nominal mortgage rates were 17 per cent per annum at their peak in 1990, and 8 per cent when Stevens reported to parliament in 2007, while the after-inflation rates were 10.5 per cent and 5.3 per cent respectively. So rates, roughly speaking, are half what they were in the peak years from 1985 till 1995 (see Figure 3).

Figure 4: Australian mortgage rates since 1960

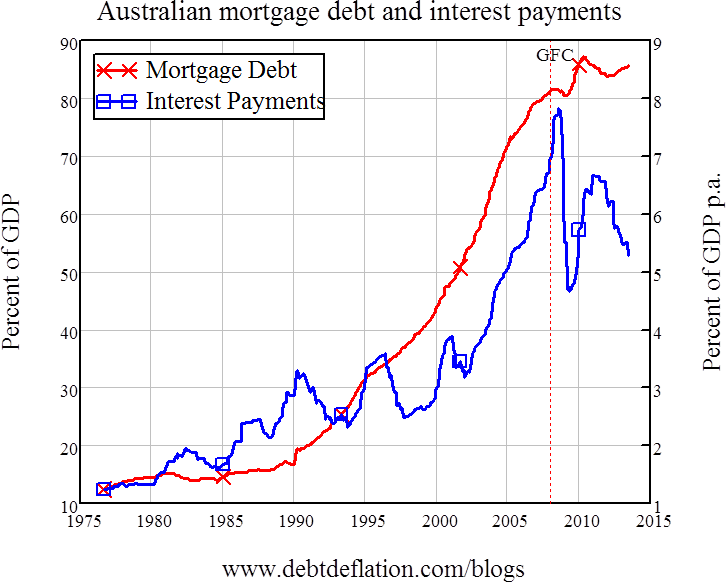

But mortgage debt didn’t merely double: it rose from under 20 per cent of GDP in 1990 to almost 80 per cent when Stevens spoke to the Parliamentary Committee. So interest rates halved, but mortgage debt more than quadrupled. The net impact is that simply paying interest on mortgages jumped from 3 per cent of GDP when interest rates were at their peak, to 6.4 per cent when Stevens made his “guess what?” quip, and maxed out at 7.8 per cent of GDP when the GFC forced the Reserve Bank to belatedly stop fighting an imaginary inflation demon and slash rates in response to a crisis it didn’t see coming (see Figure 4).

Figure 5: Mortgage debt and interest payments as a percentage of GDP

Secondly, it ignores the fact that rising debt can cause a temporary but false prosperity, as additional debt-created money is spent into the economy. Stevens is not unique here: this is a typical blindspot for mainstream economists – so far only Nick Rowe has overcome it. If central bankers really understood the financial system, they would monitor the rate of growth of private debt, and its level relative to GDP, and apply macroprudential controls when either appeared to be getting out of hand.

That is precisely what New Zealand’s Reserve Bank is now doing – and bravo to Graeme Wheeler and his staff for taking action. But Australia’s Reserve Bank remains complacent.

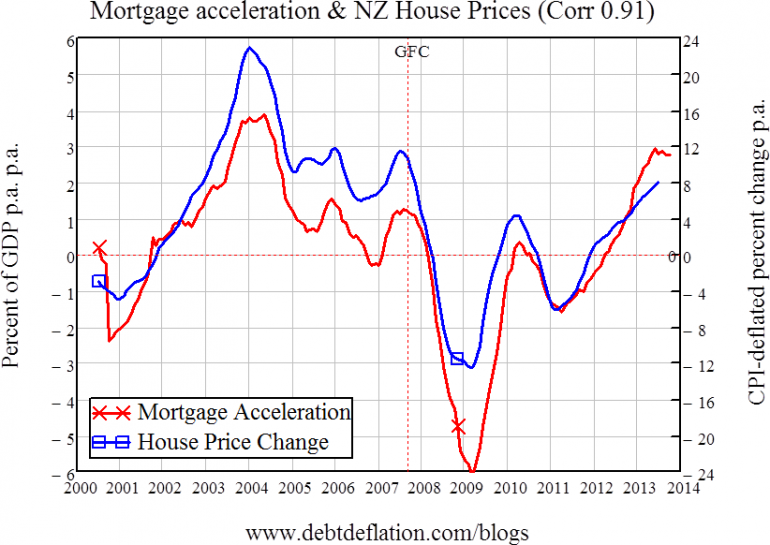

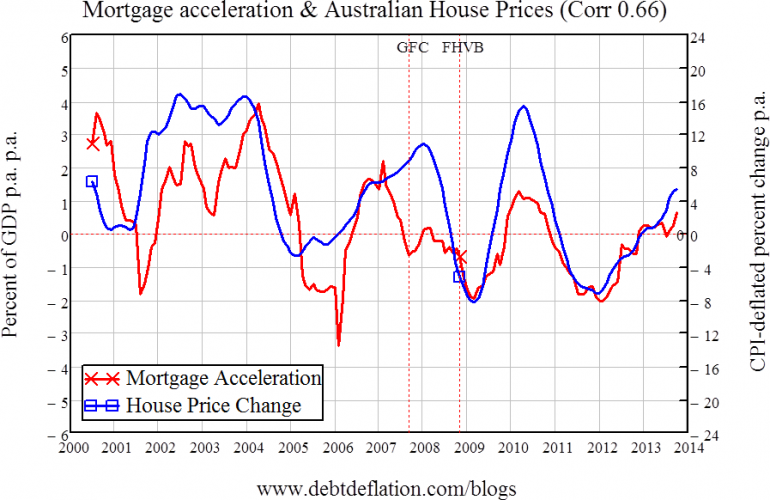

This may come back to bite the Reserve Bank next year. My favourite indicator of which way house prices will go, the acceleration of mortgage debt, is strongly positive in both countries – though it may have topped out in New Zealand. So house prices are rising on top of established bubbles in both countries (see Figure 5 and Figure 6).

Figure 6: Mortgage acceleration and house price change in New Zealand

Figure 7: Mortgage acceleration and house price change in Australia

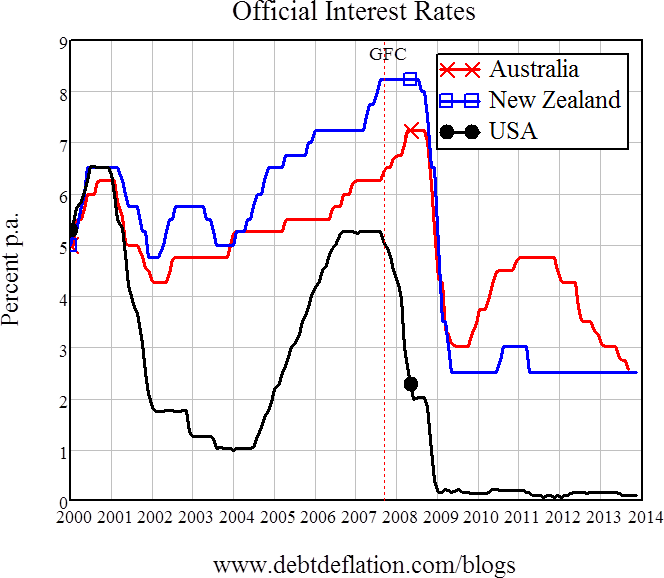

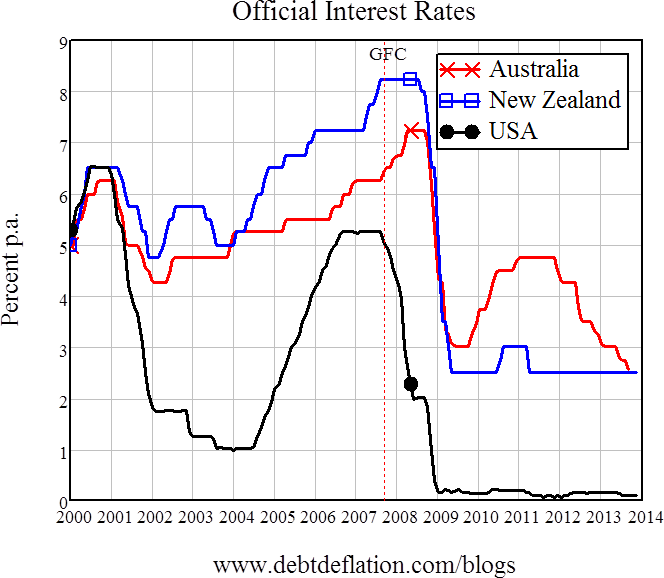

New Zealand has two weapons to fight the bubble: higher interest rates – which it is unlikely to use – and LVR controls, which it has already employed. Australia has only one: higher interest rates, which on past form it is likely to use (see Figure 7).

Figure 8: Reserve Bank interest rates since 2000

But in the past when the Reserve Bank has put rates up, the economy has been either booming, or they expected to boom in the future (note the period in Figure 7 after the GFC began, when the Reserve Bank was increasing rates because its economic models told it that a boom was approaching). Unfortunately that isn’t the case now: while asset markets are booming, unemployment is rising – and inflation is low as well. The Reserve Bank faces the dilemma of having two policy targets but only one tool, and the targets are moving in opposing directions. If it wants to stop house prices rising, it will have to increase rates; and if it wants to boost the economy and stop unemployment rising, it will have to cut rates.

Figure 9: Rising house prices and rising unemployment

Life would be so much simpler if you copied the Kiwis and introduced Loan to Valuation Controls, wouldn’t it Glenn?

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.