Kicking the economy while Qantas is down

Last week started well enough: Australia was the centre of the economic world, proudly announcing an agreement by the G20 to set a ‘growth target’ that would push global real GDP 2 per cent higher than current forecasts by 2018.

Everything had changed by the end of the week: Qantas had announced it would cut 5000 jobs and slash spending by $2 billion. Multi-lateral ‘growth targets’ seemed like a world away.

But the Qantas debacle was not even close to being the most distressing economic development for Australia last week. It was instead a mere drop in the ocean, a simple distraction compared with the impending business investment collapse. But you wouldn’t know this by browsing mainstream media last week.

Of course the business investment collapse isn’t quite as sexy as the Qantas story. It doesn’t involve incompetent management or a national icon, political theatrics or unions with an axe to grind.

Qantas is as Australian as Vegemite or Paul Hogan (so not very Australian at all anymore) but its crisis will be almost entirely irrelevant to the Australian economy over the next few years. It's just a $2.7 billion company in a $1.5 trillion economy.

By comparison, the impending business investment collapse may not be sexy but it is big news for the government, Reserve Bank of Australia, and for you too.

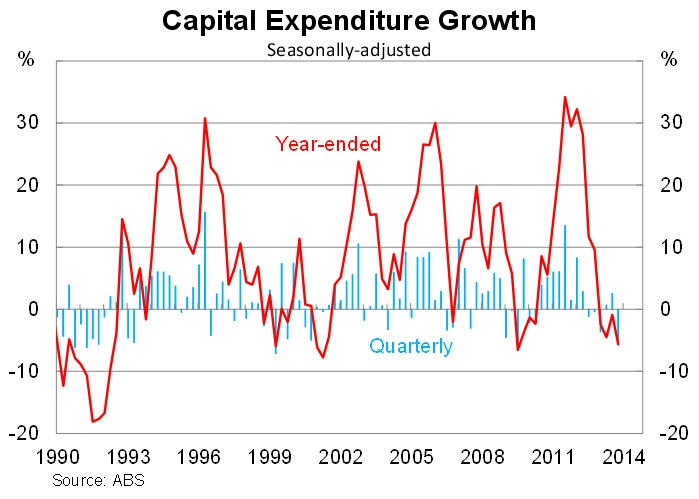

Capital expenditure fell by 5.2 per cent in the last quarter of 2013 but that decline will pale in significance compared with the expected fall in business investment over the next few years.

In total we are looking at around a $20 billion decline in capital expenditure by Australian businesses in 2014/2015, with more cuts to follow in 2015/2016. Qantas by comparison is forecasting cuts to investment of around $1 billion.

Mining investment will drive most of the decline but the manufacturing sector is set to cut real capital expenditure to its lowest level since around 1987. The fall in mining investment may be partially offset by rising resource exports, but the same cannot be said of the remainder of the economy.

Australian manufacturing is set to continue its long march towards extinction and is now picking up pace. Capital expenditure for manufacturing firms in 2014/2015 will be around half the level it was in 2011/2012. So much for that rebalancing story, huh?

Investment creates jobs; it creates infrastructure and opportunities and improves productivity. The investment intentions of manufacturing firms are a clear sign that many have simply given up. They can’t compete with international manufacturing and there’s no point even trying.

The manufacturing sector still hires over 900,000 people across Australia, so we are looking at the loss of tens-of-thousands of jobs across the sector over the next few years – potentially many more. It will prove disastrous for states and towns that rely on manufacturing.

Unfortunately many of these job losses may not be offset by sufficient demand across the rest of the economy. Mining employment has stalled over the past 18 months and construction will take a hit if these investment intentions are realised. A lack of business investment probably won’t do the financial sector any favours, retail continues to fight off online spending and I wouldn’t be betting on widespread government hiring.

The current situation forces me to ask two questions of the Coalition government:

First, was now really the best time to stand up to car manufacturers and Qantas? I’m all for letting inefficient companies fail but that process could be undertaken in a less disruptive fashion that limits the damage to the broader economy.

Job losses at the likes of Qantas are set to hit an economy already suffering from widespread labour market weakness and uncertain economic conditions. By itself Qantas may be small but combined with the other announcements there is cause for concern. Even a short-term reprieve by the Coalition could delay these cuts until the economy has improved, lift business confidence and enable these job cuts to be better absorbed into the rest of the economy.

Second, how can the Coalition pursue its austerity plans given the outlook for the economy and jobs? Particularly following its desire to promote growth at the G20 meeting? Either they are cutting spending and cutting growth or doing the opposite. The Coalition’s current stance on spending and growth is completely at odds with economic theory and common sense.

Last week the Australian media focused heavily on Qantas. It was a great story featuring a company that all Australians are familiar with and most have used. But in focusing on Qantas they missed the game changer; the development that will have huge implications for the government, the RBA and people across the country.

We may not suffer a recession but it will feel like one for thousands of workers across the country. Business investment is set to decline at rates not seen since our last recession in the early 1990s and it will happen in an environment where businesses are already struggling, manufacturing is dying and the labour market has deteriorated.

The Coalition may have been riding high from the announcement of ambitious ‘growth targets’ at the G20 last week but now they must face the real challenges at home. What are they going to do to support the economy during what is likely to be Australia’s toughest economic conditions in two decades?