June enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

The overwhelming success of the Standby Power Controller methodology has come home to roost in Victoria’s Energy Efficiency market with a greater than 14 per cent drop in prices taking place across the last month.

The lofty level of VEEC creation arising from the Standby Power Controller methodology has long been a contentious issue in the VEEC market. With supply having reached and surpassed the 2013 target relatively early in the year, the spot market came under some pressure across the first quarter.

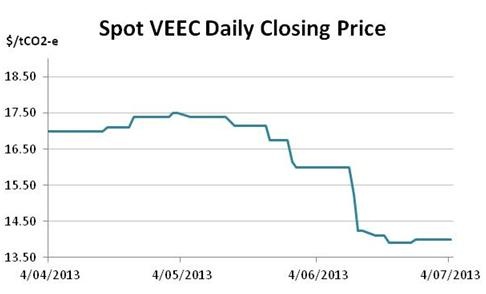

Yet other than a substantial drop in February, the overall price impacts were relatively mild with many participants believing that either regulatory intervention or market saturation would quickly bring an end to the flood of SPC VEECs. However when such a drop had failed to materialise by the early part of June, the spot VEEC market began to appear very heavy.

Having ended May at $16.00 the real falls came across the middle of the month as the market reached and then fell below the $14.00 mark, in what was a particularly difficult time for sellers. For the most part the market then stabilised in the high $13s, a level which has been essentially preserved for the last fortnight.

As it stands there are currently 5.8 million VEECs currently registered to meet the 2013 target of approximately 5.4 million, with another 918,000 pending registration.

There is of course no guarantee that all of these ‘pending registration’ VEECs will eventually be registered, indeed it is likely that some will not. Yet even a 20 per cent rejection rate would still leave plenty in the pile.

Interestingly the first signs of a slowdown in VEEC creations from the SPC methodology appear to have begun, with neither regulatory intervention nor market saturation apparently to blame. Instead, it seems SPCs have become a victim of their own success, as falling VEEC prices have resulted in the SPC giveaway model having become financially unviable.

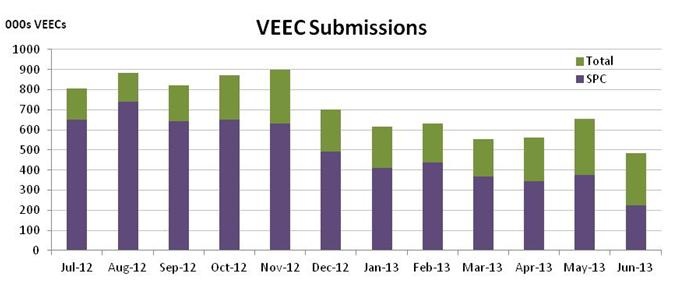

The chart above illustrates a significant drop in the number of VEECs submitted to the scheme’s Regulator in June from the SPC methodology; a phenomenon that has been anticipated for more than six months, but has continually failed to materialise. The SPC figure for June of 223,000 (which could yet fall depending on how many are rejected) represents only 57 per cent of the Jan-May monthly average.

Anecdotal evidence suggests that the SPC giveaway model is no longer viable at current prices. The market will be watching over the coming month to see whether this scenario becomes manifest in further drops in the VEEC price.

VEEC creations from non-SPC methodologies remained largely in line with the previous month.

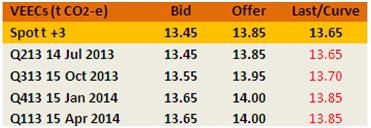

Looking at the forward market the curve is fairly flat across the remainder of the year and into the new year. Recent days have seen a number of forward VEEC transactions which have taken the form of monthly strips across the remainder of the year at prices in the $13.75-$13.85 range.

New South Wales Energy Savings Certificates (ESCs)

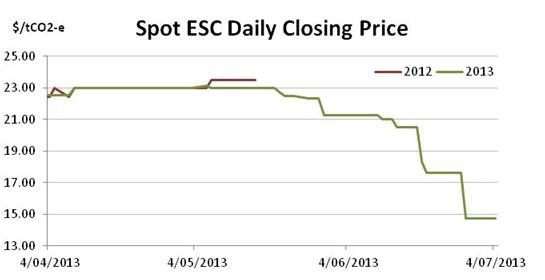

Price adjustment in the ESC market was always going to be a challenging process, owing principally to the fact that until earlier this year the market had never experienced an oversupply. In recent weeks the losses have been great but the first glimmers of hope may be emerging.

Having sat as recently as late May at the $22 level, the prospect of a growing oversupply of ESCs had made a considerable impact on ESC prices across the first half of the year. Yet all of those would pale in comparison to what would occur across June.

Early in the month the scheme administrator’s newsletter identified that, much like other environmental schemes which rely on a percentage based target calculation methodology, the Energy Saving’s Scheme target would be impacted by the falling demand for electricity being experienced across the National Electricity Market.

Expectations for the 2013 ESC target had been around the 2.5-2.6 million mark. Instead the Independent Pricing and Regulatory Tribunal advised the market that its estimate for the 2013 target was now between 2.2-2.47 million.

Given there were roughly 800,000 ESCs carried forward from previous vintages, the 2013 target was therefore already one-third met before any activity was undertaken this year. When 2013 ESCs are added to that figure it increase to 1.6 million the number of ESCs available to meet this year’s target, with just under 10 months remaining to meet the 2013 compliance date.

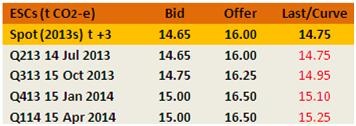

Over the last month it appears the penny finally dropped and, as a result, ESC prices have plummeted. In very illiquid fashion as is often the case, the ESC market stepped down large increments on often modest trade volumes on its way to a low of $14.75. Using as a benchmark the spot price at the time of my last update to Climate Spectator ($21.25), this represents a drop of over 30 per cent.

The drop in price has forced many in the ESC market to reconsider their models and across the last week stability has reigned. The question being asked now is whether $15 is sufficient to see ESC projects committed or will the market need to recover to keep the cogs turning on supply to the extent that the market will remain in significant surplus?

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.