July enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

Q2 surrender in the STC market has come and gone and with it a number of noteworthy developments have come to pass including a late resurgence in the spot price and an under surrender the likes of which has not been seen since the scheme began. And while the chances of the Coalition now succeeding in its thinly veiled push to shrink or potentially abolish the RET now appear doomed in the short term, some real risks for the SRES arise as a result.

In the STC market in July there were two major questions being asked by participants; a) would the market rally to replicate the highs seen in May and, b) would there be a squeeze of STCs as surrender got underway. In the end the answers to these questions were ‘yes’ and ‘no’ respectively.

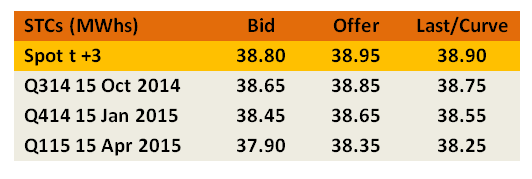

Spot STC prices were generally lower in July than they had been earlier in the quarter; an unusual outcome according to the prevailing logic in the market. The spot began the month in the high $38s and managed to breach the $39 mark in the second week. For a brief time the market moved into the low $39s reaching a fleeting monthly high of $39.40 before softening rapidly to end the month at $38.85.

Overall spot activity levels were marginally down on June with approximately 870k changing hands via the brokered market.

The STC squeeze that some of the perennial bulls had forecast failed to materialise. Indeed, instead what followed as surrender was complete was the largest ever under surrender (in percentage terms) in the STC market’s history. At just over 560k, there were 12 per cent fewer STCs surrendered in Q2 than would be the case if the scheme’s nominal target (18.65m) were met with the Q2 proportionate surrender (25 per cent). It is important to note that under surrender in this case does not mean anyone has failed to comply.

There are a number of reasons why this may have happened which essentially relate to the drop in demand experienced from lower electricity sales. This drop may be a reflection of a decrease in consumption or the loss of customers. Either way, the liable entity is not required to surrender more STCs than is necessary across the year and can apply for an exemption to avoid doing so. In the event that demand has shifted from one liable entity to another, then a true-up will need to occur in Q4.

In terms of STC submissions, recent weeks have been generally stable with modest weekly surpluses above the required run rate generally achieved.

To the future of the market and the political sphere to which it is wedded, while Labor, The Greens and the Palmer United Party maintain their stance against changes to the Renewable Energy Target, Coalition attempts to shrink or eliminate it altogether will be hamstrung. Yet the Small-scale Renewable Energy Scheme (SRES) remains particularly vulnerable to the whims of a frustrated government given the legislation affords the Minister the power to reduce the Clearing House price, as well as to alter the multiplier/deeming period which could ultimately reduced the number of STCs created per install.

From a market perspective, the prospect of changes to the Clearing House price is enough to give anyone the jitters given the likely impact on the spot price that such a change will cause. The behaviour of the Abbott Government will be closely watched especially once the RET Review Panel’s report is handed down later this month for any indication of its intentions. If a reduction in the Clearing House price appears likely, the quarter immediately preceding the time at which the change will take effect may very well be impacted.

Large-scale Generation Certificate (LGCs)

Following the sensational advent of Palmer United Party support for the RET and the hefty recovery in prices that resulted, the bull market was replaced with a more stable situation across July as participants waited for further developments. By month’s end that stability ultimately waned with the spots eventually dropping below the $29.00 mark. As predicted, the RET Review Panel’s final report will now only be handed down to government sometime in August.

High on the news that the Palmer United Party would be a roadblock to Coalition attempts to water down or scrap altogether the RET, the spot LGC market began the month of July by pushing through the $30.00 mark in a hectic period of activity. As the market moved across the month the spot remained range bound within the $30.00-$31.00 bracket. Yet by the middle of the month the spots had begun to drift with buying interest becoming harder to track down as participants appeared to be waiting for some form of development to provide an indication of where to next. Following a relatively slower second half of the month the spot eventually fell to $28.75.

In terms of aggregate trade volumes July again built on June’s numbers and, with just under 700k going through the over-the-counter market, notched up a record not seen since May 2011.

The month was also a relatively active one in the forward market with plenty of activity in the opening days in the Cal 14s (high $29s) and Cal 15 (low $31s) markets at a time when the spot stood in the low to mid $29s. By the middle of the month the Cal 15s were trading in the mid $32s and by month’s end the Cal 16 vintage also received some focus with trades at $33.30 and, subsequent to the spot dropping, $32.90.

Traders now appear to be looking to Canberra for a sign of what is to come. The Abbott Government’s RET Review Panel always appeared likely to be a little tardy in the completion of its report. Recent days have seen recognition of this fact with the panel asking for a couple of extra weeks to finalise its efforts.

Owing to the Senate opposition from Labor, The Greens and now the PUP, the Panel’s views, which are broadly anticipated to be negative for the future of the RET, may be rendered inconsequential anyway.

From statements made by the responsible Minister Greg Hunt, it appears the government may regardless seek to use the threat of the ongoing uncertainty that will be created by the lack of bipartisanship on the RET over the coming years to coax the industry into supporting a ‘real 20 per cent’ target. The argument there being that a ‘real 20 per cent’ would still require a healthy amount of new build and the compromise position would allow a return to bipartisanship, which would signal to project buyers that the long term policy certainty that is so necessary in committing to 10 year plus agreements had returned.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.