January enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

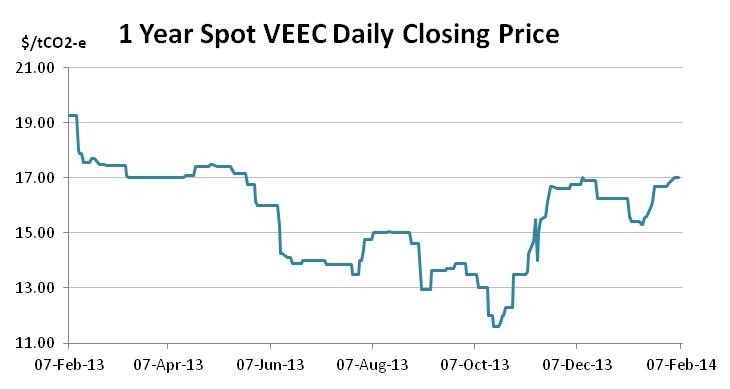

While the rebound in prices witnessed in late October and November appeared to falter either side of the Christmas Break, recent weeks have again seen the spot VEEC price on the rise with submissions for the month of January below the rate required to meet the 2014 target.

The decision to alter the Stand-by Power Controller methodology in October dramatically reduced the number of VEECs being created. Late last year this culminated in a spot price high of $17 in the second week of December. Yet having reached that high, the market began to falter as buyers looked to the future, assessing the size of the surplus as well as the potential outcomes of the current scheme review and concluded that a wait-and-see approach would suffice. The spot price ended the year at $16.25.

After the break it was more of the same with buyers thin on the ground early in January, allowing the spot price to slide back to a mid month low of $15.30. The softer prices then brought buyers back to the market with a week of stability eventually followed by a healthy recovery which, by month’s end, saw the market equal its late 2013 high of $17.10.

The price volatility was accompanied by some of the busiest periods in the spot and forward markets witnessed in over a year, with tradeless days the clear exception rather than the norm.

The supply/demand equation remains fairly straightforward. There currently exist just under 8m VEECs that are available for surrender against a 5.4m target for 2013. Added to that are another 600,000 ‘pending registration’. And while it is expected that a large number of these (100,000-150,000) will never be approved, the vast majority will.

That leaves a surplus of roughly 3m VEECs after 2013 compliance is concluded. Which means the market is already 57 per cent of the way to meeting the 2014 target. To put it another way, the market needs to create at least another 2.34m VEECs between now and January 31, 2015 in order for the target to be met.

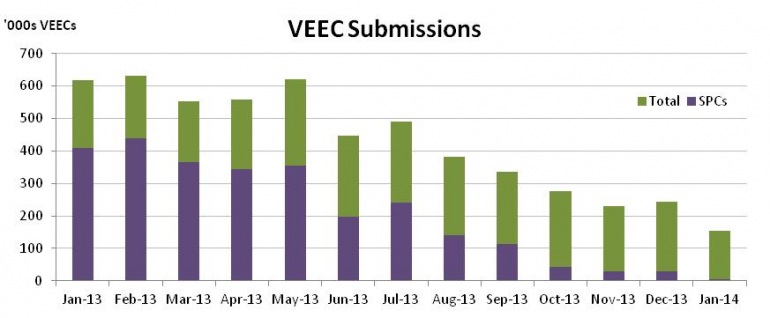

In essence the market requires at least 200,000 VEECs to be created in each of the 12 remaining months. In December the market clearly got there; in January it did not. As can be seen in the chart above, January’s figures of 155k fall short by a healthy margin.

There are two interpretations of the January figures doing the rounds at present. One of them is that 155,000 is clearly below 200,000 and hence supply is falling (as the chart indicates). The other is that the best part of half of the month of January is disrupted by holidays and hence to reach the 150,000 mark is a solid achievement. Other markets, such as the STCs see a sizeable drop off in submissions in late Dec/early Jan with many market participants being absent. While in previous years VEEC submissions in January have been both below (2013) and above (2012) average, the presence of a large surplus of 2013 VEECs means there is no mad rush among creators to ensure they receive 2013 status, given there is no scarcity-driven differential in the price of 2013s and 2014s.

Predictably, VEEC supply from SPCs continues to decline, with only 5000 submitted in January (purple sliver on the chart above). Lighting has now come to dominate VEEC creation with over 50 per cent of January’s submissions derived from the numerous lighting methodologies.

For those in the energy efficiency industry, there still appears an even money chance that the Victorian Government will seek to reduce the target for the next three year phase of the scheme. Unlike its Northern Coalition counterpart, who clearly sees the economic, social and environmental benefits of their scheme, the Napthine Government’s Review appears to regard the Victorian Energy Efficiency Target as an unnecessary impost on electricity users.

There are some political signs, however, that industry participants will find positive. 2014 is an election year for the state’s parliament. The Napthine government’s polling has been poor and it currently maintains power via the support of a controversial former Liberal, now independent MP Geoff Shaw, who appears intent of punishing the Government for perceived transgressions past. Making for a particularly unstable status quo.

As parliament returned this week, another controversial figure (the government appointed Speaker) resigned following a highly contentious end to 2013 in which a number of unusual decisions were made, including the eviction from Parliament of a number of Opposition MPs for an extraordinary length of time in a move that many believed was an attempt to avoid a no confidence vote.

With power hanging by a thread, one would expect the Napthine Government to closely consider the policy platform they take to the election and whether or not they are prepared to rock the boat on energy efficiency.

NSW Energy Savings Certificates (ESCs)

A growing surplus of ESCs as well as regulatory-driven price volatility, has characterised the last two months in the ESC market, and more changes appear likely on the horizon. Yet while Victoria mulls the potential reduction of its target, it appears the future is a little brighter in New South Wales.

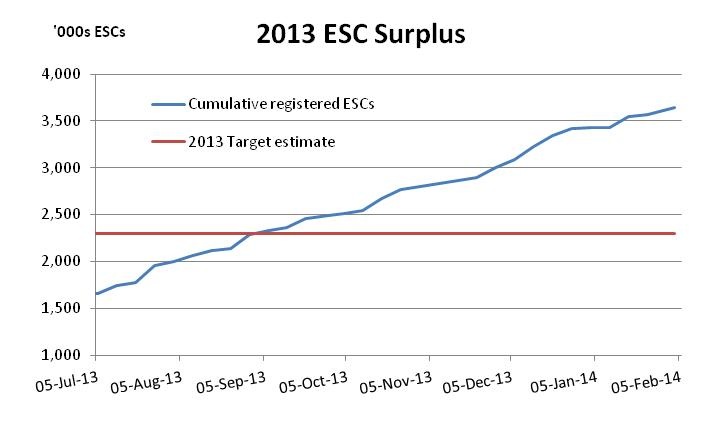

The major factor impacting on prices in the ESC market remains the oversupply of certificates. Having spent most of its early years with only just enough ESCs available to meet the target, 2012 and 2013 have broken that cycle, with a sizable ESC surplus accumulated during that period.

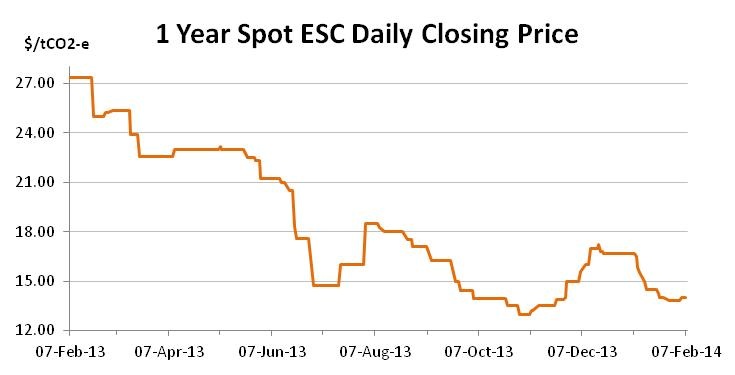

In October 2013, the weight of the surplus (which by that stage was looking likely to exceed 50 per cent of the 2013 target) was having a serious impact on pricing, with the spot having fallen to the $13 level.

Yet things did change. The announcement of potential regulatory changes, including the likely removal of some methodologies, the tightening of compliance in relation to others, as well as the announcement of a move into the domestic sphere, were enough to tip the balance in the market. By the second week of December the spot had reached a high of $17.

From such heights however, the market has since fallen. With supply continuing to surge buying interest for ESCs softened and the spot price along with it. The market closed 2013 at $16.70. By mid January it had reached $14.50 and by the latter part of the month a run of activity had seen the market fall to $13.85, though recent days have seen it creep back to the $14 mark.

The softening occurred despite the release of a review document which clearly indicates that the O’Farrell Government’s preferred method of meeting the state’s broader energy efficiency aims is via an increase to the Energy Savings Scheme target, which currently peaks in 2015. The incumbent government’s recognition of the success of the ESC market, means an increase to the target from 2016 is now a very real prospect, though there is still plenty of work to be done in the review process.

With the 2013 target expected to be around the 2.3m mark, there are currently 3.66m ESCs available for surrender (less just under 10,000 2014s which have been created) and submissions remain strong. There are those that suggest that the effects of the numerous changes to creation methodologies are yet to be reflected in ESC creations. As well as the other potential regulatory changes the future pricing outcomes in the market will likely hang on such a factor.

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.