January-December enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

Following a sharp decline in the spot price following the Q3 compliance period, the STC market continued its recovery across December amidst increasing rates of STC submissions. In January one of the first clear instances in the STCs of price differentiation between vintages was experienced. And while the waiting game for the release of the 2015 Small-scale Technology Percentage (STP) is now in full swing, it appears that further patience will be required before the final target comes.

Following the somewhat surprising and protracted softening in the spot STC price following October's (Q3) compliance period, the recovery that began in late November continued steadily across December with the market closing the year at $38.55. In January the market was generally stable until just after the middle of the month when something of a novelty for the STC market began to play out.

In years gone by the incidence of price differentiation between vintages of STCs was not a non-event yet, owing to several factors, this year it has become a highlight of recent trading activity. In order for an STC to be eligible for Q4 compliance, it has to have been submitted to the regulator by the 31 December of the compliance year. Any STCs submitted from 1 January onwards are therefore not eligible for Q4 compliance and can only be used in Q1. In years gone by however, with an average wait time for approval of 3-4 weeks and a very large STC surplus, it was hard to come by any approved STCs that were submitted after 1 January, until at least the end of that month. In effect meaning last minute compliance buyers seldom had any concerns in finding eligible STCs.

Late last year however, the regulator revolutionised the approval process; in doing so dramatically reducing both the number of STCs that were pending approval (registration) at any one time as well as reducing the average waiting time for approval. This combined with the relatively smaller STC surplus when compared to recent years lead to a premium being paid across January for 2014 compliant STCs above the 2015 vintage. At the time of writing the price differential (2014s at $38.90 and 2015s at $38.55) had existed for two weeks and generally sat in the $0.30-$0.35 range. The differential will only remain as long as there are buyers specifically seeking 2014 compliant STCs and, given the final compliance date is now only 10 days away, the run will shortly come to an end.

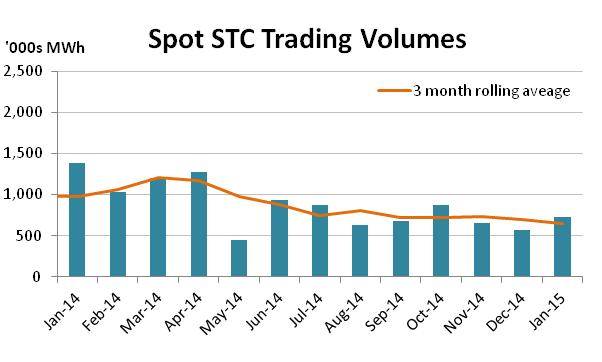

Trade activity in the spot market across December and January was generally stable with circa 560k and 720k reported across the two months respectively.

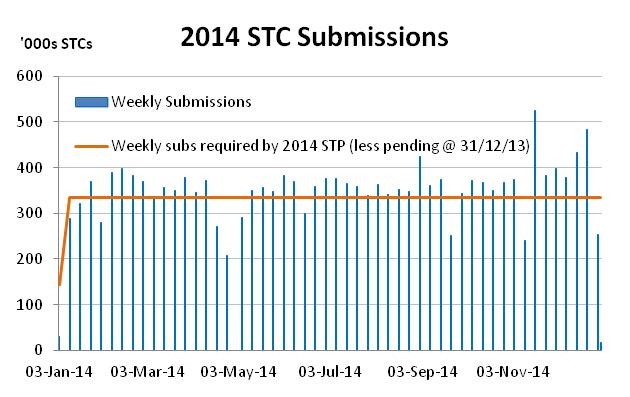

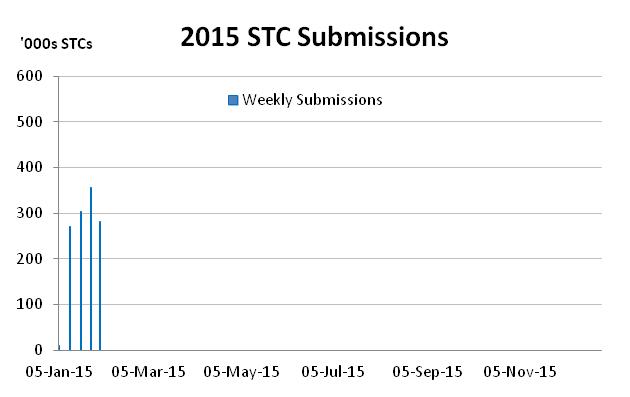

STC submissions across the end of the year were up ensuring a small surplus of STCs for the year. In truth the target set by the regulator for 2014 was very accurate with just under 18.2m STCs submitted for the year against a nominal target that was set at 18.65m. The reason a surplus occurred is because the STCs pending registration as at 31 December 2013 (1.26m) need to be added to the 18.2m and the number of STCs pending registration as at 31 December 2014 (0.58m) subtracted in order to determine the surplus which the regulator will recognise. The actual Q4 surrender will also have to be taken into account and, given the forecasts used to determine the target once again appear to have overestimated demand, a surplus of somewhere just north of 3m STCs will be carried forward into 2015.

As for the 2015 Small-scale Technology Percentage (STP), there was a strong case that a similar target to the one adopted for 2014 (10.48%) would be implemented in 2015 (current non-binding estimate is 10.10%). There are those however that believe that the increase in submissions across the end of 2014 is a sign that the market may be in for a larger year ahead, though the early indications in January were not enough on their own to validate that view.

The legislation requires the STP to be released by 31 March, though the regulator does try to get it out sooner rather than later. It appears likely that the earliest this will happen is late February.

Large-scale Generation Certificate (LGCs)

It isn't a normal year in the nation's renewable markets without some seismic regulatory activity. While the Coalition's about-face on its pre-election commitment to support the existing RET came as a surprise to no-one, the actions of the crossbench (particularly the Palmer United Party) ensured that 2014 was another case in point. At the beginning of 2015 however, despite the LGC market remaining burdened by a lack of bipartisanship, its prospects now appear considerably different.

The future of the LGC market and the RET more broadly will, as always, be determined by a group of politicians in Canberra. And, as it stands, that future is far from set in stone. Yet as the market begins 2015 there is one key difference from the situation 12 months (or even three months) earlier. The core difference is that while the Coalition could previously hold out and try to starve the renewable industry into pressuring Labor to concede to its demands, the diabolical (and, some would say, delightfully ironic) position of the Coalition at present, with its leadership issues and dire standing in the polls, has shifted momentum dramatically in the other direction.

The pressure is now on the Coalition from business to engage with Labor to achieve an agreement that will bind the latter at the next election; the idea being that obtaining some concession is better than none at all, which may very well be the outcome if no deal is reached and Labor takes out the next ballot. Yet this reality is not to say that the renewable industry is jumping for joy at present, for it is clearly not. Project development is at a standstill, and while LGC prices have improved substantially over the last six months, there is little prospect of the realisation of any long term agreements to underpin such development until a rock solid bipartisanship is restored.

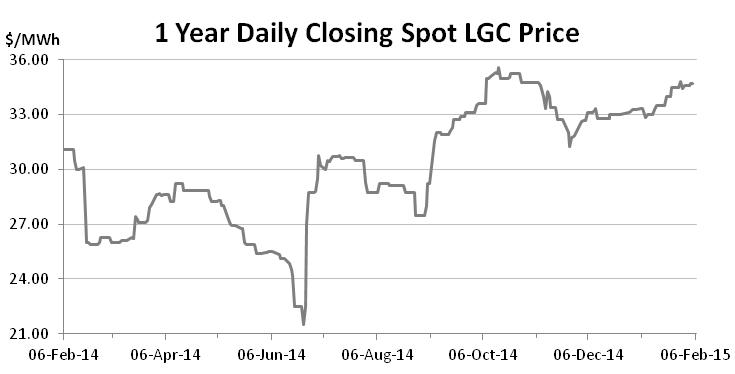

Across 2014 there were numerous periods of volatility in the spot market, with movement fueled by twists and turns in Canberra. Across December the spot market moved generally higher, trading between $32.50 and $33.25 across the month, before ultimately closing the year at $33.25.

In January however, following a softer start in which the market tracked back toward the mid $32s, the approach of the compliance period seemed to breathe new life into the market with the spot at one stage reaching $35, before continuing to tick over in the mid to high $34s toward the end of the month. While still a tad shy of the $36.50 highs witnessed in October, the current market remains toward the upper end of the trading range seen over the last two years.

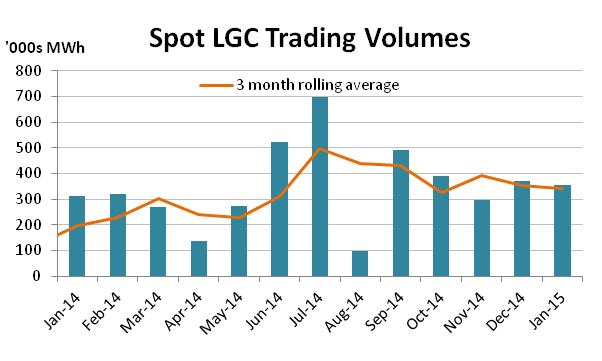

Trading volumes across December and January were stable with just over 350k reported in the over-the-counter spot market each month.

Activity in the forward and options markets was somewhat more subdued during the same period, though the Cal 15 vintage was the pick of the bunch continuing to go through at an escalation of circa 4% to the spot.

With the arrival of the final compliance date for 2014 on the 16th February (usually 14th, were it not on a weekend), the major issues to contend with over the coming months will undoubtedly be dictated by the political landscape in Canberra. If Tony Abbott survives the dismal cycle of leadership speculation, he will need to decide whether his recent attempts at barnacle removal will include the abandonment of his government's aspirations to wind back the RET. Having picked fights in so many areas and paid the price, it will be a difficult task for the PM to continue to pursue the interests of his backers in the face of strong public support for the RET. Should he fail to survive, it will come down to who his replacement is. Malcolm Turnbull is clearly aware of the reality surrounding the science of climate change including the need for immediate and dramatic action. Yet the price he will have to pay to gain the support of his colleagues may dictate his position on this issue, along with many others?

With Julie Bishop and Scott Morrison also in the fray, the truth is that the LGC market could yet be in for another bumpy ride over the coming months.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.