It's time to diversify offshore

| Summary: Leading investment advisers and fund managers are warning Australian investors to diversify into global markets, with Europe top of their list. But the window of opportunity, where large profits are there for the taking, is closing. It’s a case of doing the research, and taking the plunge. |

| Key take-out: Investing overseas is also a currency play. Putting money overseas now is a sensible tactical approach for those looking to hedge their exposure to the Australian dollar. |

| Key beneficiaries: General investors. Category: Portfolio construction. |

For way too long asset allocation for Australian resident investors has meant local shares and cash … but no longer.

The smart money is rapidly diversifying out of the local market, and now key players in the market are warning investors to get money into offshore markets while they’re still cheap.

As Mike Hawkins, chief investment officer of the Melbourne-based investment house Evans & Partners explains: “Asset allocation hasn’t been a great threat to the private investor in Australia over the past five to 10 years, but I personally think if you carry that asset allocation into the next five to 10 years it’s going to be quite diabolical.”

Speaking at the CFA Australia Investment Conference in Melbourne last week, Hawkins, whose clients include self-managed super funds (SMSFs), was clear about where investors should be parking their money.

“We’re putting money overseas as aggressively as we possibly can … and I can assure you that every one of our clients: young, old, zero tax, growth, defensive, is putting money overseas like they’ve never done before,” he said.

It is a view shared by many investment professionals, but less so by retail investors. The latest asset allocation figures from the Australia Tax Office illustrate just how stark the differences are.

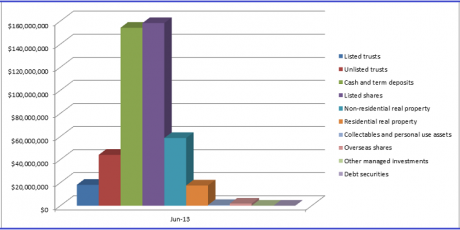

Source: ATO

As you can see from the chart above based on ATO estimates from SMSF annual returns, as at June 30, cash and Australian equities were still by far the most popular investments held in SMSFs. In contrast, overseas shares still represent just a fraction of assets.

It will come as no surprise that investors have a strong preference for investing close to home – a bias that has served investors very well in recent years. Investors seeking safety in what they know (i.e. cash, resources, banks and property) is a familiar strategy in the hunt for control, transparency and liquidity. But as this bias begins to pose greater risk, it becomes clear that many investors value perceived safety and comfort even above good risk-adjusted performance.

The message from leading wealth professionals such as Hawkins is clear: now is the time to enter and diversify into offshore markets.

“My advice for any investor is to move out of the home bias and take advantage of the fact that market prices are equilibrated by the home country investor and they reward the non-home country investor with a higher risk premium,” says Brian Singer, head of dynamic asset allocation at investment banking group William Blair.

These views support recent evidence that Australia’s wealthy have been increasing their exposure to offshore markets.

As I wrote last month, high net worth investors are being advised to invest offshore, not only to take advantage of companies trading at a discount but also to gain exposure to sectors we don’t readily have access to here. (see Australia’s wealthy take an offshore trip).

For local investors, taking the plunge offshore will require a sharp intake of breath. Remarkably, money is flowing right into trouble spots of recent times: For example, global investors are buying once-troubled European banks and European carmakers.

Credit Suisse chief investment strategist David McDonald said the group favours European banks and insurers, such as BNP – the French bank is currently trading on a forward price earnings ratio (P/E) of 11.46x, with a dividend yield of 2.81%. The current share price is €53.35. BNP also recently appeared as a choice of Australian international investor Kerr Neilson (see Neilson dives into Europe).

“We’re recommending financials in international equities. It’s an area we’re keen on, both European and US financial stocks, and also some of the more cyclical; capital goods, autos and engineering,” McDonald said at the time.

McDonald also mentions French electricity company Schneider Electric – currently trading on a forward P/E of 15.48x, with a dividend yield of 2.99%. The current share price is €62.58.

Speaking to Eureka Report recently, Kerr Neilson of the Platinum Group gave his view on opportunities in Europe.

“We’ve been buying companies like Italian bank Intesa Sanpaolo. Intesa holds 20% of the deposit base in Italy and currently trades at 0.6 times book value,” he said at the time.

(One of Italy’s largest banks, Intesa Sanpaolo is currently trading on a forward P/E of 21.18x, with a dividend yield of 2.78%. The current share price is €1.80).

“We’ve also been buying Bank of Ireland in some of our funds. We think it’s an interesting story. Coming out of this, we think BOI could look quite impressive,” Neilson said.

(Bank of Ireland provides a range of banking and other financial services to customers in Ireland and the UK. Its current share price is €0.26 … down from a high before the GFC of €11 ).

“We’re not looking for defensives in Europe; we want to participate in the improvement,” Neilson said.

Compared with Australian shares, equities outside Australia, especially in Europe, provide a near-term advantage, Singer says.

Unlike Australia, prices in European markets are still trading below fundamental values. He singles out Spain and Italy as undervalued markets that William Blair is looking at in the region.

For now, European equities provide investors with infinitely more opportunities for growth in the near term.

In a note issued earlier this month, Macquarie Private Wealth listed seven ‘must own’ stocks for 2014 based on its macroeconomic views for the region.

1. BNP Paribas (French banking group)

The banking sector is expected to see improved performance as the region’s economic recovery gets underway. BNP Paribas (BNP) is Macquarie’s pick in the sector because “consensus earnings have stabilised, it has strong dividend paying capacity and is at limited risk from the ECB asset quality review. It is also still very good value”.

2. HeidelbergCement (German multinational building materials company)

HeidelbergCement (HEI) is Macquarie’s play on a recovery in Europe’s construction sector. Although it remains subdued, there are tentative signs a recovery is underway, with construction activity picking up and expectations that interest rates will remain low for the medium term, providing further support. What’s more, HeidelbergCement is the cheapest in the sector with great potential delta, Macquarie says.

Heidelberg Cement is currently trading on a forward P/E of 16.18x, with a dividend yield of 0.82%. The current share price is €57.35.

3. Henderson (UK-based asset manager)

The recovery in European equities, combined with expectations of considerable fund inflows, is why UK-based asset manager Henderson (HGG) made the list. The group has one of the highest exposures to a recovery in European equities, Macquarie says. Karl Siegling recently wrote on the local ASX listing of Henderson (see Henderson’s healthy position).

Henderson is currently trading on a forward P/E of 15.14x, with a dividend yield of 3.4%. The current share price is £2.09).

4. International Consolidated Airlines Group (Holding company of British Airways and Iberia)

Macquarie names International Consolidated Airlines Group (IAG) as one of its chosen seven on the back of expectations that corporate spend in Europe will lift significantly in 2014. “This will benefit all airlines but it will benefit IAG to a disproportionate degree given its higher exposure to business and business-class travel,” Macquarie says.

International Consolidated Airlines Group is currently trading on a forward P/E of 31.52x. The current share price is £3.50).

5. MAN (German truck manufacturer)

Macquarie expects German truck maker MAN (MAN) to benefit from increased demand for the transport of goods to the US and UK. It is the preferred play for Macquarie because of its exposure to Europe (around 50%) and because its earnings per share are still extremely depressed, at around 15% of its 2007 level.

(MAN is currently trading on an extremely high forward P/E of 128.82x, with a dividend yield of 1.13%. The current share price is €88.63).

6. Renault (French carmaker)

A rise in consumer spending should see the auto sector rally further. Renault (RNO) is still trading well below its long-term average and is improving its product offering, making it the favoured choice for Macquarie.

(Renault is currently trading on a forward P/E of 13.74x, with a dividend yield of 2.60%. The current share price is €66.11).

7. Telecom Italia (Telecommunications group)

The last on the list is Italian telco Telecom Italia (TIT). Again, Macquarie points to an expected increase in consumer spending, with “spending on data likely to benefit”. Telecom Italia is the cheapest telco in the region and is not at risk of a major alternative threat such as cable, Macquarie says. It’s also expected to benefit strongly from changes to the macroeconomic environment.

(Telecom Italia is currently trading on a forward P/E of 6.72x, with a dividend yield of 2.98%. The current share price is €0.67).

Conclusion

Most Australian private investors have little or no overseas holdings in the equity portion of their portfolios. Advisers are strongly recommending investors begin to make reasonable and measured diversification of shareholdings into offshore markets at a level which is in line with individual risk tolerance.

Investing overseas isn’t just about taking advantage of undervalued companies; it’s also a currency play.

“Commodity prices and a commodity price boom have a very significant short and intermediate term impact on creating dislocations in the price of commodity currencies – the Australian dollar, the Kiwi, the Brazilian rand, the Canadian dollar – all of those are probably currencies that are best avoided,” Singer says. “In that regard there is a good secondary reason … to get out of the home bias and invest in equities outside of Australia.”

While the Australian dollar has enjoyed a recent bounce, it’s still forecast to weaken considerably over the coming months and years. Putting money overseas now, before the currency drops, is a sensible tactical approach for those looking to hedge their exposure to the currency.