IT sector needs reboot

| Summary: Cuts in spending on IT infrastructure and services, and strong industry competition, have taken their toll on the technology sector generally, and listed IT stocks. Most IT companies are not expecting a strong pick-up in sales this year – contrary to analyst expectations – but the sector is poised for a rebound. |

| Key take-out: The IT sector has one of the highest levels of operating leverage, meaning a small increase in sales will have a disproportionately large bearing on earnings. |

| Key beneficiaries: General investors. Category: Shares. |

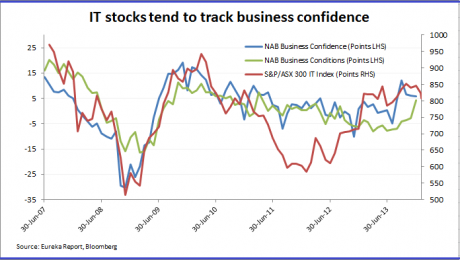

The jump in business conditions bodes well for the information technology (IT) services sector, but investors should brace themselves for a potential sell-down in the near term.

While the National Australia Bank business conditions index posted a strong turnaround to four points in December, from negative three points the month before, IT industry insiders have told Eureka Report they have not noticed, and do not expect, a recovery in demand for IT services for the current financial year.

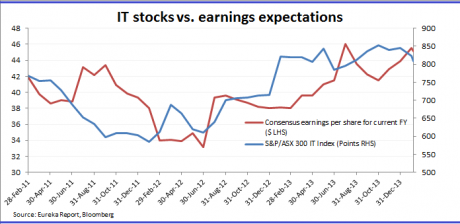

This is significant, because the market could be setting itself up for a disappointment given that around 80% of listed business software and services firms are forecast to deliver top-line growth for 2013-14.

The chief executive of Data#3 (DTL), John Grant, says he sees no tangible signs of a turnaround for the June half, although he suspects this financial year will mark the low-point for the industry. But investors shouldn’t get carried away.

“I don’t think the recovery in FY15 will be strong – it will be better, but I don’t think we will get back to the headier days of pre-2008,” says Grant.

Another chief executive of a listed IT services firm, who asked not to be named as the company is in “blackout” (the period just before a company’s earnings announcement when management isn’t allowed to talk to the public), also voiced a sombre outlook for the industry.

He says it is too early to call the start of the new uptrend and warns that project management and consultancy work is getting increasingly commoditised, which puts pressure on margins.

These comments seem to run counter to consensus forecasts for the sector. Analysts polled on Bloomberg are forecasting sales growth to average 16.5% for 2013-14, followed by an 8% uplift in the following year. The estimates stand in contrast to the five-year average growth rate of 7.2% for the group.

Some of the optimistic estimates are believable. This includes Integrated Research (IRI), which effectively pre-released its results in a recent market update. The weaker Australian dollar and revenue contributions from its strategic partnerships will help the firm deliver a net profit of between $4.4 million and $4.8 million for the December-half, compared with $2.8 million for the same period last year.

Others like RXP Services (RXP) also is expected to report higher revenue due to a number of acquisitions it made in 2013.

Top 10 IT stocks based on consensus sales growth expections for FY14 | |||||

| Code | Company | Sales growth FY14 (%) | Sales growth FY15 (%) | EBITDA* growth FY14 (%) | Total rtn 1-yr (%) |

| RXP | RXP Services | 72.64 | 22.02 | 103.58 | 46.73 |

| EPD | Empired | 68.72 | 27.85 | 124.90 | 63.23 |

| PPS | Praemium | 31.98 | 7.03 | -252.24 | 121.43 |

| HSN | Hansen Technologies | 28.88 | 4.14 | 55.93 | 51.00 |

| IFM | Infomedia | 13.06 | 3.54 | 123.97 | 80.67 |

| IRI | Integrated Research | 12.77 | 6.62 | 20.21 | -2.20 |

| ASZ | ASG Group | 12.10 | 1.56 | n.a. | -28.36 |

| TNE | Technology One | 10.11 | 8.97 | 16.30 | 55.66 |

| UXC | UXC | 7.95 | 6.04 | 14.46 | 5.16 |

| OCL | Objective Corp | 4.36 | 5.01 | 8.84 | 8.78 |

| *Earnings before interest, tax, depreciation and amortisation | |||||

| Source: Eureka Report, Bloomberg | |||||

But any sell-off on earnings disappointments could be regarded as a buying opportunity. Indeed, the sector has one of the highest levels of operating leverage, where a small increase in sales will have a disproportionately large bearing on earnings.

This leverage is amplified by the low utilisation rates across the industry. IT firms have the capacity to meet rising demand with little added costs, and this operating leverage of earnings before interest, tax, depreciation and amortisation (EBITDA)-to-sales stands at around 140% at this point in the cycle. This means a 10% increase in revenue will translate to a 14% improvement to EBITDA.

If the upswing in sales doesn’t eventuate this year, it will the next. The medium-term outlook for the sector is bright, as most of the pressure is cyclical in nature with companies and government agencies holding back on spending due to economic uncertainties. The fact is there is only so long they can hold off on spending, and economic conditions are improving.

No doubt, there are some structural challenges facing the industry, such as the trend to use cheaper overseas contractors and business migration to the cloud. However, these are not expected to inflict long-term pain as they may be as much an opportunity as a threat to existing IT companies.

Cloud computing refers to running software and storing files on the internet instead of on a local computer. You can tell the cloud sector is reaching for the sky with a number of back-door listings slated this year. This includes Bulletproof Networks and Decimal, which are doing reverse takeovers of embattled listed junior explorers in order to become public companies. This is generally a cheaper way for a private company to float on the ASX.

Another reason not to ignore the IT sector is merger appeal. Conditions are ripe for corporate activity given that the “black hole” the industry finds itself in is generally seen as a temporary condition.

While bidders, or investors for that matter, may not be able to pick up any real bargains in the sector, as many stocks have bounced back to trade at historical average multiples – such as price-earnings and enterprise value-to-EBITDA – a number of these stocks are likely to look to be good value on a three-year view.