Is this AGL and Origin's dark and difficult future?

One of the giant utilities of the European energy market and Germany's largest utility, E.ON, has announced that due to "dramatically altered global energy markets, technical innovation, and more diverse customer expectations" the company will be offloading its troubled conventional power generation and oil & gas business, to instead focus on renewable energy, energy efficiency and energy management services, and power networks.

Similar to what has started to unfold in Australia's power market but far more extreme, E.ON's financial returns from its conventional power business has been battered by a combination of declining power demand and the rapid rise of renewable energy. Together these have been like a pincer movement pushing down wholesale electricity market prices for E.ON's power generators in its main market of Germany.

The end result has been a plummeting share price as the chart below illustrates. In announcing its plan to offload the conventional energy business E.ON declared it had to write-down the value of its business by a further $6.6 billion.

E.ON share price over past five years

Source: E.ON

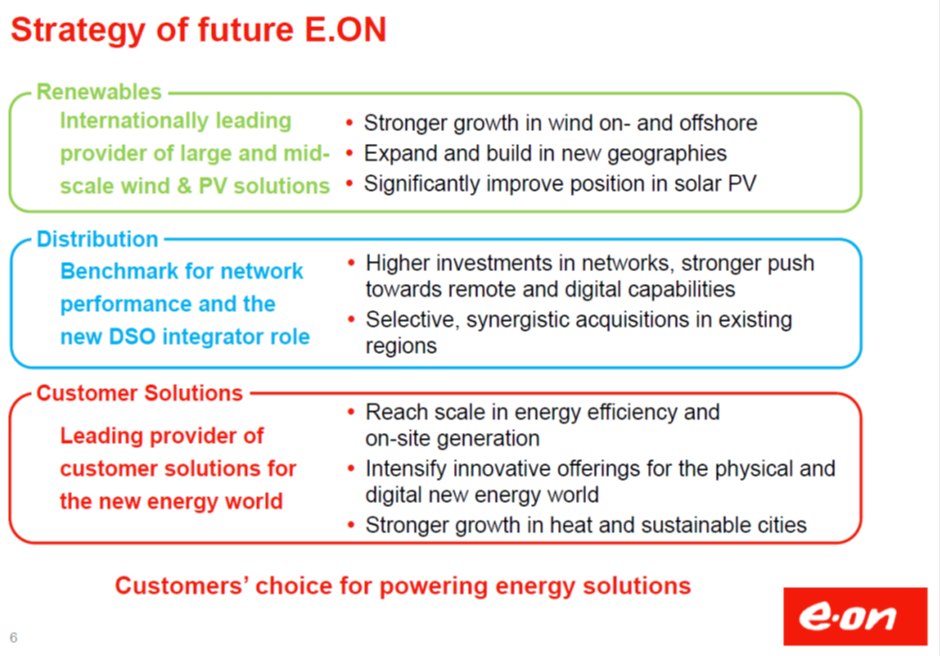

E.ON has now decided it must make a radical shift out of fossil fuels and the conventional centralised power generation model, towards a model that still hinges on the grid but with a greater focus on distributed energy solutions. Below is a slide taken from E.ON's presentation to investors explaining the focus of the newly slimmed-down E.ON on renewables, distribution networks and customer solutions – essentially a combination of traditional power retailing, but also the provision of on-site generation such as solar PV and products and services that reduce energy demand.

Source: E.ON presentation to investors, 1 December 2014

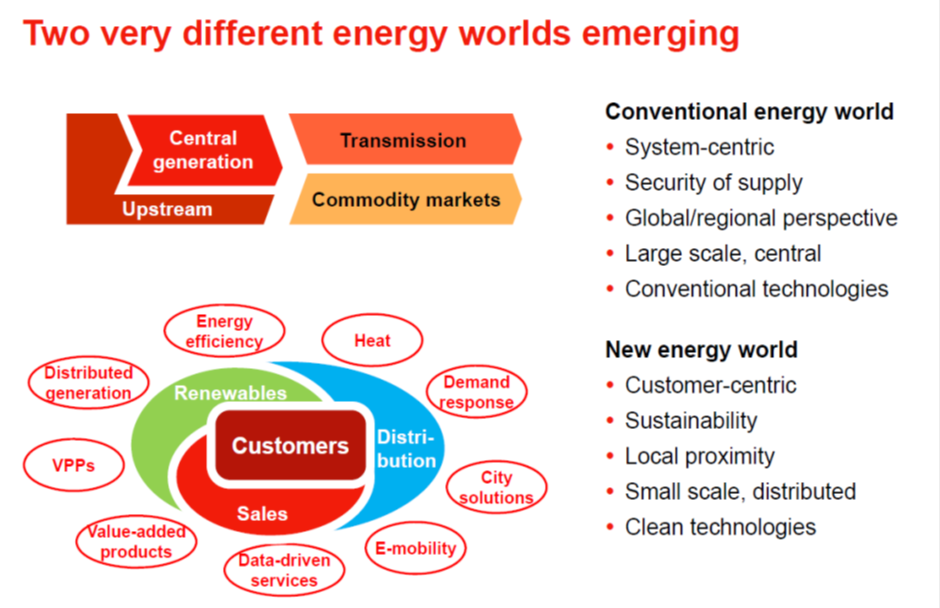

While of course E.ON was still careful to emphasise the ongoing value of the conventional energy business, it said the market for energy was undergoing a profound shift. The slide below from their investor presentation outlined that a combination of the internet of things, distributed generation such as solar, and electric vehicles and their associated batteries mean customers now have an array of options for meeting their energy needs.

Source: E.ON presentation to investors, 1 December 2014

E.ON's hope is that through their leading position in power networks and retailing they will have a competitive advantage in melding these into integrated solutions to conveniently and cost-effectively address customer's needs.

In the end E.ON has decided trying to balance the competing priorities and conflicting objectives of its new and old energy businesses did not make sense. E.ON's chief executive Johannes Teyssen noted,

“E.ON's existing broad business model can no longer properly address these new challenges …E.ON will tap the growth potential created by the transformation of the energy world. Alongside it we're going to create a solid, independent company that will safeguard security of supply for the transformation. These two missions are so fundamentally different that two separate, distinctly focused companies offer the best prospects for the future”.

This decision is likely to resonate throughout the power sector globally including Australia. Germany acts much like the canary in the coal mine for power utilities about what might be in store if governments were to aggressively pursue decarbonisation of power without the help of nuclear power.

Back in March in my article, Will utilities adapt or fall to solar?, I questioned whether it actually made sense for incumbent power companies to shift their businesses from conventional energy towards becoming providers of customer-end solutions. Just because they happen to make money out of supplying power today, it doesn't mean they are therefore well suited to provision of energy under E.ON's rather more complicated picture of the ‘New Energy World'.

Both Origin Energy and AGL as well as WA's main power-retailer Synergy (with EnergyAustralia left mired behind with more basic problems), are grappling with what to do in response to the shift towards the New Energy World. Also in a signal of greater acceptance about the potential for renewables to play a cost-effective role in meeting consumers power needs, WA's remote region utility Horizon Power has just appointed Professor Ray Wills to its board, a leading advocate for renewable energy's potential as a cost-effective alternative to fossil fuels.

Yet it is an interesting paradox that while AGL and Origin acknowledge the emergence of the 'New Energy World' they simultaneously find themselves inexorably drawn deeper into conventional energy.

All of these businesses are inherently conflicted, because the growth of the ‘New Energy World' hurts their far more substantial existing investments in the ‘Conventional Energy World'. AGL's outgoing CEO Michael Fraser even acknowledged the tension in a speech that dwelt on Kodak's demise through an unwillingness to grow digital photography because it would cannibalise its film business. Yet while highlighting the need to dramatically reduce carbon emissions, he still dug his business deeper into conventional energy by investing billions of dollars into coal fired generators.

AGL's new CEO Andrew Vesey has been sold as having expertise in the New Energy World but his company AES isn't much of a leader. Its power utilities operate in markets that are miles behind Australia in the uptake of rooftop solar PV. One of its two US utilities, Dayton Power & Light, operates in Florida where, rather ominously, CleanTechnica reported,

The approval [of utility proposals by state regulators] means that the state's major, investor-owned utility companies have more or less gotten exactly what they wanted — energy efficiency goals will be cut by over 90%, and the state will cease supporting rooftop solar at all.

In terms of Origin Energy it threw away its number 1 sales position in solar PV, and is now a bit player in that market. Meanwhile Origin's chief executive questions solar's future prospects, highlighting the technology as a subsidised freeloader.

Given this you have to wonder whether these companies have to go through the same traumatising experience as E.ON before anything really changes.