Is retail spending on the mend or not?

Summary: The latest March quarter GDP figures from the Australian Bureau of Statistics showed a deceleration in consumer spending, a stark change from the improvements which had been flagged by the Reserve Bank of Australia at its June meeting. Otherwise we know that the construction boom is in full swing, house prices are rising and the share market is generally higher – meaning consumers are getting and feeling wealthier. |

Key take-out: Given the strength is some key discretionary spending sectors, the best summation is that consumer spending is accelerating – and at a decent clip. |

Key beneficiaries: General investors Category: Economics and Investment strategy. |

So what happened to the consumer rebound? One minute we're all getting excited that consumer spending is picking up, with the RBA even noting at its June meeting that “household spending has improved” – a firmer view on spending than in May when they had simply observed “improved trends in household demand over the past six months.”

The thing is, the March quarter GDP figures, far from showing an acceleration in consumer spending, actually showed a slowing – down to 0.5 per cent for the quarter from 0.8 per cent in the December quarter. More recent data also shows this slowing extending into the June quarter with the monthly retail sales flat in April after a very modest lift of only 0.2 per cent the month prior.

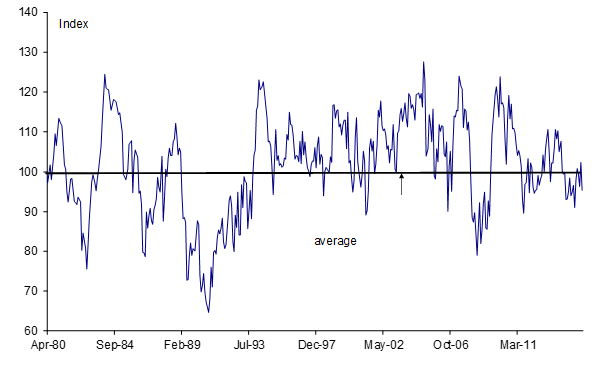

This comes on still quite soft consumer confidence figures (see chart 1 below).

Chart 1: Consumer confidence remains weak

The great puzzle though, amid the apparent softening in both consumer spending and confidence, is the strength we are seeing in some of the key discretionary spending items. Car sales for instance are at records. Similarly, spending on hotels and cafes is robust, as is household good retailing – growing at double the historical average. It's very strong.

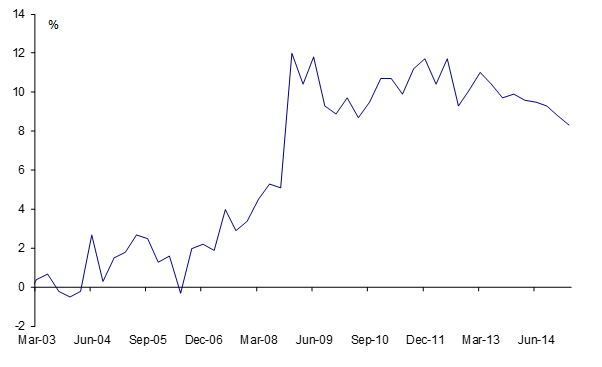

These kind of results are more in line with what we would expect. There is certainly every reason for consumer spending to lift. As we found out this week, jobs growth remains very strong – the highest in over four years – and the unemployment rate is low at 6 per cent. Similarly, the savings rate at 8 per cent is still very high relative to history. That's a big pool of ‘potential' consumption.

Chart 2: Australian savings remain high

Otherwise we know that the construction boom is in full swing, house prices are rising, as is the share market (not right now of course but generally) which means that consumers are getting wealthier – feeling wealthier.

That's an odd back-drop to see spending decline. That's why we are seeing some key components of spending rise at such a rapid clip.

The reason spending looks weak overall is because of quite sharp, in some cases offsetting, falls in other key components. Occasionally those falls reflect changing social trends, such as the large fall in spending on tobacco products. This isn't reflective of a weak consumer though. And indeed it gives consumers more money to spend elsewhere.

In other cases the numbers just look plain wrong, such as the softness in health spending despite the aging population and the boom in availability health products and services. Spending on education is also quite weak apparently.

The biggest problem though is the apparent weakness in spending on food. The ABS still reckons that food consumption hasn't grown over the year – at 0.2 per cent – and hasn't done much over the last two years, rising just over 2 per cent. This matters, because food by itself is 10 per cent of total consumption.

I have two key problems with that.

Firstly, that low growth comes despite quite solid population growth of about 3.7 per cent over that period. Secondly, such modest food consumption isn't being observed elsewhere. It appears to be a pattern unique to Australia. Well, that is when you compare it to like countries such as the US or NZ. These are countries with which we share cultural trends – consumer trends. If Australia, with its comparatively strong population growth, can barely report positive food consumption, how is it that it is so much stronger in these other economics? Indeed food consumption the US and NZ is growing at double the rate in fact it is in Australia.

That is an extremely odd occurrence when you consider that Australia has the fastest growth rates with regard to being overweight and obese in the world (according to a study published in The Lancet medical journal).

It doesn't make sense. There's strong population growth, while jobs growth has been at its strongest pace in about four years – the country has a weight problem and our cultural cousins are eating like there is no tomorrow.

Some point to weak wages growth as the answer and it is weak. Yet while growth is low – the lowest on record – the reality is the weakest wages growth on record is only 1 per cent per annum below what is usual. So instead of getting a 3.5 per cent pay rise in a year, employees are getting around 2.5 per cent. That's not a spending destroying rate of wages growth, especially in a low inflation environment. In any case those numbers are a bit misleading as those rates of pay don't include people who are getting a pay rise though promotion.

Consumer spending is improving, rapidly in some cases. Yet this doesn't show in the headline figures because it is being offset by weakness in other components. It has to be said that some of that weakness appears very strange and out of the ordinary. It doesn't make sense when you cross reference it with other things that we know – so for instance spending on education and health also apparently is weak.

Given the strength is some key discretionary spending sectors, the best summation is that consumer spending is accelerating – and at a decent clip. Data anomalies, measurement errors, etc. mean that this isn't necessarily showing up in the headline figures yet. That will change on current trends and it is likely the consumer spending figures will continue to lift as the noise washes out.