Is Reece's hot share price overheated?

| Summary: Listed plumbing and bathroom supplies business Reece Australia has put on more than $600 million in value over recent weeks, with its market worth now topping $3 billion. But, at current levels, with a price-earnings ratio of 25 times, the pressure on the company to achieve strong earnings results is higher than ever. |

| Key take-out: The likely recovery in the residential building cycle, and Reece’s reinvestment of earnings gives the company strong potential to generate growing economic value. This is attractive, but only if you can acquire the Reece shares at below their intrinsic value. |

| Key beneficiaries: General investors. Category: Growth. |

| Recommendation: Underperform. |

As the liquidity-fuelled equity market rally rolls on, there is ample evidence many share prices are beginning to disengage from rational pricing and moving well above their intrinsic value.

This comment generally applies to low-returning companies, as measured by return on equity (ROE), which perennially promise improvements but never quite perform. However, in recent times, I am seeing share prices surge for some high-quality companies that have taken them well beyond the realms of logic.

This is an important observation because the rapid expansion in price-earnings ratios (PERs) currently observable across the market is supporting many overpriced initial public offerings. High market prices attract vendors who access the market for a sale or an exit from a business, rather than the more proper purpose of raising equity for expansion. Investors need to understand the difference between capital raisings and sell-outs. I will cover that distinction in future weeks but my focus today is on clear examples of excessive pricing in the market generally.

One such example is a company I admire, Reece Australia Limited (ASX:REH). REH is Australia’s and New Zealand’s premier plumbing and bathroom supplies business. This quality company, as measured by a long period of solid ROE performance, has recently galloped upwards in share price. Indeed, a rather innocuous AGM statement suggesting a 7% lift in profits, equivalent to an increase of about $4 million in the half-year, saw the market capitalisation lift by hundreds of millions of dollars in just a few weeks. REH has 99.6 million shares on issue, and so the share price rise of $6 per share over the last four weeks has sent its market capitalisation up by an extraordinary $600 million to over $3 billion!

The major shareholders, who own about 70% of the issued capital, are the Wilson family and they must be bemused by the market price that has resulted in their fortune swelling by over a half a billion dollars in the last year. This is both extraordinary and illogical. The company is of quality, but the projected earnings of about $125 million in 2013-14 do not justify a market capitalisation of $3.1 billion. To my eye, the share price movement over recent months has nothing to do with the underlying profits of REH and is clearly suspicious.

Before I delve into my assessment of the value of REH, I would like to remind readers of two fundamental rules for value-based investing. These are:

- The identification of highly profitable businesses able to grow their intrinsic value steadily; and

- The purchase of shares in these businesses at meaningful discounts – margins of safety – to value.

In my view REH clearly satisfies rule 1, although its recent profit history is quite pedestrian as it battled difficult trading conditions. As for rule 2, it is apparent that REH is currently priced for perfection. Its current share price infers it is not possible for the company to encounter any operating problems. Indeed, its price totally belies the recent sombre outlook presented last week by the Reserve Bank, which downgraded economic growth forecasts in 2014 and lifted market expectations for unemployment to rise above 6%.

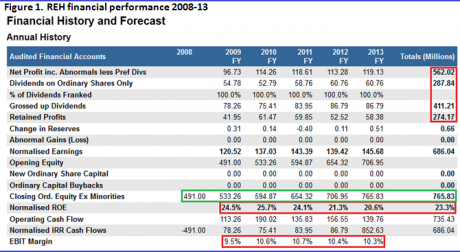

The following table (Figure 1) shows REH has battled difficult market conditions for the last four years. A heavy investment program in new retail sites and business acquisitions may soon bear fruit, but a PER of over 25 times fully prices in this potential.

Importantly, the company has invested from free cash flow as opposed to borrowings. We see this clearly below.

Source: StocksInValue.com.au

REH began the review period with $491 million of shareholders’ equity but ended the period with equity of $766 million, despite paying out $288 million of dividends. It achieved this because average normalised ROE (including franking) over the period was a strong 23%, dipping only marginally over the last two years in the building and construction downturn. REH was so profitable it earned $562 million over the period, paid out the $288 million of dividends (worth $411 million including franking credits) and still grew shareholders’ equity by $274 million.

Normally debt boosts ROE by increasing earnings on shareholders’ equity but REH averaged 23% NROE (normalised return on equity) with negligible debt. Over the last six years, short-term debt on the balance sheet averaged just $19 million compared with equity worth hundreds of millions. At last balance date cash holdings represented about $150 million or 20% of net assets.

Unusually high EBIT margins were the main reason for the impressive profitability. Most manufacturers and distributors of building and construction products earn EBIT margins of just 3-6% but REH managed to control its costs and hold onto margins.

Also, REH generated $735 million of operating cash flows over the period, way above net profit of $562 million. This indicates conservative accounting policies and no significant difficulties converting accrued sales revenue into cash in the door.

A quality business indeed!

The above analysis demonstrates why ROE is crucial to what a business is worth. Businesses are not worth more because they are popular or because stockbrokers upgrade their share price targets. Instead you should only consider paying more for a company which can use its equity base more efficiently to generate higher earnings and dividends – and which has sufficient opportunities to reinvest retained earnings to grow equity, earnings and dividends for shareholders.

So what should you pay for REH?

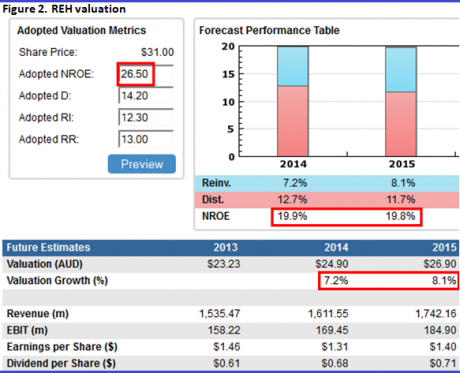

Source: StocksInValue.com.au

Figure 2 demonstrates how to value the company. Note my 26.5% adopted NROE significantly exceeds consensus forecasts of around 20% over the next two years. In my view the market consensus for REH is underestimating the likely recovery in the residential building cycle. Indeed, I think REH can sustainably reinvest around half its earnings for an incremental return on that equity of above 20%. This compares with the inferior average reinvestment rate for listed corporate Australia of much less than 20%.

Therefore REH has a strong potential to generate growing economic value, as NROE is more than double my required return of 13%. Combined, these two qualities will drive share valuation growth up by 7-8% pa over 2014-15. This is attractive but only if you can acquire the REH shares at below their intrinsic value.

The above process yields a valuation on September 30, 2014 of $24.90, which makes the stock currently 25% overvalued at a $31.07 share price. With a grossed-up FY14 dividend yield of 3.1%, 68c dividend divided by the $31.07 share price, an investor’s prospective total return at current prices is approximately negative 17%, and this is despite REH’s investment quality discussed earlier.

I urge investors to heed the lessons I have learned over many years of observing equity markets. You can lose money even on quality stocks by overpaying. Be patient, identify the quality stocks of interest for your watch list, and trust you will be able to buy them the next time the market’s mood sours. This combination of patience and aggressive opportunism is value investing at its most profitable – and enjoyable!

John Abernethy is the Chief Investment Officer at Clime Asset Management, one of Australia’s top performing equity fund managers. To hear John speak at one of a range of upcoming investor briefings across the country, visit www.clime.com.au/events.

Clime Growth Portfolio Statistics

Return since June 30, 2013: 14.22%

Returns since Inception (April 19, 2012): 34.33%

Average Yield: 5.91%

Start Value: $141,128.64

Current Value: $161,200.30

Dividends accrued since June 30, 2013: $3,622.96

Clime Growth Portfolio - Prices as at close on 12th October 2013 | ||||||

| Company | Code | Purchase Price | Market Price | FY14 (f) GU Yield | FY14 Value | Safety Margin |

| BHP Billiton Limited | BHP | $31.37 | $38.03 | 4.58% | $38.79 | 2.00% |

| Commonwealth Bank of Australia | CBA | $69.18 | $78.09 | 7.02% | $69.18 | -11.41% |

| Westpac Banking Corporation | WBC | $28.88 | $32.85 | 7.91% | $31.52 | -4.05% |

| Woolworths Limited | WOW | $32.81 | $34.44 | 5.81% | $35.84 | 4.07% |

| The Reject Shop Limited | TRS | $17.19 | $17.50 | 3.92% | $16.98 | -2.97% |

| Brickworks Limited | BKW | $12.70 | $13.59 | 4.31% | $12.75 | -6.18% |

| McMillan Shakespeare Limited | MMS | $16.18 | $12.45 | 5.16% | $12.20 | -2.01% |

| Mineral Resources Limited | MIN | $8.25 | $11.41 | 8.26% | $13.41 | 17.53% |

| SMS Management & Technology Limited | SMX | $4.55 | $4.61 | 6.20% | $5.29 | 14.75% |