Is it time to gear?

| Summary: Could conditions get much better for sharemarket gearing? Interest rates at near-record lows and the sharemarket still growing solidly, with many stock valuations still not overly stretched. There are a number of gearing avenues too, including geared share funds and protected loans. |

| Key take-out: Gearing is about buying assets with good prospects for stable and growing income streams. Capital growth will follow, and the income is the vital ingredient for covering borrowing costs and reducing the loan balance as quickly as possible. |

| Key beneficiaries: General investors. Category: Strategy. |

One of the remarkable side-effects of having the lowest interest rates in a generation is that we are also seeing some remarkable pricing in the area of gearing. Put simply, the cost of gearing (or borrowing for investing purposes) has suddenly dropped to remarkably low levels. For investors with a robust risk tolerance, the numbers are worth a fresh look.

It’s one of the oddities of the Australian market that though investors are happy to gear into the residential housing market, despite it being expensive on every measure, there remains a lack of appetite for gearing in the sharemarket where valuations are not stretched.

What’s more, it’s also worth pointing out that for more than two decades prior to the GFC gearing into shares was seen as an entirely conventional strategy recommended by most financial advisers to the vast majority of retail investors.

Jump forward to 2014 and we have a market that has gained 20% for two years in a row with a long-term average of 11%, and yet there is a deep resistance to gearing.

Now every individual’s investment and tax situation is different and I am not for a moment suggesting that gearing will return to its previous prominence. However, experienced investors should certainly be familiar with the exceptional nature of the gearing market at this time.

If you think about it, historically low interest rates are a signal from the Reserve Bank that it wants people to borrow to invest, with interest costs on sharemarket gearing products as low as 3.5% now available.

In fact, after the stifling federal budget, the main hope for our economy is that individuals and businesses do just that. The problem for most people is that GFC wounds are still very raw and so, even though the economy and sharemarket has stabilised and returned to growth, investors are reluctant to use low interest rates as the catalyst for sharemarket lending.

New gearing products and strategies may just be the encouragement that’s needed, but should only be used with a sound understanding of the fundamentals for making leverage work, and of the technical details of these new gearing vehicles.

Think like a landlord

That should be simple, but unfortunately it’s not. Gearing into the sharemarket isn’t about short-term capital growth, and gearing your SMSF isn’t as simple as the spruikers make out.

Financially, gearing is about buying assets with good prospects for stable and growing income streams. Capital growth will follow, and the income is the vital ingredient for covering borrowing costs and reducing the loan balance as quickly as possible.

This has two aspects that I call the “landlord effect” with shares.

- Growing yields are the key to prosperity in retirement (just like a successful landlord lives off rent in retirement), with income being used to fund living expenses. Stocks like NAB are yielding well over 50% based on their purchase price in the early 1990s, with capital growth around 10x their original cost.

- “Effective” leverage is a great way to shorten the “payback” period on stocks – the time it takes for the dividends to defray the original purchase price.

The keys to effective leverage

“Effective” leverage is where dividends cover interest costs and also provide for funds to reduce the outstanding loan amount. To springboard our analysis of the new gearing products, let’s look at how to lock in “effective” leverage (and how gearing risks can erode “effective” gearing).

The key is to set the gross interest expense to be as close as possible to the current income from the asset.

Current RBA rates are 2.5% per annum, their lowest level in several decades. Since 1990 the official interest rates have averaged 5.33%, and ranged from 17.5% in 1990 to 2.5% today. Sharemarket yields for quality “income” stocks are nearly double the official RBA rate and across the entire ASX 200 index, the dividend yield forecast for this year is 4.4%. (And that’s net – in other words we have not accounted for the positive effects of franking which would lift the effective dividend yield for most investors to an estimated 5.9%. To read more on franked dividends, see today’s article from John King, Franking credits propel returns.

Effective gearing is able to withstand financial shocks – which often trigger declining dividends as well as hurting personal cash flow – because the dividends should be enough to keep meeting interest costs. Setting gross interests costs to be closely in line with current dividends at the start of the loan means three things:

- The loan is neutral or self-funding at the outset, with the prospect that dividend growth will be enough to match rising interest rates.

- Ongoing tax benefits will enhance the after-tax cash flow for the borrower – with franking credits and interest deductions providing additional income at the end of each tax year (ideally these are used to reduce the loan balance).

- Setting gearing levels to trigger neutral cash flow will often mean a loan to value “LVR” ratio around 50% or less. If you are using margin lending (or products which use internal gearing) this is an important way to avoid losing stock in the event of being unable to meet a margin call if a market shock occurs. (Margin lending is not as popular as it used to be, and there are today many other gearing products to choose from apart from the demanding terms of margin lending such as geared share funds).

Geared share funds

Many investors are tempted to set up their own gearing strategies, especially if the tax benefit of interest deductibility is important to them. The alternative is to invest into a managed fund that uses an “internal” gearing strategy, and for risk averse investors this has some important potential benefits. The downside here is obviously that in using a managed fund you are volunteering to pay management fees and other fees – you are also ceding control to the fund manager in exchange for a professional service.

Typically in an ‘internally geared ‘ managed fund product :

- The fund manager arranges the borrowing and manages gearing levels to stay within a pre-set range, typically between 40% to 60% of the overall value of the fund.

- Interest costs are set at wholesale rates plus a margin. Check the current costs from the product provider.

- The investor has no liability for the loan, nor can the investor be asked to cover any margin calls. But the fund manager will be required to sell-down stocks in the event the market falls (this is how the fund manager maintains gearing levels within the specified band).

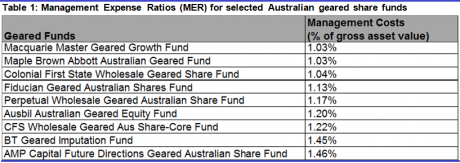

The good news is that internally geared share funds are currently available with interest rates in the range of 3.5% pa to 5% pa. Costs are at their lowest in an exchange-traded style fund such as BetaShares Geared Australian Equity Fund and highest at an intensely managed fund such as the AMP Future Directions Funds. This is because the more the fund manager actively manages the product the higher the fund manager’s costs.

Of course, the effective management costs (as a percentage of the actual cash outlaid by the investor) are higher. If the fund uses (say) 50% leverage, the MER as a percentage of the investor’s outlay is doubled. For investors wary of margin calls and personal liability for direct “margin” loans, and looking to benefit from low interest costs, this may be an acceptable expense.

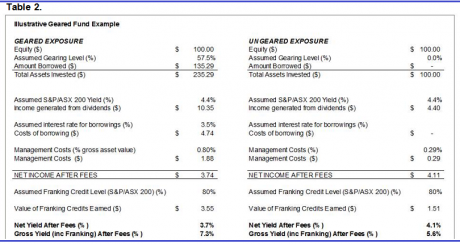

But let the numbers speak for themselves. In Table 2 below we look at the yield enhancement possible using an internally geared share fund with an internal interest cost of 3.47% which invests in the broad sharemarket via the S&P/ASX 200 index. Note that after all costs (including interest) the yield is nearly double that applicable for an ungeared investor.

Note: Ungeared example assumes investment into the StateStreet SPYDERS S&P/ASX 200 ETF with an MER of 0.29% pa. Geared share fund example refers to the BetaShares geared share fund (ASX code: “GEAR”). Actual data is used, accurate as at 2 June 2014.

Although internally geared share funds don’t allow the investor to pay down the debt related to their investment, if the income received is used to purchase more units this goes a long way towards replicating the capital growth potential delivered through “effective” gearing.

SMSF gearing – What you need to know

Internally geared share funds are eligible for use by SMSFs because the investor is not directly a party to the loan. Unlike margin loans, where the borrower is contractually liable for the loan and gives security over all their assets to support that liability, direct SMSF lending is only possible where:

- The loan is “limited in recourse” to the assets purchased with the loan.

- The loan is in respect of a new asset (i.e. SMSFs can’t borrow and pledge existing fund assets as security).

SMSF gearing is governed by section 67A of the Superannuation Industry (Supervision) Act (“SIS Act”). If you are interested, you can read the full text here.

SMSF gearing can be entered into through financial products which embed the loan within them, or by the investor themselves (using complex DIY documentation and with finance sourced from specialist SMSF lending institutions).

The problem with SMSF gearing is that it is covered by complex tax and superannuation legislation and should only be entered into directly with expert advice from qualified tax professionals. Most of the advice for DIY SMSF loans is provided by fund managers and financial planners using unqualified personnel who have undertaken short courses with less-than-sufficient attention or awareness of relevant technical detail.

That’s evident in the current outcry from the general financial planning industry, which is bemoaning the recent Tax Office backlash against DIY SMSF loans where the SMSF owner lends funds to the SMSF directly in return for the SMSF charging 0% interest. It should be self-evident that type of arrangement is close to a sham – and is certainly not supported by case law relating to bona fide gearing arrangements.

Protected loans for SMSFs

As an easier alternative to DIY gearing, an increasing range of lenders are providing “protected” loans which comply with SMSF gearing rules. Protected loans have been available for over a decade and are now being specifically tailored to suit SMSFs. Protected loans provide for two main gearing levels, in the range of 50%-60%, or 100% (in the latter, the investor’s only outlay is the annual interest expense).

Most of the major banks offer protected loans with intense competition on interest costs. Commonwealth Bank is at the lower end of the range with interest rates for its 50% LVR protected loans beginning at 5% pa (rates vary depending on the stocks selected).

Protected loans underpin “effective” gearing strategies with a twist. Investors pay for the cost of the protection within the loan by way of a higher-than-normal interest rate. It is more cost effective to set up these loans for a term of three years than to borrow for a one-year term (as protection costs are cheaper on an annualised basis for longer terms).

So instead of using annual dividend income to cover interest costs and to use any excess to pay down the loan, it’s usual for part of the portfolio to be sold down at the end of the term of the loan – to generate enough cash to retire the full amount of the loan – with any excess remaining as an unencumbered addition to the investor’s wealth.

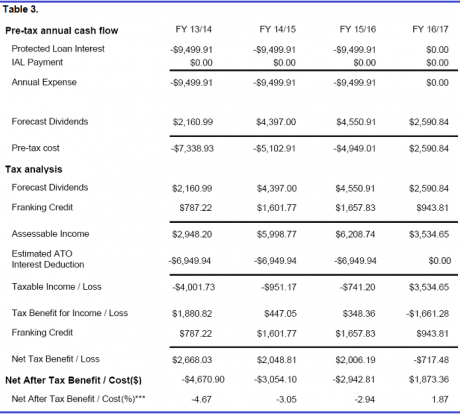

In Table 3 below we show the cash flow profile of a protected loan (with 100% gearing) over the State Street S&P/ASX 200 ETF (ASX code: STW). In this example, the investor has capped their upside at 30% over the term of the loan (three years) to reduce the total interest cost to 9.5 % pa.

Note: Dividend forecast uses consensus analyst projections. Interest cost is 9.5% pa. ATO maximum deduction is limited to 6.95% pa (based on current RBA rates). This table does not provide any tax advice or predictions as to likely returns. Contact the protected loan issuer to confirm details. Example assumes loan matures May 30, 2017. I.e. it does not include STW dividend paid as at June 24, 2017.

In the example in Table 3, the actual loan breakeven (after tax) is 2.96% pa – i.e., if the investor assumes that the S&P/ASX 200 rises by 2.96% pa each year for the next three years, the loan is self-funding.

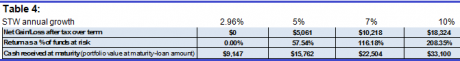

Because of the high leverage in this example, larger market rises generate very strong returns on equity. In Table 4 below the ROE for annual growth of 5%, 7% and 10% is shown:

Note: Protected loan returns expressed as a percentage of investor’s cash outlay. Returns are after tax and include allowance for 50% concessional capital gains tax liability. Note CGT concession includes two-thirds gain in assessable income for SMSF investors. Source: CBA

What’s the catch?

Low interest rates are ultimately only of benefit if sharemarket returns are stable and grow from current levels. In these examples we show how low borrowing costs can be combined with stable to growing dividends to create “effective” gearing strategies.

Whether these are used within an SMSF or by the investor directly, effective gearing strategies generate access to growing income streams for retirement as well as the prospects for eventual capital growth.

Critics of gearing often take the view that gearing is never worthwhile. On the contrary, careful gearing with an eye to the effective strategies can be a good basis for long-term wealth creation. Prospective borrowers need to carefully consider:

- What asset they are buying (and how its prospects for growing income stack up).

- What type of gearing product they use.

- Setting a conservative LVR.

- Using a medium- to long-term timeframe to allow for dividends and capital to grow during the investment term.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.