Is Bernanke watching the wrong gauge?

Last night's US unemployment data certainly gave the markets some cheer. Eighteen thousand less people were looking for work over the month. But the real number – the US government's official employment report – will come today US time and it's not expected to be pretty. Less than 150 thousand new jobs will be added, according to forecasts. At that rate, the Brookings Institute calculates it will take until 2018 for the US to move to 6.5 per cent unemployment, the magical number that Federal Reserve president Ben Bernanke has linked interest rate policy.

One has to assume that Ben Bernanke's bond buying program will have to stop before then. But no other sensible policy has emerged and Bernanke's obsession with the unemployment rate – the result of his PhD on the Great Depression – could mean that there will still be variations of quantitative easing for some time to come.

There's already been plenty of commentary on the distortive effects of that policy, from the effect on our dollar, to speculative and highly volatile market bubbles to the as yet inconceivable kicked-down-the-road inflation.

The Fed's policy is starting to resemble something of a Rube Goldberg machine with an incredibly complex structure designed for a, frankly, relatively simple outcome. Unfortunately, the huge money printing exercise is far better at lining the pockets of the investment community than it is at putting people into jobs.

The problem is, Bernanke has one eye on the unemployment rate, and one hand on the printing press, and it may well be the gauge is broken.

It is becoming increasingly clear that each recession has presided over a wave of permanent job losses in areas where routine work is performed. It started with manufacturing jobs, where robots replaced line workers but machine are also now doing to white collar work what robots have done to blue.

Erik Brynjolfsson and Andrew McAfee of MIT call it the great decoupling, where productivity is being unhitched from job creation. Take a simple clerical job like tax preparation, Brynjofsson says. These days, online tax preparation software is often faster, cheaper and more accurate than a human tax preparer. The outcome however, is that there are 17 per cent fewer people employed in tax preparation in the US than there used to be.

This is happening across the entire economy. Online retail is a perfect example. And soon machine learning will make a big dent in much of the work done by junior lawyers, call centre workers, medical diagnosticians, and yes, even journalists.

This trend goes some way to explaining why American corporate profits are the highest they've ever been, yet job creation is so sluggish. Semi-skilled, middle class jobs are being hollowed out and replaced by low skilled, low paid service ones. The National Employment Law Project in the US found that 60 per cent of the job losses during the recession were middle income ones like manufacturing, construction and information. In the rebound they have made up only 20 per cent of job growth. And 60 per cent of the job growth during America's post-recession expansion has been in jobs like retail and food preparation – jobs that pay $US10 an hour.

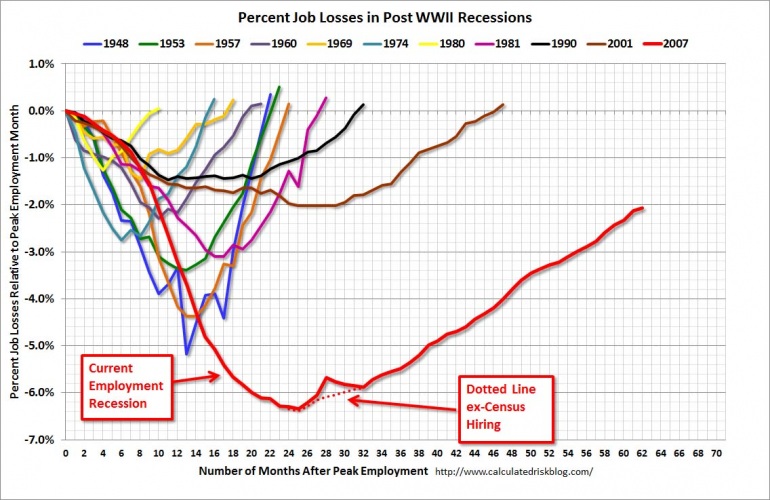

The age of employment rebounding with the business cycle has changed, as the chart below shows, with each of the last three US recessions taking many more months to recover to full employment than historical averages.

So expect Bernanke to keep the taps on for some time to come, or a confession that the policy is not working.

In Australia, that means we will have to deal with a high dollar, and overinflated prices for high yielding stocks for some time to come.

But more importantly, it's a trend that all workers should be aware of. The mining boom insured us from the wave of layoffs that have occurred in the US. There has been less need for recession driven slash and burn, or to find innovative cost saving techniques. But eventually a recession will happen here, and our corporates will be implementing policies from their American colleagues like crazy.