InvestSMART International Equities Portfolio

Our passively managed Portfolios are designed to provide returns in line with the market after fees, but at a lower cost than our Peers.

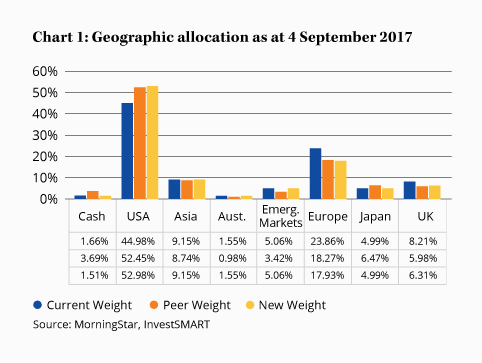

For our International Equities Portfolio, we regularly monitor the Geographic Exposure of our Peers to ensure we are aligned.

We’ve increased our exposure to US markets by introducing the BetaShares S&P 500 Yield Maximiser Fund (UMAX).

Why UMAX?

UMAX provides exposure to the S&P 500 Index while also providing regular income that exceeds the dividend yield of the underlying stocks alone.

The portfolio generates additional income by writing out of the money call options. Premiums are earned by selling the right to purchase securities in the portfolio at a specified price (strike) in the future. It is expected that at the options expiry date the market price will be below the strike, making the option worthless to the buyer. The portfolio retains the premium without having to sell the stock.

UMAX should outperform the index in sideways and falling markets, but may underperform during strong bull markets.

The investment in UMAX enables us to achieve three objectives,

- Increased exposure to the US to align with our Peers

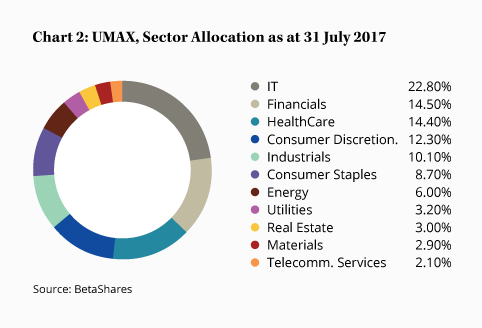

- Maintain underlying diversification across sectors

- Improve the income profile of our Portfolio

Frequently Asked Questions about this Article…

The InvestSMART International Equities Portfolio is a passively managed investment option designed to provide returns in line with the market after fees, but at a lower cost than many peers. It focuses on international equities and regularly monitors geographic exposure to ensure alignment with market trends.

The portfolio is passively managed, which typically involves lower management fees compared to actively managed funds. This approach helps keep costs low while aiming to deliver market-aligned returns.

The portfolio has increased its exposure to US markets to align with its peers and to take advantage of opportunities in the US market. This is achieved through the introduction of the BetaShares S&P 500 Yield Maximiser Fund (UMAX).

UMAX is a fund that provides exposure to the S&P 500 Index while offering regular income that exceeds the dividend yield of the underlying stocks. It generates additional income by writing out-of-the-money call options.

UMAX generates additional income by writing out-of-the-money call options. This involves selling the right to purchase securities in the portfolio at a specified price in the future, earning premiums that enhance the income profile of the portfolio.

UMAX is expected to outperform the index in sideways and falling markets due to its income-generating strategy. However, it may underperform during strong bull markets.

Investing in UMAX within the portfolio aims to increase exposure to the US market, maintain diversification across sectors, and improve the income profile of the portfolio.

The portfolio maintains underlying diversification across sectors, which helps manage risk and align with market trends, ensuring a balanced investment approach.