Investing in IPOs: A Eureka guide

Summary: Investors may be feeling inundated by the amount of initial public offering deal sheets hitting their inboxes at the moment. However, it is crucial to first consider three things before participating: whether the prospectus forecasts are sensible, whether the valuation benchmarks are appropriate and why the company is raising funds via the equity market. |

Key take-out: Put simply, do your homework before participating in the plethora of IPOs that are scheduled to happen throughout the rest of 2015. Be selective and consider the issues involved. |

Key beneficiaries: General investors Category: Shares. |

If you have a relationship with one or a number of brokers you are probably getting fresh initial public offering (IPO) deal sheets in your inbox most weeks at the moment.

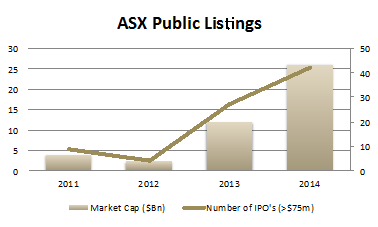

2014 saw a material pick up in IPO activity, with 74 new companies listed on the ASX raising a total of $26bn. The deal activity has certainly continued into 2015.

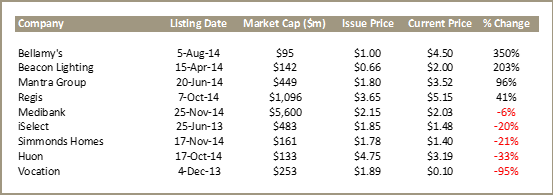

Many of the 2014 listings were highly rewarding for investors. IPOs such as Beacon Lighting, Matra Group, Regis and Bellamy's have been terrific performers. However, there have been some disasters such as Vocation, iSelect and Huon as well.

As we work through 2015, it appears that vendor expectations are now almost universally high and the quality of businesses coming to market is increasingly mixed. The former means that in some cases there may be limited value left for investors participating in IPOs and the latter means that investors may be taking on more earnings risk than they realise.

You will often hear professional fund managers say that they are evaluating deals and being highly selective. Here are a number of reasons why.

- Both the vendor and the investment bank running the listing are financially incentivised to maximize the listing price of an IPO.

- Price discovery (the ability to determine the value of the stock) is of lower quality than stocks currently trading on the market, considering analysts and fund managers have not being following the company or publishing research for years.

- There is generally limited historical financial information available to analyse.

- The time frame for evaluating transactions is often limited.

With deal activity remaining high, we thought it timely to highlight three things that you should consider before participating in any given IPO.

1.Consider whether prospectus forecasts are sensible

In most IPOs key valuation metrics are based on one and/or two year earnings forecasts made by management. These forecasts are usually perceived to be easily attainable.

If a company is floated on a sensible valuation and has a high probability meeting or exceeding prospectus forecasts, participating in an IPO will likely lead to a positive outcome. However, if there is any risk that a company will miss these forecasts, participation is a surefire way to lose your capital. We consider a number of scenarios in which investors should be cautious below.

In some cases management's visibility into its earnings is very low. This is always going to be the case with any commodity or agricultural business where earnings are largely dependent on a commodity price, which the company has no control over. Recently Huon missed its prospectus forecasts for this reason and the share price declined 20 per cent on the announcement and today remains 33 per cent below its issue price.

In some cases management's forecasts are predicated on ambitious expansion plans. If expanding into new markets were easy then management would have likely already done it. A recent example of this was the Simmonds homes IPO. Simmonds is the largest homebuilder in Victoria but its prospectus forecasts assumed aggressive growth into NSW, a market in which the company had not ventured in a meaningful way before. It may be a good business but paying a full valuation multiple on peak Victorian housing cycle earnings on the basis of growth into NSW doesn't sound particularly sensible. The stock traded 10 per cent below issue price on the day of listing and is now down a further 10 per cent.

2. Consider whether companies used for valuation benchmarks are appropriate

You may get access to a fantastic business by participating in an IPO, but it will only prove to be a good investment if you are able to invest at a good price.

Medibank is an interesting example in this regard. This company has favourable industry dynamics, is well positioned within that industry and generates good returns.

What is interesting though is that insurance companies typically trades on 15 times earnings while hospital operators trade on 25 times earnings. It can be argued that Medibank has characteristics of both sectors.

While there are lots of things to like about the investment case for Medibank, it is ultimately an insurance company operating in the health sector. Accordingly, with a listing price of 22.6 times earnings it would seem that there was limited upside left for investors at the $2.15 issue price. It isn't surprising to see the stock trading below its issue price 6 months after listing.

3.Consider why the company is raising funds via the equity market

One reason why an IPO will be successful is if the vendor's are raising money in the equity markets in order to fund future growth. A good example of this is Regis Healthcare, which is using funds for Greenfield development of aged care facilities and bolt on acquisitions.

All too often, however, IPOs are for relatively mature businesses that are being floated in order for the current owners to realise their investment.

As a very successful investor has been known to say: “It's almost a mathematical impossibility to imagine that, out of the thousands of things for sale on any given day, the most attractively priced is one being sold by a knowledgeable seller (a company insider) to a less knowledgeable buyer (an investor).”

We would encourage investors to consider whether (1) there is a tangible use of IPO funds that will drive growth in the business and (2) management/vendors are retaining meaningful financial interest in the success of the business.

If neither of these two things are in your favour and the IPO is at a full valuation, the cards are stacked against you.

So what to do?

Put simply, do your homework. We would say that if you are going to participate in the plethora of IPOs that are scheduled to happen throughout the rest of 2015, be selective and consider the issues mentioned above.