Introducing the volatility managers

Summary: The traditional way for retirees to reduce portfolio volatility is to switch out of shares and into cash. But since returns on cash are so low, this becomes impractical. Another approach is to invest in “managed volatility” funds, which often use stock picking methods that focus on buying low volatility stocks. |

Key take-out: Managed volatility funds could help retirees managed the risk in drawing down from their portfolio, maintaining exposure to higher yielding stocks compared to selling equities to invest in low-yielding cash. |

Key beneficiaries: General investors. Category: Strategy. |

2015 has begun with a bang in the Australian markets – with this week's RBA rate cut flagging central bank concerns about the slowdown in our economy. While good stocks can still grow in weak economies, local investment risk is magnified by global market worries – in combination sending troubling signals to our share market.

That's more of a problem for older investors, especially those whose plans require some selling down of stocks over coming years to fund their retirement. This is the problem known as “sequencing risk” – a phrase coined by former treasury secretary Ken Henry and which is now driving a spate of innovation from fund managers creating investment products designed to reduce portfolio “volatility”. Research data and actual returns from the new wave of “managed volatility” funds shows that this may prove to be one the most important breakthroughs in the investment world, offering real benefits to retirees and solving one of their most pressing concerns.

What is the problem and is it real?

The problem for retirees is that the traditional way of reducing portfolio volatility is to switch out of riskier assets (shares) into less risky assets (bonds, cash, term deposits) as the investor ages. Because cash and term deposit rates are so low, this is impractical for many retirees. It may also be too risky, as bond markets go through their own set of problems. As QE (the “money printing” quantitative easing program) unwinds in the US, and the massive cash injection it has produced triggers an expansion in investment “risk premia”, professional bond managers are worried about the possibility of a bond market crash. (A low or compressed “risk premia” is code for an asset trading at a high price relative to its fundamentals – e.g. a high p/e ratio.)

Right now, these global concerns are real and have triggered highly credentialed fund managers like Hamish Douglass at Magellan to increase their cash holdings citing the recent elevation of market risk.

Managing volatility

One approach simply looks at managing the volatility of individual asset classes – often seen as far easier than trying to manage risk across multiple assets, and also easier for investors to understand and use in their portfolios. For example, this means that as an Australian retiree ages, instead of being forced to sell down stocks and move into low-yielding or risky fixed income products, they can look instead to increase their holdings of “managed volatility” funds.

In the range of funds I'm considering in this Eureka Report article, the common theme is the use of stock picking methods which focus on buying low volatility stocks. Looked at another way, this approach tries to find stocks whose “variance” of return is lower than that experienced by the general market. This approach challenges traditional theories of stock picking (more on that below), but the results speak for themselves.

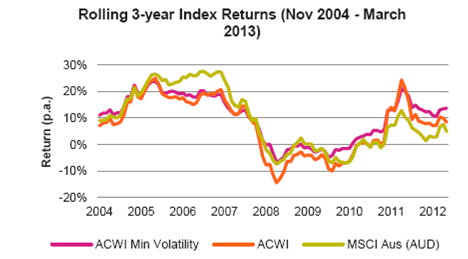

Figure 1. Comparison of returns between MSCI Australia Index, vs All Companies World Index, vs All Companies World Index (Minimum Volatility).

Source: MSCI, Lonsec Research

Figure 1 shows the downside protection implicit in the “minimum volatility” index during the GFC and the more stable compounding returns from the “minimum volatility” index generate its stronger performance over the period.

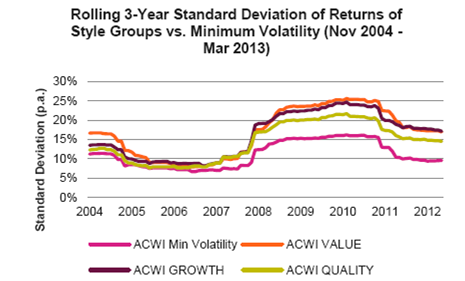

Figure 2 below shows that this more consistent compounding of returns for the “minimum volatility” index coincides with the far lower risk of the “minimum volatility” approach – measured by the standard deviation of returns compared to the traditional stock picking approaches of “value”, “growth” or “quality”.

Figure 2.

Source: MSCI, Lonsec

Why does minimum volatility investing work (and when doesn't it)?

If you look closely at Figure 1 again you will see that the “minimum volatility” approach underperforms the traditional market index by nearly 30% during the period 2005 to end 2007 (i.e. the pre-GFC bull market). That could be a problem for the “minimum volatility” approach if equity markets strongly rebound in coming years.

Traditional investment theory relies on the concept that returns from risky assets like shares compensate investors for the risk of owning the asset. This is the concept of the equity risk premium.

Up until 2006 academic research agreed with this concept coupled with diversification and fund managers chased higher risk stocks, while using complex active management tools to try to exit risky positions before they triggered losses. The noise of the GFC obscured the 2006 breakthrough which analysed portfolios between 1968 and 2005, and which proved that stock portfolios built using “minimum variance” tools out-performed traditional stock market indices with less risk.

Put simply, it is in stocks seen as “big winners” that risk premia “compression” is most likely to happen. Put simply, these glamour stocks, which trade at high P/E multiples, have now been shown by this research into low volatility investing to generate more risk than they are worth.

Let's turn now to analysis of what's available in this space for Australian investors.

Managed volatility funds in Australia

Some of the biggest global funds management brands are active in this space, with the recently launched AllianceBernstein Managed Volatility Equities Fund adding to offerings from the likes of State Street and Acadian.

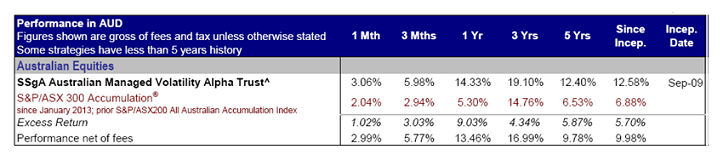

The State Street fund – SsgA Australian Managed Volatility Alpha Trust – has produced an excess return compared to the broad S&P/ASX 300 index since inception.

Figure 3.

Source: SSgA

The State Street fund has an annual management fee of 0.78% pa and can only be accessed as a wholesale fund (so for smaller retail investors it can be accessed via investment platforms including via brightday, IOOF and NetWealth).

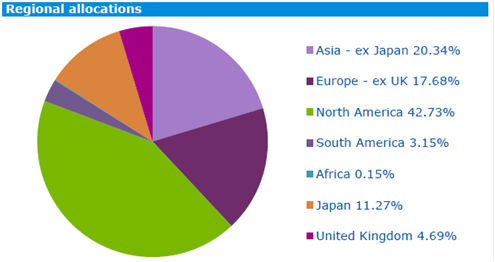

The Acadian group offers its own style of managed volatility fund in partnership with Colonial First State – and thankfully, retail investors can buy this fund directly with minimum investments of $25,000. The Acadian fund is known as the Acadian Global Managed Volatility Fund and unlike the State Street product (which is predominantly invested in Australian equities), the Acadian fund is a truly global product:

Figure 4. Acadian asset allocation

Source: Acadian/Colonial First State

In common with most funds in this new area of investing, the Acadian fund uses quantitative stock picking to bias toward lower-risk stocks and this generally favours sectors that are typically associated with lower risk, such as consumer staples, utilities, and healthcare. Under this approach the stock picking filters give more weight to lower risk (volatility) in comparison to expected returns (measured by factors like expected earnings growth, or P/E multiples). Annual management fees are 0.65% pa and the fund has also shown good returns since inception:

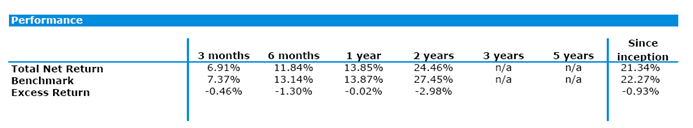

Figure 5. Acadian Global Managed Volatility Fund Returns since inception

Source: Acadian/Colonial First State

Although these returns are below index the Acadian fund could be useful for investors expecting global equities to outperform compared to Australia going forward, and its underperformance could be explained by the general trend of managed volatility funds to underperform in strong bull market periods (e.g. the US market has reached record highs over the last couple of years).

The most recent addition to this sector was launched by AllianceBernstein in April 2014. Since then its Managed Volatility Equities Fund has generated strong returns of 14.97% after fees compared to a benchmark return of 4.40%.

The AB fund invests mainly in ASX stocks but can hold up to 20% of its assets in global developed market shares and up to 20% in cash, if it needs to further reduce risk at times of heightened equity market volatility.

The AB fund strategy aims to reduce volatility by picking stocks that have reasonable valuations, high quality cash flows and relatively stable share prices (reflected by lower than market level volatility).

FX risk can be hedged and reducing individual position volatility would typically be a reason for doing so.

Interestingly the AB fund may also invest in preference shares, rights, convertibles, warrants, initial public offerings, listed trusts and /or other synthetic foreign equity securities.

Derivatives may be used to manage risks, invest cash, manage volatility and gain or reduce investment exposures. Derivatives will not be used for leveraging or gearing purposes.

Management fees for the AB fund are 0.55% with direct retail investment being possible with a minimum investment amount of $25,000. The PDS is available here.

Conclusion

Managed volatility funds deliver an innovative way to manage equity risk, in line with the growing body of academic research that shows why this approach is likely to beat the traditional idea of buying risky stocks with the hope that owning enough of them can reduce overall risk.

For retirees this approach could help manage the risk implicit in “drawing down” from the portfolio, where assets are sold as the retiree ages to help fund the retirement lifestyle. Compared to selling stocks to invest in low-yielding cash or TDs, or into potentially risky bonds, the managed volatility funds could help investors maintain exposure to higher yielding stocks (with the Australian component delivering franking credits as well).

For the true DIY investor, these funds also pass the critical test of delivering an investment strategy that would be difficult for the investor to do themselves. In conjunction with a component of direct stocks, including managed volatility funds could provide a cost effective way to better weather any forthcoming market volatility.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.