Interpreting China's mixed monetary messages

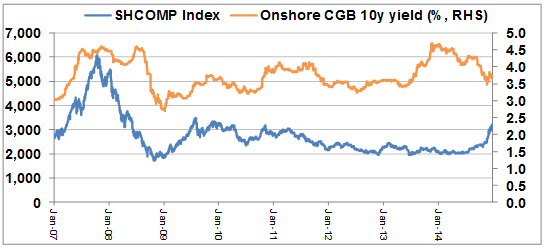

Since early 2014, the People's Bank of China (PBOC), the Chinese central bank, has deployed multiple policy tools to loosen its monetary policy stance, including cutting its benchmark bank interest rates, relaxing mortgage terms, tinkering with the outdated loan-deposit ratio rule, selectively cutting some reserve requirements and injecting liquidity into the banking system via various new facilities. Such concerted actions pressed both 10-year government bond yields and short-term interbank rates lower during most of 2014 (see Chart).

However, in response to the November interest rate cut, the 10-year Chinese government bond yield temporarily ticked up to 3.8 per cent from 3.6 per cent (see Chart), while interbank rates remained volatile. More puzzlingly, soon after the rate cut last November, the PBOC in statements on its website and senior PBOC officials rushed to repeatedly deny this policy move as a shift in the monetary policy stance. Many central banks in the advanced economies nowadays provide ‘forward guidance' to reinforce and amplify the impact of monetary policy on the full market yield curve, by communicating to the public about the expected future path of the policy rate. In contrast, the PBOC appears to have attempted to dilute what it did, by issuing confusing ‘backward guidance', cautioning the market not to interpret its latest rate cut as monetary easing!

It will probably take some time to fully comprehend this baffling mix of monetary easing and tough talking. If we assume that the PBOC wants to cushion the downside risks of economic growth without aggravating financial imbalances, then the best option would be to ease in a timely and measured manner while opening its big mouth to influence the longer end of the yield curve, which in the end matters most for both consumption and investment decisions. But these PBOC ‘backward guidance' statements instead appear to aim at dispelling expectations about further monetary accommodation on the horizon, potentially contributing to a higher yield curve and thus tightening Chinese financial conditions.

For now, one can only speculate about the motives behind such confusing PBOC signals. Here, I put forward three possible motives, all related and not exhaustive.

The first motive could be that the PBOC wants to convey the message that monetary stimulus, if any, will be minimal and fleeting, out of fear that the rate cut could stoke asset price bubbles before benefiting the real economy. In this view, the PBOC “backward guidance” is really a disguised forward guidance. I am uncertain about the precise weight the PBOC attaches to financial stability, but reasonably certain that the weightings of inflation and growth dominate, and both clearly call for meaningful monetary accommodation. Also, the asset price channel is part of the normal transmission mechanism for monetary policy, especially in light of a weak housing market. The latest surge of some 50 per cent in Chinese stock market prices over the past few months (see Chart) could be a valid concern for the PBOC; but the average Shanghai stock market valuation of some 10-time trailing and forward P/E appears manageable, and a buoyant equity share market could assist the tricky deleveraging process.

The second motive could relate to the concerns of the PBOC about the moral hazard risk associated with China's high level of local government debt. Local government officials have strong incentives to borrow, from both banks and shadow banks, to fund their pet investment projects, but then leave messy debts to their successors. These concerns make little sense to me. First of all, this is an issue of fiscal discipline facing local governments, whether the monetary policy bias is tighter or looser. Second, harder budget constraints are already gradually being imposed on local governments. This implies a de facto, sizable fiscal contraction and thus calls for reasonable monetary relaxation to partially offset the possible contractionary effects of reduced local government borrowing.

The third motive is the challenge of properly communicating the policy stance to the market under an emerging new monetary policy framework and in a more liberalised interest rate environment. The PBOC used to principally target M2 growth while also setting benchmark loan and deposit rates. More recently, the PBC has introduced a few new policy tools, such as Short-term Liquidity Operations (SLO), the Standing Lending Facility (SLF), Medium-term Lending Facility (MLF) and Pledged Supplementary Lending (PSL), in an attempt to influence market-based interest rates. Maybe the PBOC prefers to nudge the market to pay greater attention to these market rates rather than those still partially-regulated benchmark loan and deposit rates. This makes some sense but still does not justify sending out conflicting signals when a more accommodative policy stance is clearly warranted and desired.

In any case, the best course of action for the PBOC at this juncture, in my view, is to pursue a sensible and accommodative monetary policy in a confident fashion, with the aim of a lower and steadier domestic interest rate and less-managed currency. Just as forward guidance by some major central banks at the zero lower bound can help depress their yield curves further out, a clear and firm PBOC policy signal could also help flatten and stabilise the Chinese yield curve, which in turn would cushion economic growth, pre-empt deflation risk, facilitate structural adjustment and support financial liberalisation. As a minimum, the PBOC should avoid diluting the signalling effect of its own new policy moves.

This article was originally published on Bruegel. Republished with permission.