Ingloriously ousted: Six infamous CEO departures

Hamish Tyrwhitt, the latest CEO to suffer an inglorious end. Source: AAP

Sometimes a chief executive officer just has to go.

That was certainly the case yesterday with Leighton Holdings. In an attempt to woo shareholders and get a proposed buyout across the line, Spanish-controlled Hochtief, which holds the majority of Leighton’s shares, ended up ousting both CEO Hamish Tyrwhitt and chief financial officer Peter Gregg.

It was a rather inglorious end for Tyrwhitt’s career at Leighton. He had worked in the company for 27 years, but at least he’s now $10.26 million richer for falling in line with Hochtief’s plan.

Tyrwhitt isn’t the first, nor will he likely be the last CEO to see their tenure end so abruptly. Here are five other senior figures who have met similar fates:

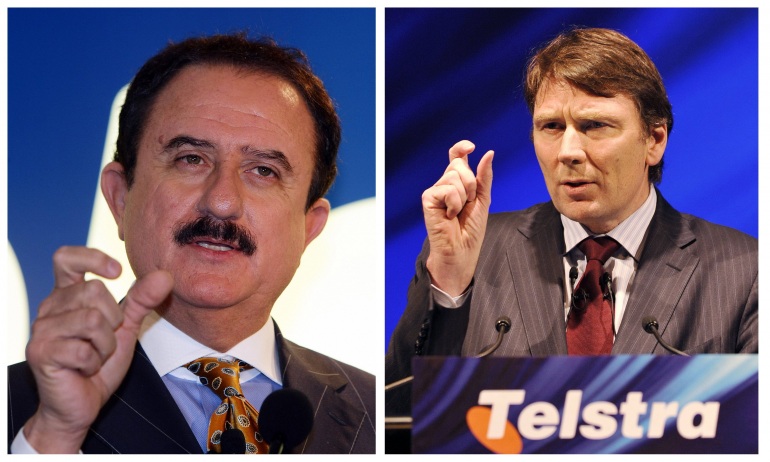

Sol Trujillo, Telstra

Can you spot the difference? One lifted the share price, the other didn't. Source: AAP

Sol Trujillo started at Telstra with a five-year plan to fully transform the company from a public entity into a private telco superpower. He went back to the US after four, failing to put a dent the telco’s rock-bottom share price.

Today, Trujillo is famously known for exaggerating the potential of the company’s directory arm, Sensis, and belittling the efforts of the now internet juggernaut Google. It’s all captured in that immortal phrase from Trujillo: “Google-schoomgle”.

Total payout for leaving: $9.6m

Mark McInnes, David Jones

Mark McInnes is proof that fallen CEOs can reverse their fortunes. Source: AAP

Mark McInnes turned heads back in 2010 when he resigned in the wake of allegations that he sexually harassed former David Jones publicist, Kristy Fraser-Kirk.

At least McInnes landed on his feet. He’s now the head of Premier Investments, a group that manages a number of popular retail chains like Just Jeans and Peter Alexander.

It seems David Jones’ fortunes also departed with McInnes. David Jones is struggling and now mulling a takeover bid from Myer in order to survive. Meanwhile, Premier Investments has reported a string of record profits and is now focusing its efforts on expanding overseas.

Total payout for leaving: $1.9m

Tom Albanese, Rio Tinto

He jumped without a chute, but landed on a lot of company shares. Source: AAP

The story of Tom Albanese’s departure from Rio Tinto illustrates just how hard a failed acquisition can hit a company. Albanese resigned last year after Rio Tinto was forced to write off around $4 billion on a coal mining company takeover in Mozambique.

Albanese left the miner without a cash payout. However, it was reported that Albanese departed the company with £10.7m in shares.

Marius Kloppers, BHP Billiton

Calm, controlled, and really wanted his staff to keep their desks clean. Source: AAP

As James Kirby previously reported, there are many reasons as to why Marius Kloppers departed BHP Billiton.

Perhaps the most curious was Kloppers' tendency to micromanage, which was best seen through a company policy that forced staff to keep their workstation tidy and only place one photo per desk.

Saying all this though, it’s worth noting that both Kloppers and Albanese led BHP Billiton and Rio Tinto respectively through one of the biggest boom periods the mining sector has ever seen.

As with Albanese, Kloppers refused his golden parachute, but was still paid a $16m salary for fiscal 2013.

David Dearie, Treasury Wine Estates

Unlike fine wines, this story shows that time likely won't improve the performance of most CEOs. Source: AAP

So far, all of the CEOs on this list have left their positions without a whimper or a complaint to the media or the public. David Dearie is the exception to this rule.

Dearie was forced out of the company after a decision to write off its excess US inventory. The move cost the company $160 million. In a statement, Treasury Wine Estates’ chairman Paul Rayner said it was time for the company to look for an executive with a “stronger operational focus”.

In an interview with Fairfax, Dearie hit back at the claims saying:

''I don't know what was meant by 'operational' experience…I had been chief operating officer in the past. So you need to ask the chairman what he meant by those comments.”

He also questioned the company’s strategy, saying that his decisions were based on long-term viability rather than short-term profits.

Dearie secured $1.35 million severance in leaving the company. He’s yet to resurface after leaving Treasury Wine last September.

Are there any former CEOs that you think should be on this list? Or are there any current CEOs that you think should join this list? Let us know in the comments below, or tweet the reporter @HarrisonPolites.