Inflation will stay the RBA's hand, for now

Inflation eased considerably in the September quarter but that won't be enough for the Reserve Bank of Australia to cut rates further -- at least not yet.

Nevertheless, the outlook for inflation remains benign, particularly on the domestic front, with the exchange rate the only factor likely to push inflation towards the top of the RBA's target band in the foreseeable future.

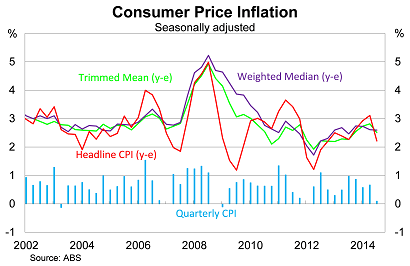

On a seasonally-adjusted basis, consumer prices rose by 0.1 per cent in the September quarter -- the weakest result since March 2012 -- to be 2.2 per cent higher over the year. Annual inflation peaked in the June quarter at 3 per cent but with strong results dropping out of the annual figures, inflation should ease further next quarter.

Core measures of inflation (which remove volatile items) were also relatively benign. The trimmed mean measure of inflation rose by 0.4 per cent in the September quarter, to be 2.5 per cent higher over the year. By comparison, the weighted median measure increased by 0.6 per cent in the quarter and is now 2.6 per cent higher than this time last year.

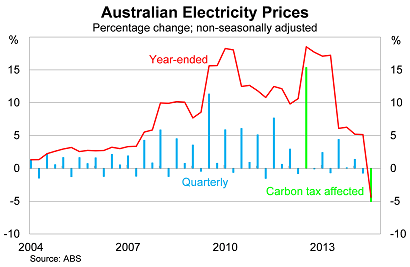

The main contributors to inflation in the September quarter were fruit (up 14.7 per cent), new dwellings purchased by owner-occupiers (up 1.1 per cent), property rates and charges (up 6.3 per cent) and other services relating to motor vehicles (up 5.8 per cent). The most significant price falls were related to electricity (down 5.1 per cent) and automotive fuel (down 2.5 per cent).

Both electricity and fuel prices provide some upside risk for inflation. The carbon tax was repealed in the September quarter and explains the fall in electricity prices. Unfortunately, the ABS noted that “it is not possible to quantify the impact of removing the carbon price.”

Over the past decade, electricity prices have on average increased by 4.8 per cent during September quarters (excluding those quarters affected by the carbon tax). In the September quarter 2012, electricity prices rose by 15.3 per cent (around 10.5 percentage points above average) while in the September quarter 2014, electricity prices fell by 5.1 per cent (around 10 percentage points below average).

On the basis of this admittedly simple analysis, it appears as though most businesses have fully passed on the savings from the carbon tax repeal.

As a result, it is unlikely that the RBA will overreact to today's weaker inflation result. In fact the result was largely expected, with quarterly inflation exceeding market expectations. The RBA will be placing greater emphasis on the trimmed mean and weighted median measures, particularly while the repeal of the carbon tax weighs on annual growth.

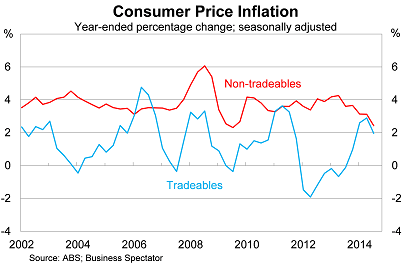

But inflation may ease further in the next couple of quarters and that could easily tip the RBA's hand. To understand why, we should have a look at inflation on tradeable and non-tradeable goods.

On a seasonally-adjusted basis, prices on both tradeable and non-tradeable goods rose by just 0.1 per cent in the September quarter. Prices on tradeable goods have increased by 2.0 per cent over the past year, boosted by a lower Australian dollar, while inflation on non-tradeable goods has increased by 2.4 per cent.

Soft employment growth and historically poor wages growth should ensure that domestic price pressures stay benign in the near term. Expect inflation on non-tradeable goods to ease further over the next year and don't be surprised if inflation dips below its post-crisis trough.

Inflation on tradeable goods is naturally more difficult to predict. Around 30 per cent of the price of tradeable goods is determined by the exchange rate (compared with just 10 per cent for non-tradeable goods).

The Australian dollar has declined by 4.2 per cent against Australia's trade-weighted index since the end of August. If that persists, then the exchange rate could contribute as much as 0.8 percentage points to annual inflation over the next year -- potentially more if the dollar declines further.

However, it is important to remember that even inflation on tradeable goods has a significant wages component. Around 30 per cent of the cost of tradeable goods is due to labour costs, so any increase in inflation on tradeable goods will be at least partially offset by soft wage growth.

Inflation is set to ease further by the end of the year and that may put some pressure on the RBA to lower rates. I expect inflation to decline to around 2.0 per cent in the December quarter and that combined with a soft labour market and domestic growth may be sufficient for the RBA to act. But for now it is likely to attribute the weak September result to the carbon tax and place greater emphasis on core measures of inflation.