Increasing weighting to European Equities

iShares Europe ETF (IEU)

Over the last couple of months we have been looking for an opportunity to invest more directly into the European equity markets and we have now initiated on this view; implementing an allocation of between 1.2% and 8.6% depending on the appetite for risk.

The European economy, so long under pressure with austerity measures and economies not pulling in unison has now suffered a further set back with inflation declining precipitously and moving still lower. In contrast the US inflation rate, after years of declines has seen a modest uptick after the Federal Reserves aggressive Quantitative Easing (QE) programs.

As we discussed late last year, one of our reasons for turning more optimistic, the expectation that the ECB would embark on a QE strategy began to get more focus and led to a rise in European equities although over any longer term time frame, European Equities have significantly underperformed other developed markets. Whilst the path will be volatile, this will not be inconsistent with the lessons from the US QE journey but the ECB’s balance sheet expansion should ultimately lead to a long-term rise in European stocks and close the underperformance gap.

The InvestSMART Diversified Portfolios currently hold their European Exposure inside the Vanguard All-World ex-US Shares ETF. This ETF has an exposure of circa 31% in Europe and the purchase of the iShares Europe ETF is in addition to this. To fund the purchase of Europe we have reduced our exposure to emerging markets via a reduction of iShares MSCI Emerging Markets and the Vanguard All-World ex-US Shares. With the purchase of the iShares ETF, the portfolios now have and exposure to Europe of between 2% and 14%.

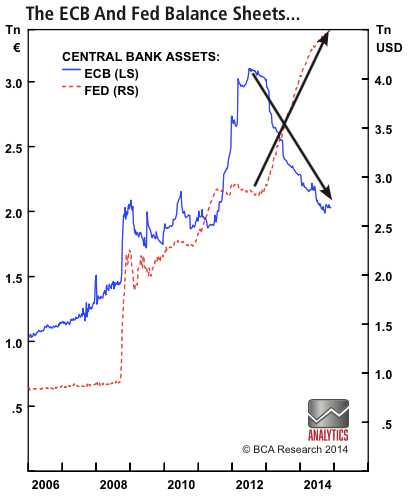

The chart below shows the different trajectories in both the US and the European central banks’ respective balance sheets. With the European economy faultering, the ECB announced that it would embark on an aggressive policy of QE and expand its balance sheet by over $1trillion (tr) towards $3tr. Whilst these numbers are large, they are short of the US Federal Reserves strategies and may see additional bond repurchases.

While every care has been taken in preparation of this document, InvestSmart Financial Services Limited (ABN 70 089 038 531, AFSL 226435) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and see professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Frequently Asked Questions about this Article…

Investors are showing more interest in European equities due to the European Central Bank's (ECB) aggressive Quantitative Easing (QE) strategy, which is expected to boost European stocks in the long term despite current economic challenges.

The European economy is currently experiencing declining inflation, in contrast to the US, where inflation has seen a modest uptick due to the Federal Reserve's QE programs.

The iShares Europe ETF is an investment vehicle that provides exposure to European equities. It is significant because it allows investors to directly invest in the European market, which is expected to benefit from the ECB's QE measures.

InvestSMART Diversified Portfolios have increased their European exposure by purchasing the iShares Europe ETF, while reducing exposure to emerging markets through a reduction in iShares MSCI Emerging Markets and Vanguard All-World ex-US Shares.

The ECB's QE strategy is expected to expand its balance sheet significantly, which should ultimately lead to a long-term rise in European stocks and help close the underperformance gap with other developed markets.

Investing in European equities can be volatile due to economic challenges and the ongoing adjustments in monetary policy. However, the ECB's QE strategy aims to stabilize and boost the market in the long term.

The European QE strategy involves expanding the ECB's balance sheet by over $1 trillion, which is substantial but still less aggressive than the US Federal Reserve's past strategies. This may lead to additional bond repurchases in Europe.

Investors should consider their risk appetite, the current economic conditions in Europe, and the potential long-term benefits of the ECB's QE strategy. It's also advisable to seek professional financial advice tailored to individual investment goals and needs.