IMF misses on global growth

| Summary: The International Monetary Fund issued a downbeat assessment of global economic growth this week, pointing to weak conditions and downside risks. Yet, with global growth around trend levels, ultra-low interest rates, ongoing government stimulus programs, and economic recoveries underway across many countries including the US, UK and Europe, the IMF’s downside risks are overstated. |

| Key take-out: Downside risks are being swamped by the upside risks presented by the strong private sector recovery, and massive monetary stimulus. Problems to do with public sector debt are a longer-term challenge while debt servicing costs are so low. |

| Key beneficiaries: General investors. Category: Economy. |

As we finish day 10 of the US government shutdown, at least we’re closer to a deal being nutted out.

President Obama and key US government members have met and at least talked about a solution, and the Republicans have agreed to a six-week debt ceiling extension. At least they are talking.

For my part I remain confident that a crisis will be avoided, not least of which is because, and as I mentioned last week in A US impasse opportunity, a default is expressively forbidden by US law. So, while there are legal alternatives available to the President – and no matter how fanciful some might appear – a default won’t occur.

Unfortunately this makes it highly unlikely we’ll get that correction, and I say unfortunately because as we otherwise know, the US economy is accelerating, notwithstanding dovish overtones from policy makers. A correction would have made it easier to find value – a great entry point.

Anyway, the big question looking beyond the US shutdown and debt ceiling, is now what? And the answer to that isn’t so straight forward. I’ll come back to this in more depth over coming months.

For now, and as a first step, it’s important to have a brief look at what the International Monetary Fund and other policy makers around the world have to say – in sum. It seems, from their perspective, the economic backdrop is far from benign, and while the IMF receives its fair share of criticism for being behind the times (especially in relation to its Australian growth forecasts) it is still worthwhile looking at what the IMF says. This is largely because of the IMF’s ability to capture the policy consensus – and often the broader economic consensus too.

But yes, the IMF is pretty downbeat, suggesting in its world economic outlook released this week “that global growth is still weak, its underlying dynamics are changing, and the risks to the forecast remain to the downside.”

That makes for some grim reading and certainly adds to the view that equities globally are expensive, and that even in Australia value is hard to find. I mean, where is the earnings going to come from in a weak global environment?

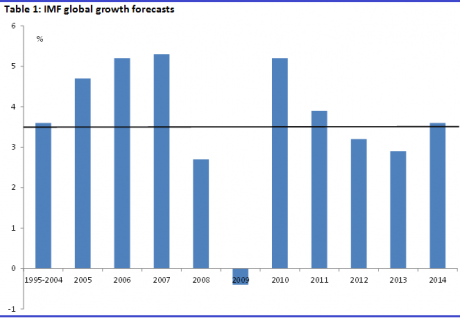

What’s interesting in all this is that if you actually scratch beneath the surface, things don’t look anywhere near as bad, even on the IMF’s own analysis. Take a look at table 1 below. Growth of 2.9% for 2013, if indeed that is what we end up getting, is well below trend of about 3.6% – it’s weak.

However note that this result seems to be an outlier if anything, not representative of the broader trend. You can see that because growth either side of the 2013 year either was solid, in the case of 2012, or expected to be, in the case of 2014.

Is it correct to state with those numbers that growth, or its underlying trajectory, is weak? I don’t think it is. Global growth is around the trend level, has been for a while, and that’s with some quite serious public sector headwinds. These headwinds are set to unwind as the year progresses. That aside, I’m more concerned about the IMF’s assessment of risks.

By and large the IMF is still of the view that downside risks predominate. Not only that, it is also of the opinion that these risk have somehow intensified. This, unfortunately, is what retail investors read in the media, and it weighs. Yet I would disagree with that view and would suggest, on the IMF’s own logic, that it’s more accurate to state that the upside risks have intensified.

Think about this. The IMF notes that “some new downside risks have come to the fore, while old risks largely remain”, and it is right to note these risks. The risks are well known and include high levels of public sector indebtedness, while some of the newer ones include the US government shutdown and concerns over the US debt ceiling. New, but at the same time not really.

However, the main reason why the IMF has adopted a more downbeat assessment is because “financial conditions have tightened in unexpected ways”. It is, of course, referring to the surge in bond yields of 100 basis points or more, especially at the long end (10 year bond etc.), which has occurred as a result of an anticipated tapering of quantitative easing by the US Federal Reserve. Unexpected? I shouldn’t have thought so given the Federal Reserve is pretty much buying up all Treasury issuance, indirectly in the secondary market.

Yet I think it’s a little disingenuous to become more bearish on global growth on this basis, and there are two key reasons that for this.

- Firstly I don’t think it is accurate to assume, as the IMF does, that in an ultra-low interest rate environment rates and growth have a linear relationship. That is, an ‘x%’ lift in the bond yield or shift in the yield curve leads to an ‘x%’ decline in growth. I would argue instead that at ultra-low rates, the economy is far less sensitive to interest rate changes.

- Secondly, the Fed has stated explicitly that the timing and magnitude of any tapering will depend on financial conditions. That is, if interest rates rise too much they may not even taper. Moreover, the Fed has in effect promised not to tighten monetary policy for years to come.

So, the way I see it then, while the risks are legitimate they are overstated and premature. To focus on them now, and to make downward revisions to global growth on the back of them, I think gives a misleading picture of economic prospects for investors. Because when you take that concern away, or rather relegate it to its appropriate place, what we are left with is:

- An ongoing ultra-low interest rate environment that will, in the words of the Fed, ECB , Bank of England and, we can take it for granted, the Bank of Japan – last for the foreseeable future.

- Very low debt-servicing ratios for heavily indebted governments, which are unwinding austerity and emerging from recession. Budget deficits have improved markedly. That’s even in the context of little actual deleveraging and ongoing, and in some cases growing, debt levels.

- A private sector recovery that is characterised as strong, even by the IMF, has few headwinds (low debt and high cash balances) and is well placed to accelerate.

With austerity unwinding and many of the major economies in Europe such as Spain, Italy and the UK set to emerging from recession, and to bring budget deficits under control, I don’t see how risks can be predominantly to the downside on a 3-5 year view.

I don’t think this is accurate in any way. That’s not to say that downside risks don’t exist – of course they do, they always do.

But I think, to be fair, that they are swamped by the upside risks presented by the strong private sector recovery, and massive monetary stimulus. The problems to do with lingering public sector debt are a longer-term challenge the way of I see it, while debt servicing is so low.