Ignore emotion, look at the trends

Summary: Over the last 20 years America's share index has outrun Australia's, except in the bull market that preceded the financial meltdown of 2008. But after the recent near 15 per cent fall in the local market, investors are torn between denial and fear. Trend and momentum based market timing models react unemotionally to the market at such times. |

Key take-out: Fearful investors should consider a proven timing strategy using market trend and momentum indicators as the best “insurance” against a potential crash. This allows them to react objectively to what it is actually happening. |

Key beneficiaries: General investors. Category: Shares. |

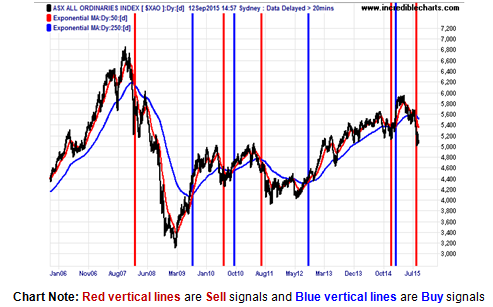

In my column last month, I suggested timing the Australian share market using a red medium term (50 day) and blue long term (250 day) trend lines crossover trading strategy. Investors who did so will now be safely in cash because a “death cross” appeared on August 18 (i.e. the red trend line fell below the blue one).

Applying a 50 day and 250 day trend lines crossover strategy to the All Ordinaries index

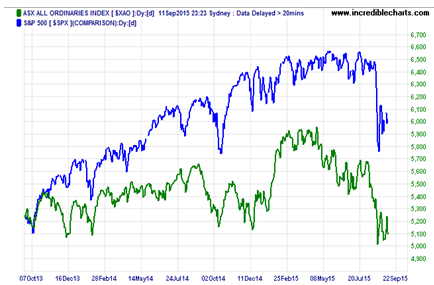

From peak to trough in the current market correction, the US S&P 500 share index has fallen 12.4 per cent while Australia's All Ords share index has dropped 15.8 per cent. A slight bounce back has seen these falls trimmed to 8.4 per cent in America and 14.4 per cent in Australia. See chart below.

Blue US Share Index versus Green Australian Share Index, Oct 2013 – Sept 2015

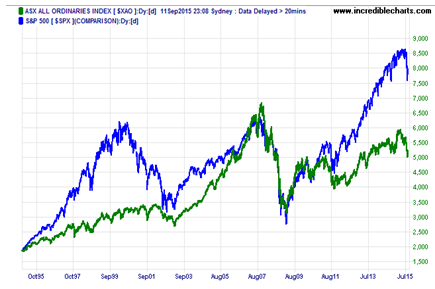

The next chart shows that over the last 20 years America's share index has outrun Australia's, except in the bull market that preceded the financial meltdown of 2008.

Blue US Share Index versus Green Australian Share Index, Oct 1995 – Sept 2015

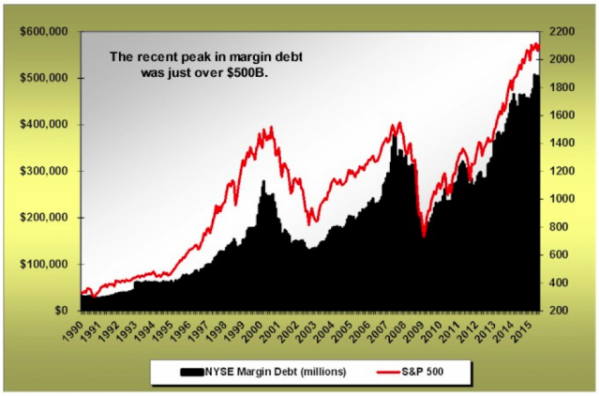

With global share markets now experiencing their biggest drop since 2011 the burning question is whether this will stay a correction (a 10-20 per cent drop) or become a crash (over 20 per cent drop). No one knows, but the longer a concerted rally is delayed the greater the chance of a share rout as investor nervousness intensifies. That's because share markets are overleveraged with margin-loan debt. See following chart for the US.

Chart Source: Brian Pretti,The Margin-Debt Time Bomb , Peak Prosperity, September 4, 2015

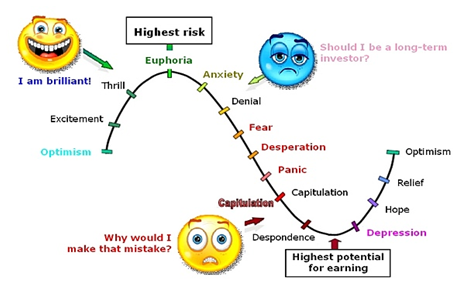

Observe the typical cycle of investor emotions depicted below. At present the market mood is between denial and fear as investors slide the slope of hope. Should the market fall further desperation and panic will set in. This could trigger capitulation as investors rush for the exit for fear of getting trapped. Despondency and depression are the mindsets after that.

The typical cycle of investor emotions – greed versus fear

Historically, most corrections do not become crashes. Indeed oversold markets usually bounce back (see: A total global affair). But when they don't, the price fall can be 20 per cent or much greater and destroy portfolios. Hard earned savings can take a decade or two to recover. For instance the All Ordinaries index is presently trading at the same level it did in 2006 which was nine years ago.

In Japan, the Nikkei share index has more than doubled since 2012, yet that only puts it on par with its level in 1986, 29 years ago. The conventional wisdom that share markets always go up is true over the very long run, but there are extended periods when they fall or stall. Unless you are young, such setbacks can dash retirement plans as many discovered in 2008.

A proven timing strategy using market trend and momentum indicators is the best “insurance” against a crash since it's not based on guessing what the market will do, but on reacting objectively and unemotionally to what it is actually happening. That's why my Active share strategy exited the market on August 12 and my Conservative strategy did so on August 18. International market timer monitor, Timer Trac.com can confirm that.

Who else in Australia issued definitive Sell signals on those dates or slightly earlier? Not one adviser to my knowledge. Of course some analysts gave warnings, but they held back from issuing a full evacuation alert as MarketTiming did. Should the market rally my timing models will signal getting back into listed equity funds (ETFs), but in the meantime I‘m relaxed about being in cash. Incidentally, Timer Trac.com ranks my Active and Conservative strategies as being in the top quartile of its world performance league tables for the past one, two and three years.

That's not because I foresee things that others can't. I don't. It's because I consider forecasting as soothsaying so the best way to protect oneself in the share market is to objectively gauge its trend and momentum and react accordingly. By staying on the right side of the market's medium to long term direction it is possible to avoid the roller coaster ride of a buy and hold (i.e. set and forget) share investor thereby smoothing capital returns.

Back-testing shows that a good trend-following system can deliver high share market returns with low bond market volatility over the long run.

Take for instance the simple 50 by 250 day moving average crossover strategy I mentioned at the outset. The red vertical lines are Sell signals and the blue ones are Buy signals.

Applied to the Japanese share market over the last 30 years it would have kept an investor in every major rally and out of every major crash. Note however that trend following creates small whipsaws (losses or opportunity costs) when the market is trendless (green circles) as occurred in Japan between 1993 and 1997 and 2009 and 2012. No system is perfect!

Where the global share market goes from here is anyone's guess. Rather than put my trust in fundamental analysis (which looks for value) or most technical analysis (which looks for patterns) I will stick with my trend and momentum based market timing models because they are grounded in reality (i.e. respond to Mr Market's actual moves).

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.