If it's a "melt up" timing will be key

Summary: Melt ups often precede melt downs and no-one rings the bell at the top of a market. This market is likely to melt up, and the melt up could last for all of 2015 or abruptly end and become a melt down. There may still be more juice to squeeze out of rising share prices, but you need to have an exit strategy. |

Key take-out: A trend-following signals system is one safeguard against a market crash. |

Key beneficiaries: General investors. Category: Shares. |

In the recent Eureka Report lead story Will the markets melt up? (February 4), Doug Turek, principal advisor with Professional Wealth, made an astute observation:

"It may seem counterintuitive but [central bank interest rate cuts] may actually drive a “melt up” in share prices this year, complementing the already melted up bond market.”

Since bad news sells more than good news, the phrase “melt up” doesn't appear as often in the media as the more worn “melt down”. A melt up is simply the opposite. It is when investment prices rise rapidly and well above fundamentals. According to Investopedia, a melt up is driven by a stampede of investors who don't want to miss out on rising prices. Perhaps today we should say instead it is being driven by a stampede of central bankers, or simply yield-hungry investors.

It should be no surprise that melt ups often precede melt downs, so be warned.

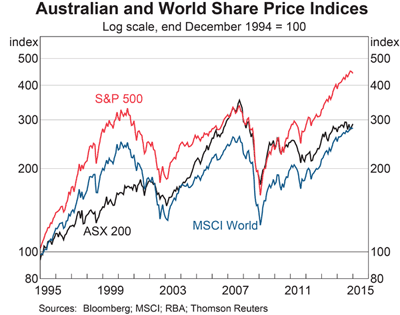

For the past seven years the global share market, and especially Wall Street, has enjoyed a strong bull market following the bear market of 2007-09.

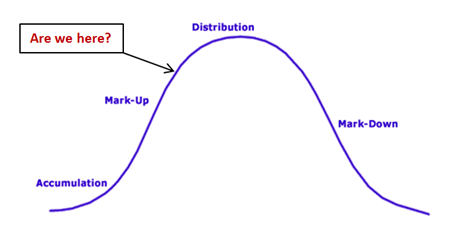

A typical share market cycle undergoes four phases as follows:

An explanation of each of these phases can be found here.

Many think the global share market is moving from its Mark-up phase to its Distribution phase. If so then there is still more juice to be squeezed out of shares. But you need to have a well-planned exit strategy.

No-one rings the bell at the top of a market. But I do believe market timing strategies, using objective trend and momentum indicators, can tell you when the market is exhausted and has changed direction warranting selling your listed share funds so you avoid the slippery path most investors experience in a bear market.

With interest rates at historic lows and government spending overstretched both monetary and fiscal stimuli may have been exhausted. Yet worldwide total debt is now 20 percentage points higher that it was before the GFC, so households, corporations and governments are reluctant to borrow more even though money has never been cheaper.

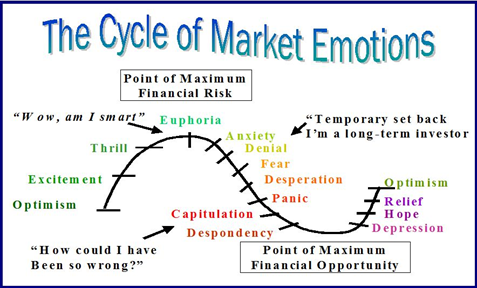

Instead speculators have used cheap credit to fuel an asset price boom as reflected in bond, equity and property markets. And ordinary investors to make ends meet have abandoned low yielding cash and bonds for the higher returns being offered by soaring share and property prices. Because the music didn't stop (except for an interlude in 2011 when Greece looked like it might default), investor sentiment has transformed from fear to complacency.

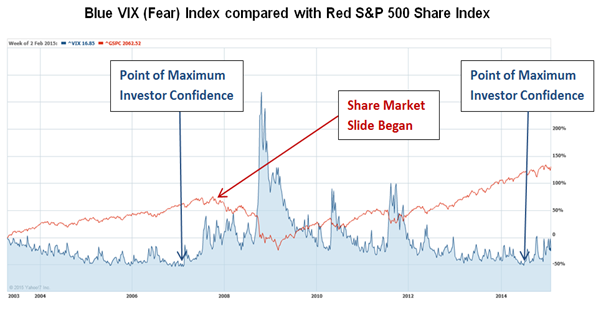

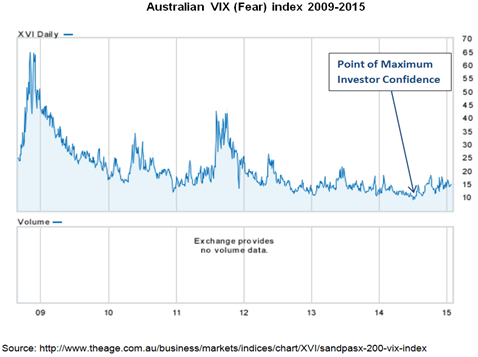

But it's precisely when everyone thinks it's safe to take risks again that markets have a habit of biting us. Look at the following chart that measures the American stock market's price volatility. This VIX index is commonly called the Fear index because it accurately gauges investor fear.

Note that the last crash happened just after the market had reached supreme confidence as reflected by very low volatility. Note also how volatility (fear) peaked just before the share index troughed. Finally observe how volatility last reached its low point in mid-2014 and has been rising since. The same pattern is evident in Australia.

I'm not saying that the market is about to crash. Indeed it is likely to melt up as Doug Turek says. And this melt up might last for all of 2015 or abruptly end and become a melt down triggered by some cataclysmic event such as a Greek exit from the euro or a proxy war between Russia and America over Ukraine.

Alternatively, share markets could continue soaring if March 2009 marked the start of a new secular bull market like the one that ran between 1982 and 2000.

As always, nobody knows the future: But what we do know is that a safeguard against a market crash is a trend-following signals system. As I have said before even a crude 50 by 250 day moving average trend-line crossover strategy demonstrates that anyone trend trading either the US or Australian share indices would have avoided the worst of the busts of the last twenty years yet enjoyed the run-ups to these crashes and participated in the rallies that followed them.

Here are the trend trading busts in the Australian All Ords Share Index 1995-2015:

Historically, slow trend trading a listed fund (like the SPDR S&P/ASX 200 Share Fund – ASX Code STW) has given better returns with less emotional trauma than passively holding such an indexed fund.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.