Hunting for the next Blackmores

Summary: Demand in China for Australian lifestyle and consumer products has received plenty of media attention – now it's time for investors to consider the likely value and growth potential of stocks affected by this thematic. For instance, Blackmores has a strong brand and plan, but we must factor in the exceptional long term earnings growth the company must see in order to maintain share price momentum. |

Key take-out: Eureka Report will be on the lookout for new opportunities in the China space going forward. |

Key beneficiaries: General investors. Category: Shares. |

After another earnings upgrade for infant formula stock Bellamy's, there is no sign of a slowdown for the popular thematic of Chinese consumer demand for Australian “clean and green” products.

Bellamy's (BAL) announced the earnings upgrade leading into its first half result expected on the February 19. The announcement was in response to a volatile week for the company with its share price declining from $13.98 to a low of $10.23. On Friday after the upgraded guidance, the stock closed the day up nearly 15 percent to $12.80.

Moreover, Bellamy's peers in related milk, vitamins and health food industries also gained immediately: Dairy group A2 Milk (A2M) and health products manufacturer Blackmores (BKL) responded with 10.3 percent and 5.7 percent gains respectively.

The guidance from BAL of first half revenue of $105 million and earnings before interest and tax (EBIT) of $19m is well above previous expectations. The company expects revenues in the second half to be stronger than the first half and has contracted additional infant formula volumes to be supplied through the second half and beyond.

The company's recent announcement on the Fonterra manufacturing agreement is expected to begin in late FY16 with the benefit of additional volumes to be realised in FY17.

But with the Bellamy's share price up about 550 percent in the last 12 months and Blackmores up 350 percent, the two key questions are:

1. Is there more upside in this sector, and

2. Are there other stocks benefiting from the same thematic that haven't run as hard yet?

The story of Chinese consumers' increasing demand for quality Australian products such as skincare, milk powder, vitamins etc. is only really 12 to 18 months old.

Given the ongoing urbanisation and rise of the middle class in China, the trend is clearly in the early stages and should be here to stay. Therefore, it is a worthwhile exercise to consider what other ASX stocks may provide opportunities in the future.

Chinese Consumer - demand drivers for Australian “clean and green” products

Recent Austrade data on searches for Australian products on websites such as Tmall (business-to-consumer) revealed 40 per cent were for skincare. Food and wine accounted for 19 per cent of searches and milk powder 16 per cent. But what are the dynamics driving this interest in Australian-made products for China? Here's seven key issues investors need to consider:

1. Past health and safety issues have resulted in many Chinese consumers not trusting local manufacturers/producers, and increasing demand for Australian “clean and green” products, that require TGA (Therapeutic Goods Administration) manufacturing approval.

2. Chinese individuals or third party distributors making a profit from transporting Australian quality products to China (such as vitamins, infant formula). Company's such as BAL and BKL estimate that 30-50 per cent of their Australian based sales are actually ending up in China via the “grey market”!

3. Increasing use of Chinese e-Commerce channels (eg Tmall Global and JD Worldwide), with sales from third party distributors as well as the flagship stores of companies such as Blackmores.

4. Increasing Chinese incomes and demand for products such as complementary medicines. For example, the total market of "Vitamins and Dietary supplements" is expected to reach at least $16 billion in 2015, and China's average income has risen to about $7,000 per year in GDP per capita, up from $3,800 in 2009. McKinsey has forecast that by 2020, the affluent class in China will represent 20 per cent of the country's total population, and total spending will surpass Japan to become the second largest in the world.

5. Ageing population driving demand for vitamins and healthcare. From 2000 to today the percentage of China's population aged 65 and over rose from 6.9 per cent to 9.5 per cent of the country's total population, and the National Bureau of Statistics of China forecasts this to reach 11.9 per cent by 2020.

6. The abolition of the “one-child policy” last year will stimulate population growth and be a particularly strong driver for baby products suppliers such as Bellamy's.

7. The newly signed China-Australia Free trade Agreement will ensure increased access to the Chinese market for Australian companies.

It is relatively easy to see that Chinese demand for these products is likely to continue to grow, where it gets a little more difficult is the assumptions of what the actual growth rates will be. What's more, we need to be able to value how a company benefits from the increased demand.

The increased appetite from China's middle class is a hot topic with some of that hype potentially reflected in the share prices. For example, considerable media attention has been given to stories of a lack of supply of baby formula in Australian supermarkets, because of Australian based Chinese people buying whatever they can and making a profit from sending it back home. Given the hype, care needs to be taken in assessing the risks and ensuring the share prices are not getting ahead of themselves.

Blackmores – what is factored into the price?

Perhaps the nearest example of an iconic stock in this areas is not the closely watched infant formula specialist Bellamy's but Blackmores, a considerably larger operation which has a solid history on the ASX.

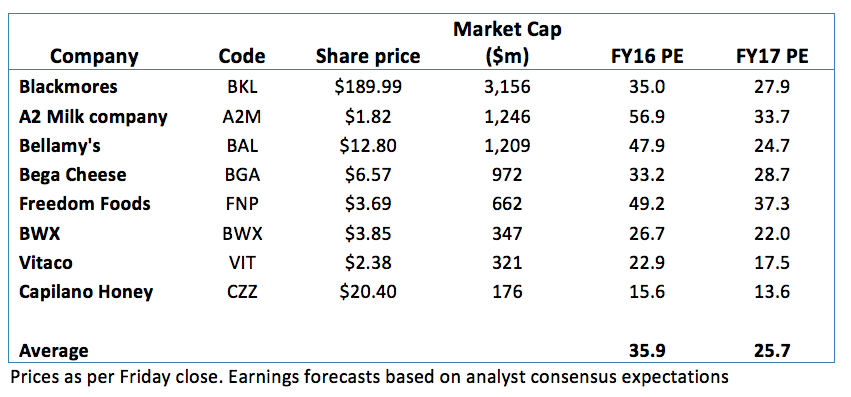

Blackmores is a perfect case study of what is factored in, and what earnings growth needs to be achieved to justify the current share price ($190 per share, $3.1bn market cap). On current analyst consensus forecasts, Blackmores is on a FY16 PE of 35, and FY17 PE of 28.

The company is clearly growing at a rapid rate. In the year to September 2015, BKL earned $534m of revenue, compared to $326m in 2013. The 65 percent revenue growth also led to net profit growth of 157 percent because of the operating leverage in manufacturing vitamins.

In the $2bn Australian vitamin and dietary supplement market Blackmores and Swisse are the market leaders with an approximate market share of 15 percent each.

Inside the $15bn Chinese vitamins market, it is worth noting that Blackmores only has an approximate 1 per cent share.

At home the Australian market grew at a compound annual growth rate (CAGR) of 9.6 percent between 2009 and 2014. The Chinese market has been growing at a faster rate and is likely to maintain 10 percent plus annual growth for many years to come.

To get a valuation above $200 per share for Blackmores we need to assume approximately 25 percent earnings per share CAGR for the next 10 years. If we assume market growth above 10 percent per year, then Blackmores will need to increase its current Chinese market share of 1 percent to about 3 percent in this period. To get a valuation of above $300 per share, we need to assume the BKL Chinese market share gets to around 5 percent in that 10-year period.

Given the strength of the Blackmores brand, management and operations, the above assumptions to justify the current share price are certainly achievable. But to assume 25 percent compound annual growth for 10 years, for an industrial company, doesn't leave much room for error.

Blackmores – what about the risks?

The major risks at Blackmores would include issues of regulation, supply/capacity constraints, brand damage, competition and currency.

A key regulatory risk includes any changes to ensure all food imports comply with Chinese food safety standards. There has been initial discussion of regulatory changes that would disrupt the “grey market” and have a short term effect on some BKL sales into China.

BKL would need to re-structure its business to enable greater capacity for sales directly into China either via online channels or a physical presence in China. Although this would be a short term negative, it actually could be a long term positive because it increases the barriers to entry and would increase the earnings margins for BKL.

Blackmores' key strength is its brand, so anything to change this strong reputation or the perception of Australia's “clean and green” products, would have an immediate and drastic impact on the company and its share price. The difficult component here is that it could be out of BKL's control, as even an Australian competitor having safety or quality issues would have a material impact.

China consumer stocks

As can be seen from the table above, the average FY16 PE of these stocks that have been able to tap into the Chinese consumer is 35 times. The FY17 average is 26 times. Although both years are well above the market average the trend for these stocks especially over the last six months has been earnings upgrades. The companies that continue to meet or exceed earnings expectations, and show that they have strategies in place to execute continued high growth rates are likely to have extended support from the market.

Briefly some of the other China consumer opportunities include:

1. A2 Milk Company (A2M): The manufacturer and marketer of the a2 Milk label reported a larger than expected increase in sales in late December. Driving the upgrade was its new a2 Platinum infant formula, with strength in both Australia and China. The stock is up about 130 percent in the last six months.

2. BWX Ltd (BWX): Manufacturer and marketer of natural hair and skincare products, including flagship brand Sukin. The naturally sourced Australian ingredients used in Sukin products are popular with Chinese consumers, as evidenced by the expectation of approximately 40 percent revenue growth overseas this year.

3. Vitaco (VIT): Vitaco listed in September last year and has vitamins, Sports nutrition and health foods divisions. Previously based in Australia and New Zealand, the company is attempting to replicate the success of Blackmore's by expanding into China. Initially this Chinese growth is mainly via the “grey market”, with plans for a more direct China strategy down the track. The challenge is the Vitaco vitamins brands don't have the same reputation as Blackmores, and the non-vitamin divisions do not have the same level of Chinese potential.

Emerging China stocks

On top of the obvious contenders we have already featured in this piece, it is worth being on the lookout for other Australian based companies that are attempting to position themselves to benefit from the rise of the Chinese middle class consumer.

As well as skin care, food, infant formula and vitamins increasingly Chinese based opportunities are likely to open up in healthcare, aged care, and financial services.

The key will be identifying these opportunities before the market has re-rated the stocks, but also balancing out the risks and likelihood of successfully executing their China based strategies.

Pental (PTL) – positioning for Asian expansion - BUY

One such example is the Australian based Pental (PTL). The company engages in manufacturing and distribution of a range of home care and personal care products currently in Australia and New Zealand.

Its brands such as White King, Pears, Velvet and Country Life are well recognised in Australia and mostly market leaders in their categories.

We are waiting for more details at the half year result, but management has previously discussed the potential to export its soap products into China and other Asian countries at its AGM.

It is early days and there are no guarantees chief executive Charlie McLeish and his management team will be able to execute the Asian growth strategy. But at the current share price of $0.645 ($89m market cap) there is also not much expectation of success priced in. Pental is trading on a PE of 14 times FY16 Australian based earnings, with $11m net cash.

We have a BUY recommendation for Pental and it is in the “growth first” model portfolio (see here: Price is right at Pental, December 14, 2015). We will also be on the lookout for other China consumer based opportunities that are yet to receive a share price re-rating.