Hunt for yield: The sequel

Summary: The search for yield is showing no signs of ending as interest rates fall. We've put together a table of the best yield stocks on the ASX 200, and restricted it to companies offering fully franked dividends. Some industrial and resources stocks are now offering better yields than the banks. |

Key take-out: When considering yield, it's also worth thinking about how a company's dividend is likely to change over time, as well as keeping an eye on capital preservation. |

Key beneficiaries: General investors. Category: Shares. |

After the lowering of interest rates last month, and in anticipation of further easing to come, the hunt for yield is set for a sequel.

Bank share prices have soared as investors chase steady dividends, but shareholders who have held financial stocks for an extended period are uncertain about whether to stay put or take profits.

So where do we look now?

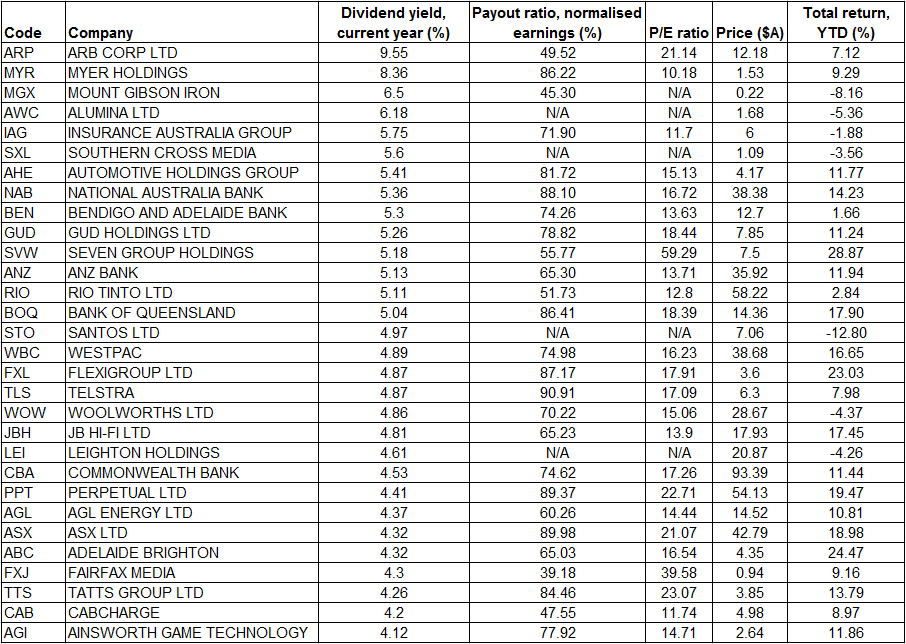

After the recent half-year reporting season, we've put together a table of the best yield stocks on the market at the moment.

There are several changes since the last time we listed the companies with the best yields (see The best yield stocks post-correction, October 29, 2014).

The yield of market darling Commonwealth Bank has fallen to 4.53 per cent, as its share price continues to rally in response to falling interest rates. Yields for the other major banks have also compressed.

In contrast industrial stocks are offering better numbers: For example, Automotive Holdings Group has a higher yield than any of the banks – and it's seen as a takeover target to boot.

Yields in the resources sector have also risen, though there are often very different reasons for this development.

The table below lists the best yield stocks on the ASX 200. Note we have restricted the list to companies offering fully franked dividends.

A second criterion is that the companies are all on a price-earnings ratio of 10 or higher – we've removed stocks with lower P/E ratios, as this can indicate the market thinks future earnings may not be able to sustain dividends.

These companies also have payout ratios of less than 95 per cent of earnings, as high ratios may suggest dividends are not sustainable, and ratios above 100 per cent mean a company is paying out more in dividends than it earns.

Companies with three or more recent broker downgrades have also been removed from the list.

As always, any stock that has a dividend yield of 6 per cent or higher will invariably require an investor to do more research. High dividends may point to either an attractive company or one which the market thinks has ongoing troubles.

Source: Bloomberg, Eureka Report, as at March 19

The top stock, four-wheel drive accessories manufacturer ARB Corporation, is trading on a yield of 9.55 per cent after it reported a modest lift in first-half profit. The company said it plans to cut costs and warned that the mining slowdown was weighing on sales, but said demand remains healthy and noted its long-term growth plans in Australia and offshore. The stock has traded sideways over the past year.

Department store chain Myer takes second place, offering a compelling example of why investors should do their research on companies offering strong yields. Myer's share price has fallen over the past year, dropping sharply after the company surprised shareholders by announcing the resignation of former chief executive Bernie Brookes, then falling further after the company posted a lower first-half profit and cut its full-year guidance. Incoming boss Richard Umbers has flagged a new strategy, including a boost to its online offering.

In resources, troubled iron ore junior Mount Gibson Iron takes the third spot on the list with a 6.5 per cent yield, but investors beware: its share price is less than a third of what it was a year ago.

Meanwhile, diversified miner Rio Tinto emerges as a top ranked income stock with a yield of 5.11 per cent, higher than some of the banks.

The first bank stock on the list is National Australia Bank, which has faced ongoing challenges in its UK operations, with a yield of 5.36 per cent. But it is closely followed by junior lender Bendigo and Adelaide Bank, with a yield of 5.30 per cent. ANZ has a yield of 5.13 per cent, Bank of Queensland is on 5.04 per cent and Westpac is on 4.89 per cent.

CBA's yield of 4.53 per cent may be less handsome than in the past, but is still higher than the returns on offer from the bank's term deposits.

Perth-based car dealership manager Automotive Holdings Group has a higher yield than any of the banks, at 5.41 per cent. Tom Elliott has previously written that the company is a prime target for merger activity, saying fellow car dealer AP Eagers is likely to approach AHE with a proposal (see Beyond Toll: More takeover targets to watch, February 18).

Dividend payers or dividend growers?

During interim reporting season, companies on average increased dividends by around 5 per cent: AMP Capital chief economist Shane Oliver has commented that the season was better than expected with profits rising for banks and industrial stocks and falling for resources companies.

Some 55 per cent of December half profits beat expectations, while 62 per cent of companies increased their dividends, Oliver said.

When considering dividends, it's also worth thinking about how a company's dividend is likely to change over time. A steady dividend appears attractive, but a growing dividend may be more appealing over the long term.

Companies that are likely to grow their dividends often fall into the category of “quality growth businesses” that produce “real cash profits, not paper profits”, says Capital Group senior vice-president Andy Budden.

This means that the underlying business is steadily growing, increasing profit and cashflow each year. These companies also have a solid balance sheet, with an appropriate amount of debt. And the companies have quality management who are skilled in allocating capital in the interests of long-term shareholders.

Budden says the other type of companies that are likely to grow dividends are companies where the payout ratio is very low, but management commits to increasing it over a four- or five-year period. They can be newer companies, and this has been particularly common in technology stocks over the past 10 years, he says.

Even though the Australian share market may seem expensive, Budden says there are “virtually always” opportunities, and reminds investors to look overseas as well. He notes a wide variation between payouts from different offshore companies, with some paying no dividends and others paying attractive dividends. Capital Group established a World Dividend Growers fund in 2012, and has recently offered this to Australian investors; Budden says the yield from these investments has been competitive compared to Australian stocks since inception.

The hunt for yield is unlikely to end any time soon. In the meantime, it's always worth keeping capital preservation in mind.