How you can still play the Greek market

| Summary: The Global X FTSE Greece 20 ETF is not one for the fainthearted, but it could provide good upside if a Greek deal is hammered out quickly. But it is a very risky play. |

| Key take-out: Even if Greece remains in the EU, the Greek economy and its equity market are going to struggle for some time to come. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

Well, the Greeks seem to have overwhelmingly voted against their creditors' conditions and demands overnight.

While this vote doesn't necessarily mean that they all want to leave the EU, it gives the left wing Syriza government a stronger bargaining chip with the EU. “Bargaining” is the key word here because that's what we will see over the near term: more dialogue between the two parties and of course market volatility.

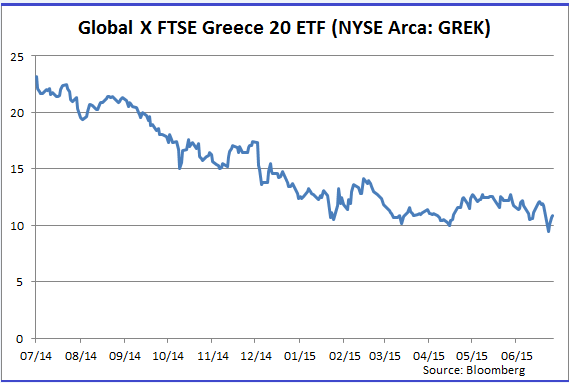

How could investors play this? Well there is a Greek Exchange Traded Fund or ETF (symbol GREK) that trades in USD on the NYSE in the US that tracks the Athens exchange. It holds the largest companies that trade on the local stock exchange (see graph).

Inside this ETF are most of the key companies in Greece and you'll notice that Coca-Cola Hellas has a stunning 20 per cent of the portfolio – just one indicator of how important tourism is to this troubled economy.

Top 10 Holdings (77.93 per cent of Total Assets) | |

Coca-Cola Hellas | 19.91 per cent |

Hellenic Telecommunications | 9.93 per cent |

Greek Organisation of Football Prognostics (OPAP) | 9.47 per cent |

Natl Bank of Greece | 9.25 per cent |

E F G Eurobank SA | 6.44 per cent |

Bank of the Pireaus | 6.11 per cent |

Alpha Bank | 4.76 per cent |

Titan Cement Co | 4.17 per cent |

Folli Follie Group | 3.95 per cent |

Jumbo SA | 3.55 per cent |

Eureka rule of thumb

When it comes to ETFs always know what you are buying. This ETF is heavily weighted towards banks (27 per cent) and the consumer sector (37 per cent), two areas that will be heavily influenced for better or worse by any decision regarding remaining in the EU. That being said it's one cheap ETF, trading at a PE of roughly 12X EPS with a book value of 0.6!

GREK was trading at $US10.85, close to its 52 week low of $US9.42. It is down over 70 per cent from its highs earlier this year. Remember, though, that the Greek stockmarket has been closed for a week. Where GREK opens tonight is anybody's guess, so that's another layer of risk.

If, as a result of the ongoing negotiations, both parties hammer out a deal then this ETF will have a substantial bounce of 10-20 per cent, maybe more. However if a deal is to be struck it must be done quickly and the ECB must continue to support the Greek banking system via the ELA. If it were me and I'd successfully made the trade, I would cash out and adopt a wait and see approach. Because, even if Greece remains in the EU, the Greek economy and its equity market are going to struggle.

The risk / reward here is slightly skewed to the upside from an “odds” point of view, since in spite of their hard-line stance, the EU wants Greece to remain in the union.

However the wildcard here is Prime Minister Tsipras, who may be so emboldened by the vote that he rejects even more favourable terms and leads Greece back to the drachma (the original Greek currency) and its own destruction.

So from a returns point of view, I estimate there is 60-70 per cent downside to the Greek ETF if the country decides to revert to the drachma. It won't go to zero because of that 20 per cent in Coca Cola Hellas, if that's any consolation!!

I used to be quite an active investor in Greek equities. From 2004 through 2007 my global funds held a selection of Greek small and mid-cap stocks, which at the time were not well covered by European brokers.

Some interesting companies that come to mind: Fourlis SA, the only listed pure play for the IKEA home furnishings business in Greece; Jumbo Babyland, a leading toy and children's wear retailer; National Bank of Greece, Alpha Bank, and Intralot, a global company that supplies integrated gaming, transaction processing systems, game content, and sports betting management.

I believe that Alan Kohler met with Intralot when he was in Greece recently. We might revisit them once the smoke clears a bit.

While the Greek drama has been playing out in some form or another since 2010 and has pressured the Euro and European markets over the past months, I believe the crisis will eventually be contained whether Greece stays in the EU or not. It will continue to cause some market volatility from news flow, but remember it is a political event NOT an economic one.

As one commentator put it, Greece's economy “is the size of Alabama”. I would not hesitate to hold European equities nor refrain from buying and holding equity assets in other global markets.

The Euro and the European Union will survive this crisis, as will the rest of the world. Greece? Well, we'll see!

As an ex-Classicist I can't resist the phrase Timeo Danaos et dona ferentes (Virgil's Aeneid: Book II, 49). The phrase means “Beware of Greeks bearing gifts”, a reference to the Trojan Horse.