How to protect against a correction or crash

Summary: The bull case for future share market moves argues that the world continues to be flooded with liquidity, private and public debt is falling, oil prices are falling and emerging markets will help offset the ageing populations of developed countries. But the bear case suggests that deleveraging will drag on growth, central banks have run out of ammunition, China's economic miracle is ending and all major asset classes are overvalued. |

Key take out: Given this uncertainty, balance your portfolio by allocating assets based on your age, insure your portfolio through a stop loss and make sure to diversify. |

Key beneficiaries: General Investors. Category: Economics and investment strategy. |

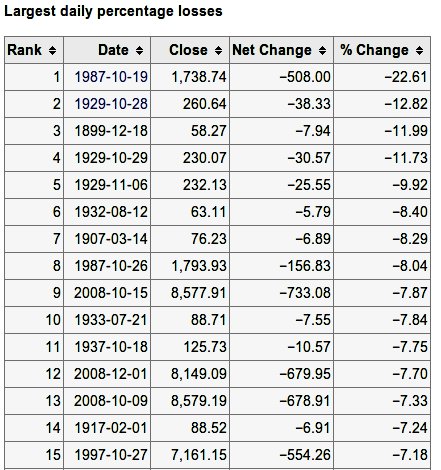

October is renowned for stock market shocks. Here is a history of the worst daily hits on the Dow Jones index in the last century.

Source: The Outsider Club e-letter, October 15, 2014

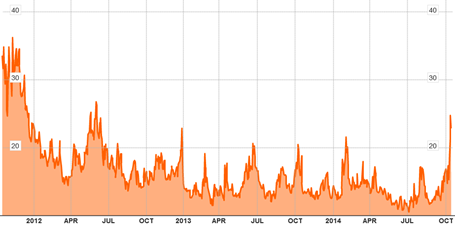

So far the biggest one-day fall in the Dow this month has been 2%, which is small by historic standards. But the uninterrupted 5.2% fall in the Dow between October 8 and October 16 unsettled many investors, as did the recent spike in US stock market volatility as measured by the VIX (or Fear) index.

Source: Bloomberg

So it's timely to review the bull and bear cases for the share market both here and overseas.

The bull case

- The world continues to be flooded with liquidity with Japan (and possibly soon Europe and China) taking up quantitative easing as the US and Britain cease printing money.

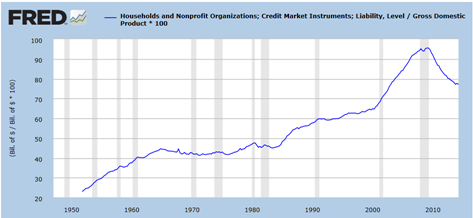

- Progress is being made in paying down private debt and stemming public deficits. Witness this chart for America's households.

Source: St Louis Federal Reserve

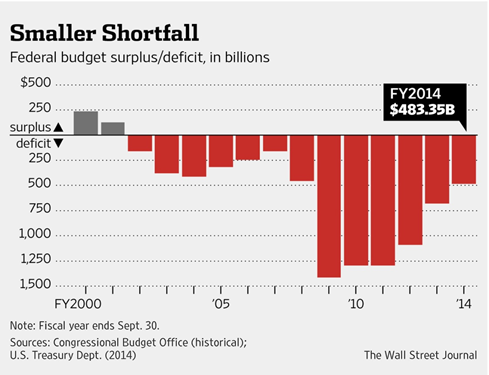

Meanwhile, the US fiscal deficit has been cut from 9% of GDP in 2009 to 2.9%, or $US483 billion, this year.

- New digital and robotics technology will usher in a growth era unprecedented in human history.

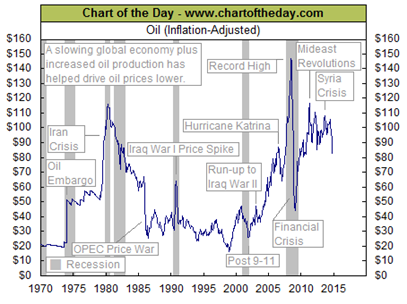

- Oil prices have fallen dramatically as a result of oil shale fracking which is making America self-sufficient in energy and reducing the cost for consumers.

- Emerging markets will provide the population dynamic to offset an ageing population in developed countries.

- Immigration will keep Australia and America's population relatively young thereby avoiding the acute ageing trap afflicting Japan and Europe.

- The scarcest resources are arable land and mineral resources and Australia is well endowed with both.

- The 21st century belongs to Asia. Australia and New Zealand are the only European-derived societies living in the same time zone.

- In Australia, higher dwelling construction and infrastructure spending and a falling Australian dollar will offset much of the slowdown in mining construction.

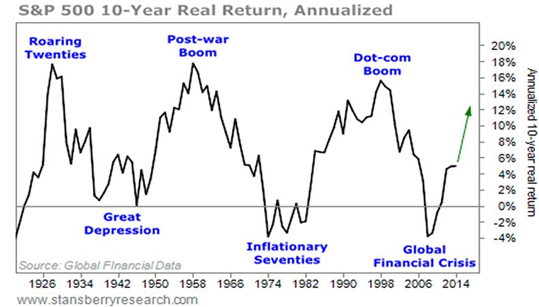

- Based on 10-year annualised returns, the USA is just half way through its stock market upcycle while the rest of the world has just embarked on this journey.

The bear case

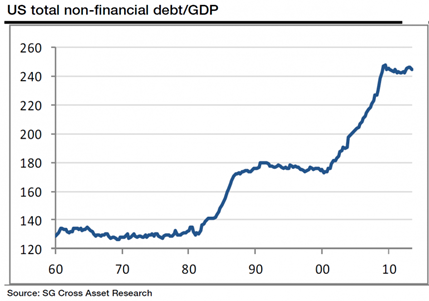

- The world's debt problems are far from over and deleveraging will act as a drag on world growth. Public debt in most developed countries remains dangerously high (see The Economist's global debt clock) while total US non-financial sector debt to GDP remains at an elevated record level.

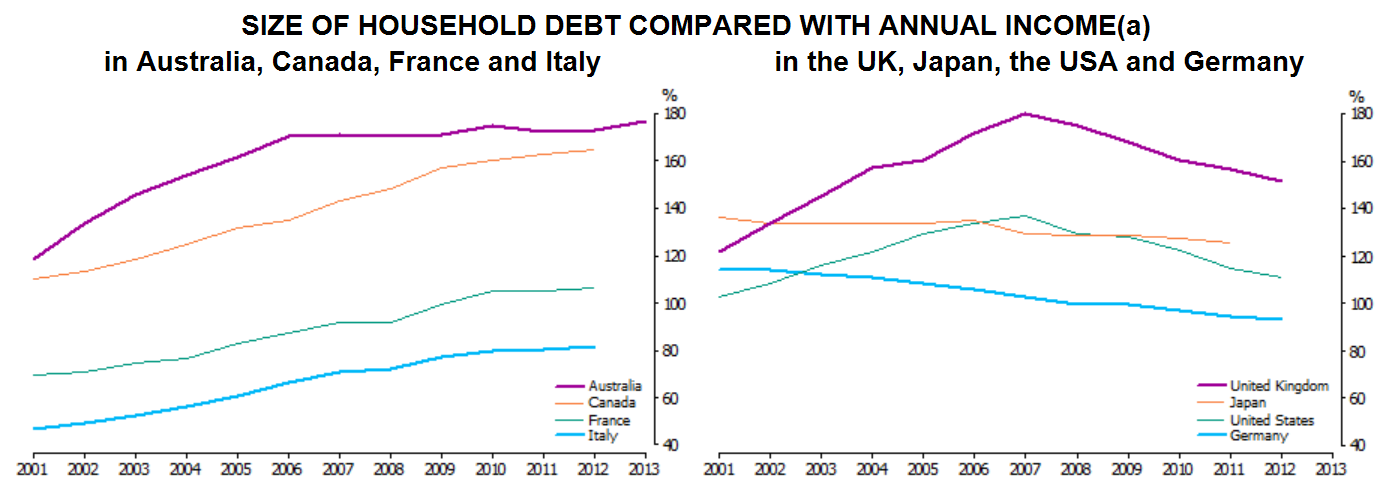

Furthermore in Australia household debt to disposable income is at its highest level ever and well above that of other countries.

Source: Australian Bureau of Statistics

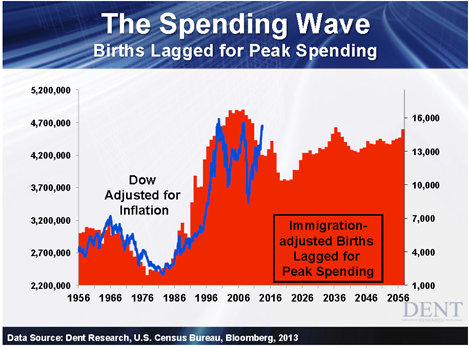

- The ageing of the population will reduce economic growth and with it share market indices. Harry Dent in his book Demographic Cliff claims that the share market index is driven by the peak spending group (who are aged 46-50) which is in decline.

- Cheap credit will dry up as the US Federal Reserve reverse quantitative easing and increases cash rates.

- With record low interest rates and inflated balance sheets (from money printing), central banks have run out of ammunition and have no plan B.

- The world is facing natural limits – the Club of Rome was right, just 30 years too soon.

- Faith in democracy is dashed and the future is one of war, political turmoil and legislative gridlock. Pew's global opinion poll survey shows low faith in government.

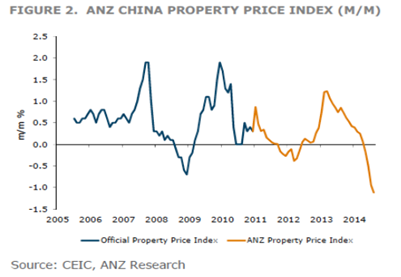

- China's economic miracle is coming to an end as it tries to switch from an investment-led to a consumption-driven economy and cracks down on free-wheeling corruption.

- Australia is about to experience “dog days” (Ross Garnaut) with real national income per person already falling by 2% over the last two financial years for two years — the worst result since the 1980s.

- The digital and robotic revolutions are lifting productivity, but at the expense of destroying skilled and professional jobs which will disrupt most economies.

- All major asset classes are overvalued – bonds, property and shares – so it's only a matter of time before there is a correction or crash.

Faced with this conflicting picture of the future, what should an investor do?

Here is my three step suggestion: balance, diversify and insure.

Balance

First, have an asset allocation commensurate with your age. One rule of thumb is to hold defensive assets (cash, term deposits and bonds) in proportion to your age. So if you are 60 years of age be 60% defensive with only 40% of your portfolio in aggressive assets (e.g. property, shares and precious metals).

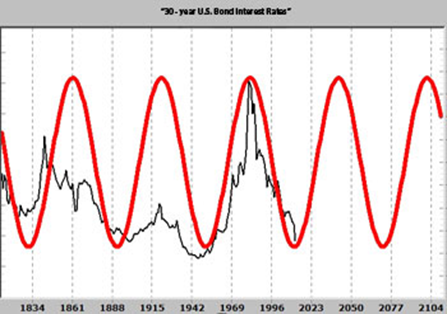

With regards to bonds, extra care can be taken by holding mainly floating rate or CPI-linked bonds since the world is at the bottom of its historic interest rate cycle which could see long-dated fixed rate securities (e.g. 10-year Treasury or Corporate bonds) crash when yields eventually rise.

Diversify

Second, diversify your assets so that if a few go sour you still keep the rest. That means holding a large portfolio of shares and property rather than a concentrated one. The easiest way to do that is through unlisted managed funds, exchange-traded funds and listed investment companies where the minimum investment may be as low as $1,000, but gives you access to a multitude of shares or properties.

Insure

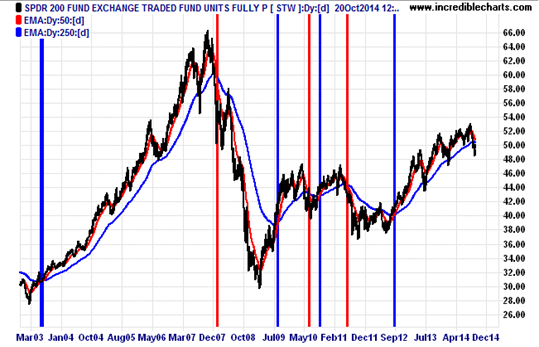

Put a stop loss on the riskiest portion of your portfolio, which is likely to be shares. The easiest way to do that is to hold a large chunk of your share exposure in the form of an exchange-traded fund (like STW, SFY, VAS or IOZ) or a listed investment company (such as AFI, ARG and MLT) and then apply a 50/250 day moving average crossover strategy to signal when to hold the share fund and when it's safer to bail out and be in cash.

As you can see this model when applied to STW (the SPDR S&P/ASX 200 share fund) is very close to a red sell signal (when the fund's red short term trend line falls below its long term blue trend line). Whether the stock market pulls back from a correction or crash only time will tell.

Percy Allan is a director of MarketTiming.com.au. For a free three week trial of its newsletter and trend-trading strategies for listed ETF funds, see www.markettiming.com.au.