How to buy the resources rebound

| Summary: Attendees at the London Mines and Money conference last week were told that the hot commodities in 2014 will be diamonds, zinc and tin. Buying stocks exposed to these commodities is the easiest route in, and there are multiple avenues for Australian investors. |

| Key take-out: Supply squeezes, or a demand revival, are the key factors that will drive diamonds, zinc and tin ahead of other minerals commodities. |

| Key beneficiaries: General investors. Category: Commodities. |

Eureka Report’s mining correspondent Tim Treadgold returned from the London Mines and Money conference last week with a clear call on what the world’s miners believe will lead a resources recovery in 2014.

According to Tim (Prepare for a resources rush), some of the world’s greatest minds in mining finance anticipate diamonds, zinc and tin will be at the forefront as investors are expected to return to the oversold commodity markets in the months ahead.

But how can an Australian retail investors get access to these three resources? Here’s a guide.

Private equity firms, seeking higher returns amid paltry interest rates, are expected to unleash a portion of their funds on the Australian resources sector in 2014 as pressure builds from cashed-up British and European investors.

ASX-listed resource stocks appeal in particular as investment opportunities because of the commodity and future currency benefits from the fast-depreciating Australian dollar.

The experts say diamonds, zinc and tin should lead the charge. Each of them are either experiencing a supply squeeze from poor investment in mining infrastructure, or are enjoying a demand revival as technology continues to progress.

But given the potentially high returns of the three commodities, what are the best ways you can leverage exposure to them for 2014?

Diamonds

Diamonds – which are already beginning to lift in price – are experiencing tightening supply due to lack of exploration success from most companies in the global sector.

However, investing in diamonds is perhaps the trickiest out of the three commodities set to run next year as investors can choose to buy a highly finished version of the physical commodity in jewellery shops as well as invest in the companies that mine them.

“If you go to buy a diamond as investment, make sure it’s high quality, a good colour and well made,” says Ronnie Bauer, the board director at the Jewellers Association of Australia (JAA).

First, make sure the diamond is certified, he says. Most diamonds are granted certification through HRD Antwerp in Europe or by GIA, the US approved laboratory, but Australia has its own approved laboratory called the Gem Studies Laboratory (GSL).

When selecting the diamond, Bauer stresses to be careful. Don’t look anything weighing under half a carat as small diamonds don’t hold value, make sure its quality is at least VS-1 (very slight inclusion), and only choose a white diamond with colours ranging from D to F. The stone should also be cut symmetrically, with proportions allowing for light to play through the stone.

However, this is only a general recommendation as older stones that don’t fit these criteria can also be valuable.

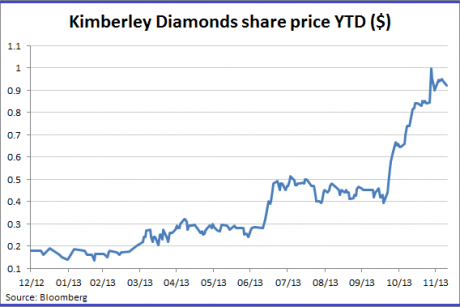

The other option is to gain exposure to the commodity by buying shares in diamond mining companies, such as Kimberley Diamonds. The stock climbed to a record high of 94 cents last month, and currently hovers at around 90 cents.

Zinc

The global stockpile of zinc is shrinking, but demand remains unabated for the rust-proofing metal.

Surplus zinc held in the London Metal Exchange’s warehouses has fallen to approximately 946,000 million tonnes – the equivalent of under 10 weeks of zinc demand – from 1.24 million tonnes a year ago as more zinc mines run out of ore and close.

With mine production slowing, zinc is expected to face a supply shortage in the future (see Tim’s article, Stirring in the zinc pot). The last time this occurred between 2004 and 2007, zinc surged almost 300% to $US1.50 a pound. Zinc now sits at about US85 cents.

“As we see upside for prices over the next couple of years, there are clearly a number of opportunities available for investors,” said Morgan Stanley in a broker note to clients last month.

The broker sees a steady increase in the zinc price over the next few years, to $US1.05 a pound in 2018.

However, in common with the diamond sector, Australia’s selection of zinc stocks is restricted. Miners find zinc challenging because it often occurs underground together with silver and lead, and all three need to be extracted regardless of each commodity’s commercial viability.

Currently only Terramin mines considerable amounts of zinc, while Iron Bark (IBG) and KBL (KBL) are also exposed to the metal. At Eureka Report we have paid particularly close attention to junior base metals miner YTC Resources, which has been picked by Brendon Lau among the Uncapped 100.

The next 12 months will be even more eventful for YTC Resources because the miner has recently received funding from one of the world’s most powerful commodity groups, Glencore.

All these listed zinc companies are high-risk investments, as they depend on a higher zinc price to succeed. Key indicators in deciding to invest are the zinc stockpiles falling further and the zinc price lifting above US90 cents.

Tin

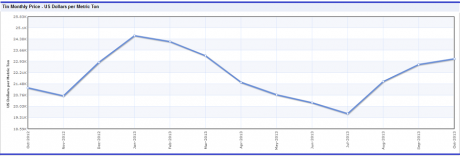

Consumption of tin has increased each year in the past decade as more of it is used for soldering electrical appliances, but supply remains stuck at the same level (see Robert Gottliebsen’s article, Getting in on tin).

Rather than companies putting together the capital to open up new mines, various mechanisms are being used to gather the malleable metal from existing mines to try to maintain output.

The tin price has increased by 50% to around $1,073 a pound over the past four years and has become less volatile recently. At current prices, it is again viable to open up new mines.

Australia’s biggest tin producer, Metals X (MLX), is up more than 20% in the year-to-date. The company, which owns half of the low-cost producing Renison Bell tin mine, is expected to produce a substantial amount of tin in the future.

However, Metals X is also exposed to the gold price after purchasing a gold mine in Western Australia, and the outlook for gold is bleak (see Gold in the cold).

Another stock in the tin sector is Kasbah Resources (KAS), a miner that Toyota has the option to buy a 20% stake in. This could be because Toyota sees the potential for tin for the development of electric cars, as Gottliebsen said in his article.

But, like Metals X, Kasbah carries a substantial amount of risk as the mine is in Morocco.

Other smaller tin players include Venture Minerals (VMS), Consolidated Tin Mines (CSD), Stellar Resources (SRZ), Elementos (ELT), Ausnico (ANW) and Niuminco (NIU).