How not to win an economic argument

A critique of a yet-to-be-published paper of mine (“Loanable Funds, Endogenous Money and Aggregate Demand”, forthcoming in the Review of Keynesian Economics later this year; the link is to a partial blog post of that paper) by non-mainstream economist Tom Palley reminds me of one of my favourite ripostes by a politician, back in the days before spin doctors stopped them saying anything offensive -- or indeed anything interesting.

As Sir Robert Menzies, former Australian prime minister and leader of the conservative Liberal Party, was giving a campaign speech in 1954, a heckler called out “Mr Menzies, I wouldn't vote for you if you were the Archangel Gabriel”. Menzies shot back: "Madam, if I were the Archangel Gabriel, you would not be in my constituency.”

So it is with Tom’s critique. He criticises me for a whole range of things that I didn’t discuss, that he thinks I should have discussed, and for techniques I used that he thinks I shouldn’t have used. But Tom wasn’t in my intended audience for this paper -- and not because he “wouldn’t be in my constituency”, but because he is. We have our differences, but we’re generally on the same side on the topic of this paper -- and I didn’t write it for people who agree with me, but for those who don’t on two key issues: the role of banks, debt and money in the economy, and the role of the change in debt in aggregate demand.

There are plenty of people in the ‘disagree’ camp -- almost all of them prominent mainstream economists. But the fact that they do disagree with me on this point is, in some respects, mind-blowing. This disagreement has something in common with the Medieval Scholastic “How many angels can dance on the head of a pin?” debates, in that the ordinary folk of the Middle Ages couldn’t believe that the leading intellectuals of the day wasted their time on such topics. Today’s hoi-polloi have a similar reaction: of course banks, debt and money matter in the economy, and of course private debt affects demand: why are economists even debating it?

But debate it they do, and by far the majority position among economists is that (a) banks, debt and money are fripperies that can and should be ignored in macroeconomic models, and (b) that private debt generally doesn’t affect demand (the exception being “except during a liquidity trap”).

I’m with the hoi-polloi on this one: the dominant position in economics is simply nuts. But how do you convince someone who believes that they’re being logical that they are in fact nutty -- especially when they’ve been awarded Nobel Prizes for their nutty ideas?

My approach was to take the other side’s model, and show that if their assumptions were correct, they were right: banks could be ignored in macroeconomics, and changes in private debt had only a miniscule effect on demand.

Then I made one realistic small change, and hey presto -- banks were essential to macroeconomics, and changes in private debt were the main game (but not the only one) in changing aggregate demand.

There was a challenge here: because mainstream economists don’t believe that banks, debt and money matter, the vast majority of mainstream models don’t have banks, debt or money in them. But there was one such model -- by my old mate Paul Krugman and his techno-whiz colleague Gauti Eggertsson, in the online Appendix to their “Debt, Deleveraging, and the Liquidity Trap” paper. Banks did indeed exist in this model, but they functioned as mainstream economists believe they do: as “mere intermediaries between savers and borrowers”. The banking sector took deposits from the public -- which was broken down into consumer-goods producers and investment-goods producers -- and then, in return for an intermediation fee, facilitated loans from the consumer sector to the investment sector.

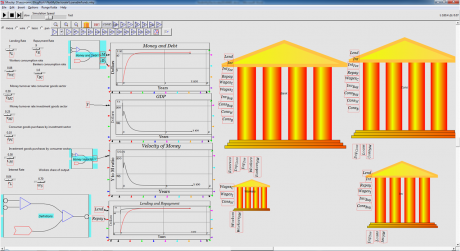

That was pretty easy for me to model in my program Minsky. I created a model with a banking sector that stored everybody’s deposits, but made no loans itself. Instead the consumer-goods sector lent to the investment sector, so loans were an asset of the former and a liability of the latter -- and all the bank got out of it was a fee paid by the consumer goods sector. That set-up is shown in Figure 1, with the direction of flow shown by the arrows.

Figure 1: Flows of money in Loanable Funds

Then I added the other basic financial transactions in the simplest manner possible: both the consumer and investment goods producers had to hire workers, and buy inputs from each other, and both bankers and workers bought consumer goods.

To simulate this model, I needed to put some numbers to the flows, and the simplest manner in which to do this was to relate all rates of spending to the money in bank accounts. I made absolutely no assumptions about why people spend (or lend) -- thus circumventing the religious wars in economics over how behaviour is determined -- and the rates of spending could be varied at will as the model ran.

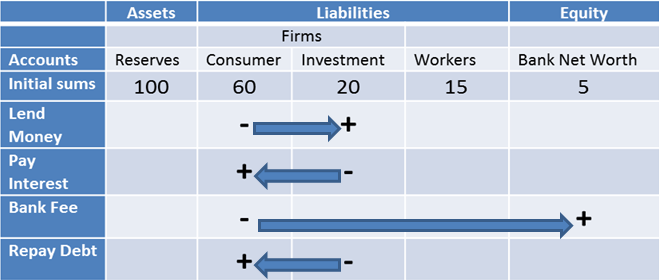

You can try it yourself if you like, by downloading and installing Minsky, running this model (right-click and choose “Save As” to save it, otherwise you’ll get XML gobbledegook in your browser and nothing on your hard disk), and varying the spending and lending rates to change the parameter values as the model runs. Figure 2 shows the model, and how it behaves if the parameters aren’t changed.

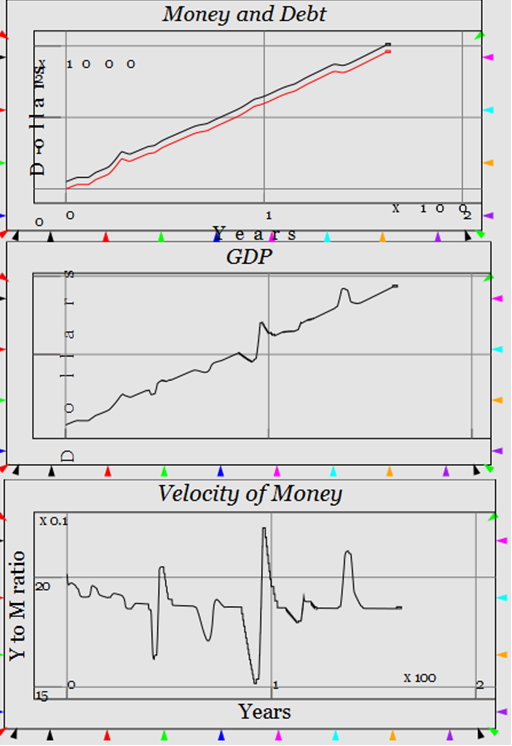

Figure 2: The Loanable Funds model with default parameter values, run for 160 years

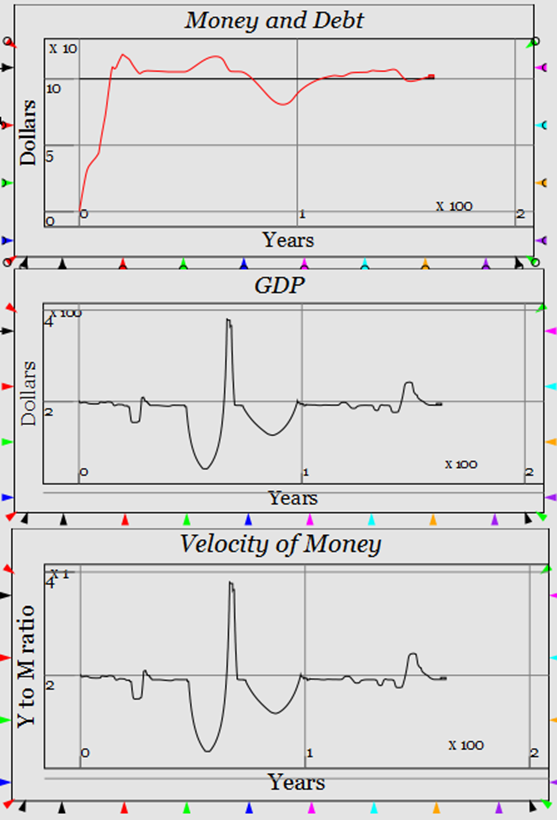

To change them as the model runs, click on a slider (or put your mouse cursor over one of the sliders and use the arrow keys to change its value). You’ll get an outcome something like that in Figure 3, where GDP does indeed change over time -- but the changes precisely mirror those in the velocity of money (which is simply the ratio of GDP to the money stock).

Figure 3: Very every parameter in Loanable Funds and GDP flatlines over 160 years

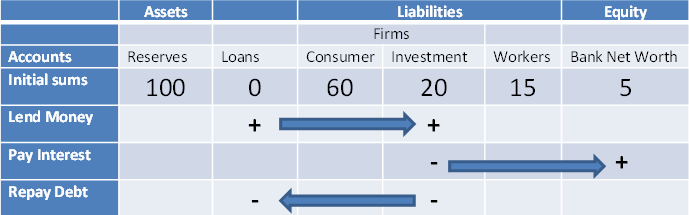

Then, to model the Endogenous Money vision of banking that Tom and I share, I took this model and made two simple changes: lending was from the bank to the investment goods sector (and therefore also interest payments and debt repayments), and there was no intermediation fee. The corresponding table of financial flows is shown in Figure 4 (right-click here to download the model).

Figure 4: Money flows in Endogenous Money

Spinning the parameter values in this model leads to a vastly different outcome, because the growth of loans by the banking sector caused the money supply to grow as well. That’s the essential difference between the mainstream Loanable Funds and the Endogenous Money vision of banking, and that was the key point of my paper and the models in it.

Figure 5: Very every parameter in Endogenous Money and GDP booms and busts over 160 years

This is how the banking sector actually operates in the real world, and I am far from the only one who has been trying -- so far unsuccessfully -- to get this message through the thick skulls of mainstream economists. The Bank of England recently had a go, and Lord Adair Turner -- hardly someone to be dismissed as a “Banking Mystic” -- has recently weighed in:

“We tend to assume that: … Banks take deposits from savers and lend money to finance capital investment, but in fact banks create money and purchasing power, and most lending is unrelated to capital investment.” (Lord Adair Turner, March 26th 2014)

The Endogenous Money model mirrors what happens in the real world, whereas Loanable Funds is a myth that suits mainstream economists because it fits in with their equilibrium fantasy about the nature of capitalism. This Loanable Funds myth that private debt doesn’t matter to macroeconomics cost society dearly, because it is the reason why mainstream economists didn’t see the economic crisis coming.

Now, if I wanted to build a complete economic model, I’d have added all sorts of additional features -- and indeed Tom criticises me for not adding those additional features. But I didn’t add them because this was a deliberately parsimonious model. Why didn’t I model people taking money out of the banking system as cash? Because Krugman and Eggertsson’s didn’t. Why don’t I have consumers borrowing as well as firms? Because Krugman and Eggertsson didn’t either. And so on.

What Tom has done in his critique is ignore the context of the Endogenous Money model in my paper, and then criticise that model in isolation. Well sure, the model can be criticised, but those criticisms are irrelevant to why I developed it, and how it was used in this paper.

In effect, Tom has picked word out of sentence, and criticised the word: why did Shakespeare have Hamlet use the word “question” in “To be or not to be: that is the question”, when “dilemma” is a much better word?

I knew a bloke who used to think like that, way back in my student days in the 1970s. If you said something to him, he would choose the word in your sentence that most interested him, and extemporise on it. It made for amusing but of course pointless discussions as he wandered about Sydney University, throwing marijuana seeds into the flower beds.