How healthy is the Australian residential sector?

Summary: A supply shortage is driving record property demand in Australia, with demand for all dwellings nationally jumping 17 per cent in the past 12 months to September this year. |

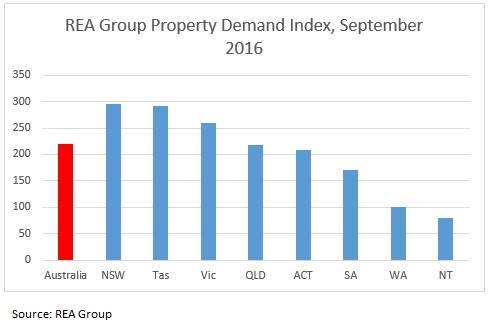

Key take-out: NSW and Victoria remain Australia's most in-demand markets, with demand levels now at their highest ever recorded by REA Group. Tasmania and the ACT are also experiencing strong demand. |

Key beneficiaries: General investors. Category: Property Investment. |

Another report released by a foreign bank, in this case UBS, last month outlined how risky the Sydney residential market was, which added to a long list of offshore observers puzzled by the strength of Australian housing.

Some clearly show a misunderstanding of the market, with the most common misconception being that the slowdown of the resources sector impacts Sydney and Melbourne as equally as Brisbane and Perth. Others, however, make very valid points.

Australian property is very unaffordable based on incomes compared to prices. Australian property is unprofitable based on rental yields. Yet demand continues and prices continue to rise. How healthy is this growth? And should we be worried?

What is driving the market?

In pretty much every country, good economic growth means a strong residential sector. This is because people are employed, confident about their futures and their ability to pay loans. Markets like the US and Australia are seeing good economic growth and housing markets are strong. Contrast this to post Brexit Britain and southern European economies like Italy where economic growth is slow and consequently housing growth is weak.

Although this is generally the case, government policy can significantly change the performance of markets. The Chinese Government regularly introduces policies to calm speculation and overheating. In Vancouver, a city with previously no restrictions on foreign buyers, the introduction of a 15 per cent tax for this group in August led to a drop in properties on the market, although prices have continued to rise. In Australia, the Australian Prudential Regulatory Authority has put restrictions on banks as to how much they can lend to investors. Right now this is having minimal impact on house prices.

How strong is demand for housing?

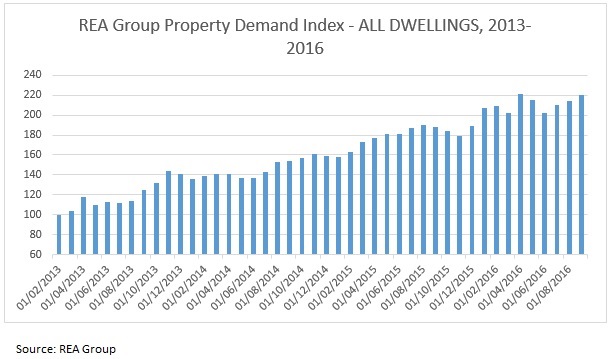

REA Group regularly tracks demand by comparing the number of visits to the number of listings. This week, we launched our inaugural REA Group Property Demand Index, which shows that demand for housing in Australia is high but has come off slightly from a peak in April 2016. Nevertheless, the index has risen by 17 per cent over the past 12 months.

Although the index has risen, there is a difference between how houses are performing relative to apartments. And despite there being significant development of new apartments and concerns about the oversupply of this form of housing, the difference is relatively small. Demand for apartments has risen by 10.7 per cent over the past 12 months compared to 17.6 per cent for houses.

Although demand levels are growing, some states are performing far better than others. Right now, the index is highest in NSW, Tasmania and Victoria, with all these states sitting higher than the Australian average. In NSW and Victoria, this is being driven by strong economic growth. For Tasmania, a strong drive to affordable locations which we are seeing nationally is likely to be a key. The poorest performing states are not surprisingly WA and NT, which have seen declining prices for some time.

Is there too much housing being developed?

Another theme common in the media is that Australia is seeing too much apartment development. In many ways this is contrary to the affordability argument that is also being set. It is difficult for a market to be in oversupply and to also have affordability issues. Without a doubt, there are pockets where there does seem to be too much development such as Melbourne CBD and Brisbane CBD apartments, and house and land developments in Perth. Overall, however, the amount of development taking place does seem about appropriate.

In the case of Sydney, there is still too little development taking place. Sydney is the second least affordable city in the world, based on incomes compared to price growth. The city does not do much better from a rental perspective, being 17 per cent more expensive on a weekly rental than the next most expensive city to rent, which is Canberra. Sydney has built 30 per cent less housing than Melbourne over the past decade. It has lost 160,000 people to other states over the same time period with affordability likely to be a key driver of this, particularly in recent years. If Sydney does not continue to develop more housing at a relatively high rate, it will be a major burden on economic growth as many people find it simply too expensive to live there.

Is there a bubble forming?

The UBS report stated that Sydney was at risk of a bubble because prices have surged over the past five years, and there was too much supply and a slowdown in interest from offshore, predominantly from Chinese buyers. Right now, affordability is an issue and we have seen a slowdown in interest from offshore. However, as our index shows, demand levels still remain elevated and we have issues with too little supply.

Sydney is also continuing to achieve strong economic growth and remains aspirational as somewhere to live. The city may be losing people to interstate but remains the top destination for overseas migrants. It may be expensive, but it would take a strong economic shock, as big as Brexit, for a dramatic reduction in prices. In reality, what is likely to happen is that Sydney prices will continue to surge for some time longer but will then see a relatively flat market for an extended period of time.

In Melbourne, a city that has seen a lot of development, price growth has not been as aggressive over the past five years and overall it remains relatively affordable. In Brisbane and Adelaide, price growth has been relatively soft, while Perth has seen more of a slow deflate as opposed to a dramatic bubble popping decline in prices.

Conclusion

Australia does have issues with affordability and price growth is causing challenges in Sydney in particular. However overall, Australian residential does remain relatively safe compared to other countries around the world.

As a final note the OECD has stated that Australia is one of the most overpriced countries in the world. On the other end, it has stated that the most undervalued country is Japan. Japan is currently going through a major demographic shift.

Over the past five years, the country has shrunk by 1 million people and by the end of the century, Japan stands to lose 34 per cent of its population. This has obvious implications for housing demand with the forecast decline in population of almost 43 million people towards the end of the century leading to more than 14 million dwellings no longer being required.

While Australia may be expensive, we're also forecast to require at least an additional 6 million homes over the same time period, meaning housing will still be in high demand.

Nerida Conisbee is Chief Economist of REA Group.