How Europe's making the market a nervous wreck

Behind the latest fall in global stock markets is a deep-seated fear that the big European banks have lost big sums and once again their solvency will be threatened.

The fact that this is happening at the same time as China’s central bank is signalling that it will not take additional steps to increase liquidity and the US is adjusting to a looming end to quantitative easing adds to the stock market’s nervousness.

At the end of last week you could see nervousness building in European bond and stock markets (A Fed shadow over the real market monsters, June 21).

In simple terms many European banks had suspect balance sheets until the European Central Bank president Mario Draghi last year declared he would do “whatever it takes” to keep the euro from disintegrating.

That boosted Spanish, Italian and German bond prices particularly when the waves of money coming from US quantitative easing flowed into Europe.

Many European bankers, flush with cash, did not have industrial and domestic borrowers to absorb the money so bought bonds. That lowered bond interest rates and took the pressure off governments. Now those bonds are falling rapidly in price and sending up yields. That will put the pressure back on governments.

Spain’s 10-year bond yields jumped to 5.07 per cent last night and Italy’s 10 year yield rose to 4.79 per cent – both up about a percentage point since early May. Greece’s 10-year bond yield managed a low of 8.04 per cent on May 22 but is now 11.31 per cent. In the US the 10-year treasury yield has risen above 2.6 per cent from a low of 2.10 per cent a week ago.

Prior to the 2007 financial crisis, too many bankers gambled with bank money to gain personal bonuses, leaving their banks in danger of requiring a bailout. There are grave fears they have done it again, particularly in Europe.

European share markets are being punished more severely than the US.

Australia is hit with about four forces – China’s lower growth, overseas market weakness and declining commodities, plus our domestic political morass.

But it is not just trading banks that have assembled huge stores of bonds – the Swiss based Bank for International Settlements last night highlighted massive growth of central banks' balance sheets.

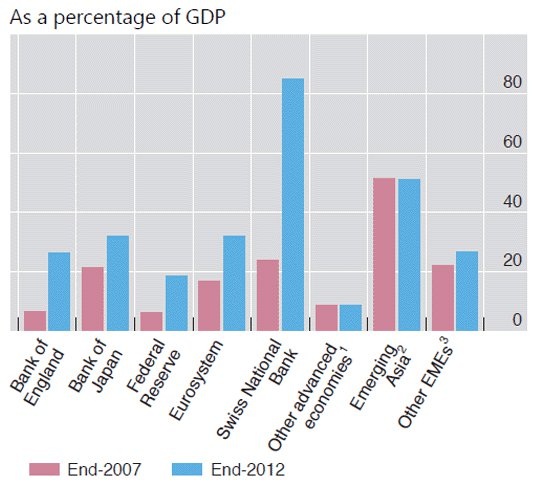

The value of assets held by the world's central banks have doubled over the past six years to about $US20 trillion, the equivalent of about 30 per cent of global gross domestic product. Asia has been a major grower although that growth has been matched by economic growth. Central banks in Asian countries have mainly grown their balance sheets by accumulating foreign exchange reserves.

In the case of Switzerland the central bank is involved in a massive currency stabilisation play which carries high risk.

To the extent that these central bank assets are invested in bonds that are now falling in value it will not be just the big trading banks that will be under pressure.

Below is a graph from the Bank of International Settlements that shows central bank assets as a proportion of countries' GDP: