How does Australia look from overseas? Overweight

Australian equities are a favourite investment class for Australians, and it’s obvious why. Money invested in locally listed companies has grown at a faster rate than if it was invested in an index of international companies.

For the 30 years to December 2014, the S&P/ASX200 index returned 11.4% a year on average, whereas the MSCI World index returned 10.1%.

That might not sound like a huge difference but it means a balance of $10,000 invested here would have grown to $255,009, as opposed to $179,316 if it was invested “over there”.

Australian investors in ASX-listed companies also benefit from franking credits, where company tax paid on profits counts towards the shareholder’s personal tax liability.

For someone in retirement, who pays no tax, $1 of fully-franked dividend is magically transformed to $1.43. Fantastic! Even better, Australian companies pay about twice the yield as international ones.

So we can all give ourselves a pat on the back for having a “home bias” which pays off, but let’s not get complacent.

Out of balance

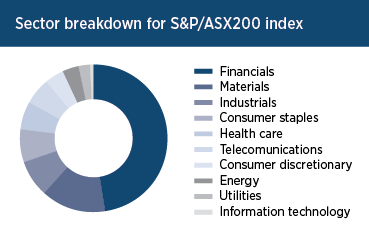

Probably the most compelling reason to diversify into offshore equities is that the local share market is so heavily weighted towards banks, which are included in the “financials” sector of the listed space, and miners, which show up in the “materials” sector.

Banks make up close to half of the index. When miners are included, about 60% of the market is covered.

Is that a reason to be alarmed? It depends how the rest of the world is divided up. Let’s have a look.

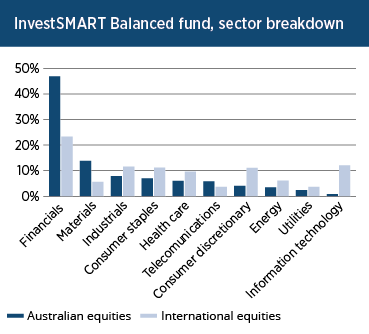

The chart shows the sector breakdown for Australian and international equities holdings for the InvestSMART Balanced portfolio, where offshore holdings are held in a selection of exchange-traded funds over various geographic regions.

Straight away we can see financials is the biggest sector offshore too, but nowhere to the same extent as in Australia. The InvestSMART Balanced Portfolio’s second biggest sector globally is IT, featuring big names such as Apple, Microsoft, Google, Facebook and so on. Australia’s IT sector is tiny in comparison.

The consumer discretionary, health care, consumer staples and industrials sectors are far more prominent in the offshore markets, and populated by the world’s biggest brand names.

Buy the world

It may feel good to look backwards at the past performance of Australian companies and tell yourself it’s better to focus on what happens at home, but the local share market is way off balance when compared with the rest of the world.

Such a concentration of risk may not be a good thing in times ahead. As long as you can do it cheaply, it is better to buy a lot of great companies across a lot of different industries across a lot of different countries. This type of strategy generally outperforms a more reactive asset allocation whereby investors move in and out of cash to in and out of equities as market volatility moves up and down with market cycles.

InvestSMART Diversified Portfolios, allows investors to get access to some of the world greatest brands in some of the fastest growing industries in the world.

Frequently Asked Questions about this Article…

Australian equities are favored by local investors because they have historically provided higher returns compared to international indices. For example, over 30 years, the S&P/ASX200 index returned an average of 11.4% annually, outperforming the MSCI World index's 10.1% return. Additionally, Australian investors benefit from franking credits, which enhance dividend income.

Franking credits are tax credits that Australian investors receive on dividends from local companies. These credits account for the tax already paid by the company, reducing the investor's personal tax liability. For retirees who pay no tax, a fully-franked dividend can increase in value by 43%, making it a significant benefit.

Diversifying into international equities is important because the Australian market is heavily concentrated in the financials and materials sectors, primarily banks and miners. This concentration poses a risk. International markets offer exposure to a broader range of sectors, such as IT, consumer discretionary, and healthcare, providing a more balanced investment portfolio.

The Australian equities market is dominated by the financials and materials sectors, with banks and miners making up about 60% of the market. In contrast, international markets have a more diverse sector composition, with significant representation in IT, consumer discretionary, healthcare, and industrials, featuring global brand names.

Investing in a diversified portfolio, such as InvestSMART's, allows investors to access a wide range of global companies across various industries. This strategy reduces risk by spreading investments across different sectors and countries, potentially leading to better long-term performance compared to a concentrated, reactive investment approach.

Having a 'home bias' can be risky because it limits exposure to a narrow range of sectors and companies, primarily in the local market. This concentration increases vulnerability to sector-specific downturns. Diversifying internationally can mitigate these risks by providing access to a broader array of industries and economic conditions.

Over the long term, Australian equities have outperformed international equities. For instance, from 1984 to 2014, the S&P/ASX200 index delivered an average annual return of 11.4%, compared to the MSCI World index's 10.1%. This performance, coupled with benefits like franking credits, makes Australian equities attractive to local investors.

International markets have a more diverse sector representation compared to Australia. Sectors like IT, consumer discretionary, healthcare, and industrials are more prominent globally. These sectors include some of the world's largest and fastest-growing companies, offering investors opportunities for growth beyond the Australian market.