Housing glut doesn't stack up

| Summary: The property market is on the improve, but that doesn’t point to an imminent housing glut. Apartment construction levels have strengthened, although house construction levels are well below their peaks. |

| Key take-out: The ratio of housing construction relative to population growth continues to fall, strongly suggesting we are nowhere near a glut. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

Pick any major city in Australia and the chances are the skyline is dotted with cranes developing the latest in a series of apartment blocks.

Generationally low interest rates have led to a surge in investor interest in property. Developers have responded. Naturally enough, talk has started that a supply glut is developing and that investors must beware.

So is there a glut?

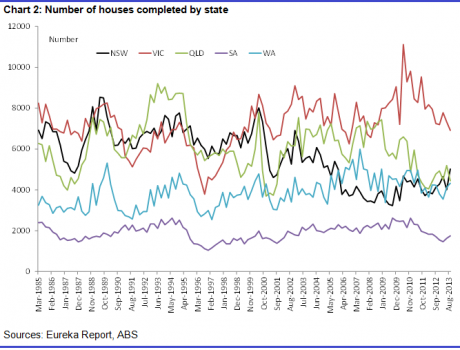

At a national level the answer is an unequivocal ‘no’. The number of houses being built is particularly weak and in fact has been constant, at a decade low, since 2011. In contrast, activity in the apartment space has been stronger – thus the cranes. Yet so far the numbers being built aren’t outside any usual range, especially as recent strength follows a period of weakness from 2005 to 2010. The only thing the data shows is a solid rebound in the number of apartments being built – but that’s not necessarily indicative of a glut.

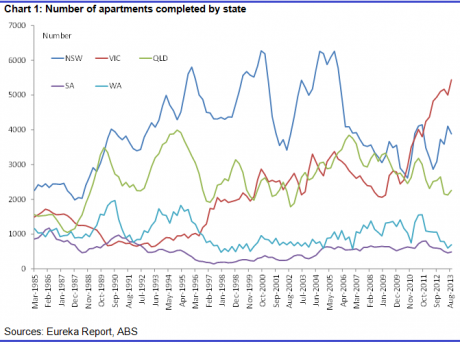

That’s especially the case when you look at chart 1 below. The chart shows the number of apartments being built is really only at ‘elevated’ levels in Victoria – at a record high. Elsewhere, it’s nowhere near as bad. Indeed, even with the recent 35% rebound in apartments completed in NSW, numbers are still some 10% below the 25-year average. Queensland is in a similar boat – 6% below average – and Western Australia is 11% below.

Otherwise, chart 2 shows no problems in any of the states regards housing. Activity has been especially soft in NSW and Queensland.

In terms of a ‘glut’ then, the only contender at this point would be the apartment market in Victoria. I only say ‘contender’ at this point though, and you’ll see why below.

Is there a chance of one developing – or spreading?

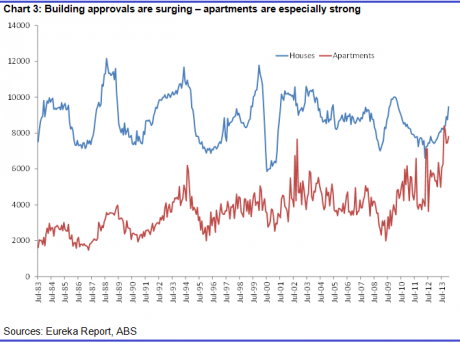

That’s easy. Of course there is, and some analysts are already alarmed by the chart below showing a surge in building approvals.

Once again, I don’t think the housing market is at risk at this point. As you can see from Chart 3, housing approvals have picked up but they are nowhere near peaks yet. Indeed, over the last year they have run about 10% below the decade average and they’re about 25% below cycle peaks. The fact is housing approvals have been quite weak for well over a decade, averaging (since 2000) 2% or so below the prior 14 years. And that’s despite population growth being 50% higher! To even be concerned about a glut of housing you would need to see housing completions surge, on average, by nearly 50%, and we’re a long way from that. Approvals point to maybe a 15% increase.

For apartments it’s a different story. Approvals over the last 12 months have been about 48% above the decade average – they’re at a record high. That decade average in turn is about 40% above the prior 10 years – and the surge is broad-based across the states. It’s perhaps a little disconcerting to note, within that, Victorian apartment approvals are still rising strongly. They are up 24% over the last year and are still some 10% above the average of the last two years, notwithstanding the 150% spike in apartment completions since 2009.

Demand side pressures

In each case though, a surge in approvals doesn’t necessarily mean that a glut will ensue – even in Victoria. This apparent lift in supply has to be measured against demand side pressures. Whether we get a glut or not will depend on how readily this supply gets absorbed.

So far the price mechanism is telling us that there is no shortage of demand – that’s why price growth has been robust. Indeed over the last 12 months – unit prices in Victoria are up about 7% and rental yields are still at a healthy 4.2% (according to RP Data) notwithstanding very strong construction growth rates.

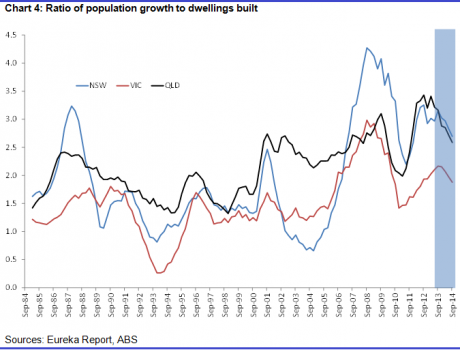

I made the point in 2013 that dwelling construction has been below population growth for many years. This idea has gained significant traction – the Reserve Bank governor only this week noted “on most estimates Australia’s additions to the dwelling stock have been running at a rate below population growth over recent years” and there has been plenty of press on the issue this week as well. Chart 4 below gives you an idea of the magnitude of the problem. It maps population growth to the number of dwellings (houses and apartments) being built – expressed as a ratio. The higher the ratio the stronger population growth is relative to dwelling construction. The shaded area in blue shows you an extrapolation of the ratio using current population growth rates and an assumed 20% surge in dwelling completions.

The bottom line is that dwelling construction has been so weak recently, relative to population growth, that even if we see a surge in building, by the end of 2014, the ratio will still be well above normal levels – even in Victoria. Currently in NSW the ratio is twice its usual value – in Queensland and Victoria it’s over 1.5 times. This may not be unequivocal proof of a shortage, but it does strongly suggest that we are nowhere near a glut.

Noting all of that, and if you want to play it safe, buy an investment house. You can’t go wrong. Buying an apartment is only a little riskier, but if you’re worried you could perhaps avoid the Victorian market. However population statistics suggest there is nothing to worry about there either. In the end, we are nowhere near a glut at this point and one doesn’t look like it is developing given strong population growth.

One could certainly develop, I’m not saying it couldn’t, but we are a very long way from that point. It would take many years of very strong construction growth to even be concerned. Realistically, the main concern for policymakers is still a lack of supply, especially for housing, and affordability. This requires more, not less construction.