Homing in on a soft spot in the US recovery

It’s two steps forward, one step back for the United States recovery, with labour market indicators leading the way but housing and household spending showing signs of moderation. Strength in the labour market will eventually require the Fed to act, consistent with its mandate, but a soft household sector cannot be easily ignored.

Initial jobless claims declined to 284,000 in the week ending 19 July, with the four week average falling to its lowest level since mid-2007. These results are consistent with strong job growth across the broader economy, with the last five months creating the greatest number of jobs in eight years (US jobs growth could spur an early rate hike, July 4).

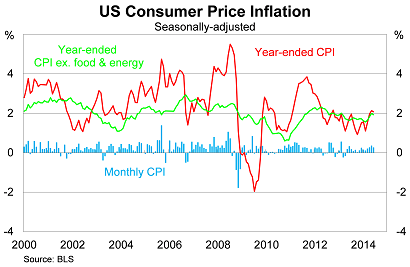

Consistent with the labour market tightening a little, headline inflation rose by 0.3 per cent in June to be 2.1 per cent higher over the year. Core inflation, which excludes volatile items such as food and energy, climbed by 0.1 per cent, to be 1.9 per cent high over the year to June.

While some measures of inflation are either at or approaching the Fed’s upper target for annual inflation, their preferred measure remains somewhat weaker and hints at greater spare capacity than indicated by the unemployment rate.

The core personal consumption expenditure deflator is tracking well below other measures of inflation, increasing by just 1.5 per cent over the year to May.

The different measures of inflation are showing some signs of convergence and I expect that to continue, suggesting that the core PCE measure will push towards the Fed’s upper target before the year is out.

While the labour market goes from strength to strength, the same cannot be said for household spending or the US housing sector.

The household sector continues to misfire, following a subdued start to the year, and is set to contribute only modestly to growth in the June quarter. Real personal consumption in April and May is only 0.3 per cent above the March quarter average. More timely data showed that retail sales rose by just 0.2 per cent in June.

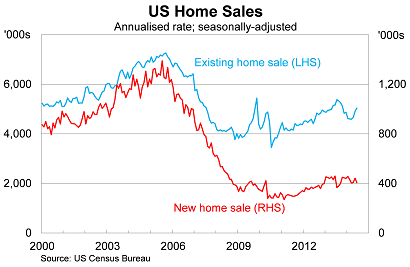

According to the Fed minutes from mid-June, the housing sector remains fairly subdued and recent data was no exception.

New homes sales fell by 8.1 per cent in June, completely offsetting last month’s stellar gain, to be 11.5 per cent lower over the year. In addition, the May reading suffered the largest downward revision on record.

Existing home sales have improved significantly over the past three months but are still 2.3 per cent lower than they were a year ago. Building permits, which are a useful measure of upcoming residential construction, are only slightly higher over the year.

Mixed data creates a challenge for central banks, who have to peer through the volatility and identify the key trends. The housing sector remains disappointing but, following the global financial crisis, residential construction is simply too small to do much damage to overall momentum.

Household spending is a legitimate concern -- perhaps reflecting the decision to not extend unemployment benefits -- but strong growth in non-farm payrolls should begin to support a less cautious household sector.

As a result, I’d recommend focusing more on the labour market data, which provides a clear indication that the US recovery remains on track. With the unemployment rate set to fall below 6 per cent in the next few months, it will become increasingly difficult for the Fed to justify such low interest rates.

The Fed is all but certain to wind back its asset purchases by a further US$10 billion when they meet at the end of July. But it should also give serious consideration to adjusting its communication, preparing markets for the possibility that rates may climb sooner than expected.