Hold the fizz on a retail victory

Household spending is booming but now we need some jobs created. Only then can we be confident that the Australian economy is on its way to a sustainable rebalancing of its growth drivers.

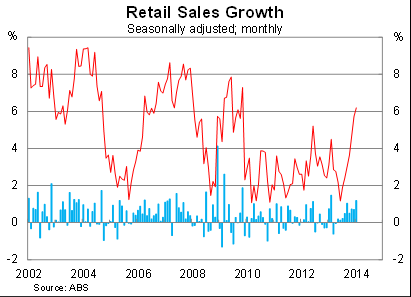

Retail spending rose by 1.2 per cent in January, much higher than market expectations, to be 6.2 per cent higher over the year. Annual growth is now at its highest level since November 2009.

With wage growth remaining subdued, Australian households continued to dip into their savings during January, following a strong December quarter. It is evidence of a more optimistic household sector, which has been buoyed by rising asset prices and lower interest repayments.

Interestingly it sits in stark contrast with measures of consumer sentiment, which have fallen significantly over the past few months. According to those measures households are becoming a little more cautious. I’m sure this inconsistency will be rectified – one way or another – soon.

In the meantime though it is clear that low interest rates have prompted households to spend more and they are certainly doing their bit to help rebalance the Australian economy. Exactly as the Reserve Bank would have hoped.

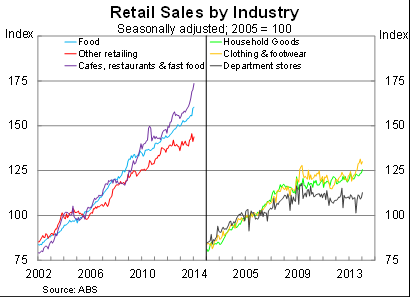

January saw a cyclical upswing in household spending, with discretionary items doing particularly well. Growth was led by spending at cafes and restaurants, while household goods also did very well. The overall result was particularly impressive given the minor contribution from food, which is by far the biggest category for retail sales.

At the state level we continue to see a shift away from Western Australia, where sales fell by 0.3 per cent in January. But that is hardly a surprise and exactly what we would expect as the economy rebalances away from the mining sector.

Sales in the other mainland states were up, with particular strength observed in New South Wales and Victoria. New South Wales actually accounted for over half the growth in January and 40 per cent of retail sales growth over the past twelve months.

The data suggests that the Australian economy has continued to rebalance, perhaps at a faster pace than analysts suggested. Solid export data, also out today, would tend to collaborate with that narrative – as does the December quarter GDP result.

The next challenge for the Australian economy is to generate some jobs. Employment didn’t grow at all over the year to January and the economy continues to lose full-time jobs in favour of more flexible but lower paying part-time ones. The real cause for celebration will depend on whether the momentum in household spending can translate into a material pick-up in job creation. If it can’t then that momentum will quickly slow.

Another factor worth mentioning is that the government’s Schoolkids Bonus came through in January, providing eligible families with $205 for each child in primary school and $410 for each child in high school. This may have temporarily boosted department store spending and clothing and footwear, and could lead to a dip in growth for February.

The Reserve Bank will certainly be pleased with most of the new data released over the past couple of weeks – capital expenditure notwithstanding – but I don’t expect it to move on rates. At least not yet – I expect it to wait until it knows more about the government’s budget intentions.

The RBA is currently playing a long game, with one eye set firmly on 2014 and the other on 2015. It know that business investment is set to collapse and its board members knows that they have to ensure that the economy is in good state when that occurs. They will be reluctant to lift rates much, thereby slowing momentum and increasing the Australian dollar, before that event arrives.