Hockey needs a crash course on income tax

Does federal Treasurer Joe Hockey require a crash course on Australia's tax system?

Speaking to Neil Mitchell on radio station 3AW yesterday, Hockey made a serious blunder that begs the question: does the Treasurer understand the difference between marginal and average tax rates?

The average tax rate is, of course, the total amount of tax you pay divided by your income. The marginal tax rate, on the other hand, is the amount of tax you pay on each additional dollar you earn; for low income earners the marginal tax rate is low (or even nothing) and it increases as you push into a higher tax bracket.

It's pretty simple stuff but apparently beyond the comprehension of our federal Treasurer.

“When Australians spend the first six months of the year working for the government with tax rates nearly 50 cents in the dollar it is a disincentive,” Hockey said. “You're working July, August, September, October, November, December just for the government and then you start working for yourself.”

What's amusing about this statement is that it is complete nonsense. There is not a single Australian in the country paying half their income in tax. Hockey's statement applies to not a single Australian -- rich or poor.

The highest marginal tax rate in Australia is 45 per cent and is applied to incomes over $180,000. Higher income earners also get slugged an extra 2 per cent for the Medicare Levy and the deficit tax; bringing their marginal tax rate to 49 per cent.

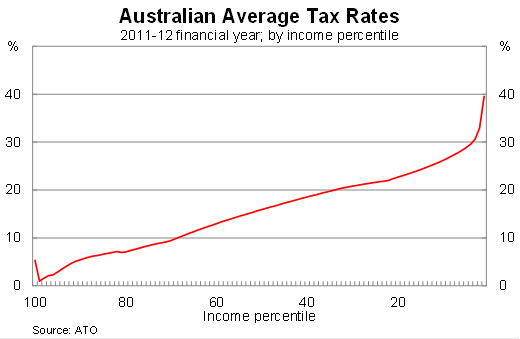

Average tax rates, by comparison, are much lower. Ignoring the Medicare Levy and the deficit tax, someone earning $180,000 will actually have an average tax rate of around 30 per cent.

Someone earning $1,000,000 a year will have an average tax rate of around 42 per cent. Adding in the Medicare Levy and the deficit tax is difficult -- owing to a variety of scenarios relating to relationship status and kids -- but the results are still well below Hockey's claims.

As of the 2011-12 financial year, just 3 per cent of Australians earned $180,000 per year. That has surely increased since then -- due to inflation and income growth -- but would still reflect an exceptionally small share of Australians.

Utilising the tax statistics from the Australian Taxation Office we can get a feel for how misleading Hockey's statement was. In 2011-12, the top 1 per cent of income earners (earning more than $291,007) paid 39.5 per cent of their income in tax after deductions.

The top 10 per cent (those earning as much as $115,848) gave the federal government 26.2 per cent of their income. Those in the top 20 per cent (earning as much as $84,513) paid just 22.3 per cent.

Realistically these stats, while useful, don't really give the full picture. The federal government offers world-leading deductions and tax concessions that are simply not captured by the ATO data.

An IMF study, released last year, shows that no other advanced country foregoes more tax revenue through “differential, or preferential, treatment of specific sectors, activities, regions or agents”, on an annual basis than Australia (It's time to fix Australia's leaky tax sieve, January 31).

These include everything from the capital gains tax, negative gearing and superannuation concessions. While the marginal tax rate on income might be high in Australia there is no shortage of ways to reduce your tax burden. These tax concessions are significant -- accounting for as much as 8 per cent of nominal GDP -- and primarily accrue to the wealthy.

Hockey is right to say that income tax is too high and he is also correct in saying that high taxes create disincentives. I'm sympathetic to his need to reform welfare spending -- even if we don't agree on the particulars -- and if the federal government does push for widespread tax reform I'd get behind that as well.

But the debate doesn't benefit from distorting the statistics nor does Hockey's credibility benefit from failing to grasp the subtle difference between average and marginal tax rates. The Abbott government's margin for error right now is non-existent and Hockey should have learnt his lesson following similar gaffes last year.