Historic pact; Turkey crossroads; Arctic winds

The surprise announcement of an agreement between China and the US – the world's largest emitters – to limit carbon pollution dominated the news last week. Not only does the deal alter the course for the two countries involved, it may nudge otherwise recalcitrant emitters to commit to reductions, and limit global warming.

US President Barack Obama pledged to cut his country's emissions by 26-28% by 2025 from 2005 levels. The earlier target was to reach 17% below the 2005 emissions level by 2020. His Chinese counterpart, Xi Jinping, said that that China's emissions would peak by 2030, and that 20% of its primary energy mix will be derived from zero-carbon sources.

“The two giants coming to an agreement in any form carries weight. The pact shows strong support for the global climate negotiations process leading up to talks in Paris next year. And it may put pressure on other major emitters to come forward with their own goals,” Bloomberg New Energy Finance said in a note, published last week: The ambition and significance of the US-China Climate Pact.

BNEF analysis shows China's power sector emissions peaking around 2026 at just over 6.3Gt/year. Power sector emissions in the US will drop 30% by 2025, even if there are no new policies. Though the transport sector's emissions are also expected to continue to fall, “the US would need to stretch – and more policy will be needed – to get to 26% reductions economy-wide,” the note said.

Obama is widely expected to sidestep Congress and rely on regulatory agencies like the Environmental Protection Agency to implement the cuts, steps that Republicans promised to undo. “This deal is a non-binding charade,” Jim Inhofe, an Oklahoma Republican who is the senior member of the Senate Environment and Public Works Committee, said in a statement. “As we enter a new Congress, I will do everything in my power to rein in and shed light on the EPA's unchecked regulations.”

Meanwhile, chief executives of the biggest coal burning utilities in the US predicted black-outs and rising power bills if they were not given more time to achieve emission cuts. The move threatens to shutter coal-fired plants before enough new generation can be built to replace lost supplies, said Thomas Fanning, chief executive officer of Southern Company, and Nick Akins, CEO of American Electric Power.

In Turkey today, Bloomberg New Energy Finance is launching a report examining the power choices for that country to 2030. The report , funded by the European Climate Foundation and commissioned by WWF-Turkey, argues that a renewables-based strategy could meet Turkey's power needs over the years ahead at comparable cost to the coal-led strategy its government has so far favoured.

Moving to Europe, the news was more about projects. The Isle of Man, a UK dependency in the Irish Sea, said Denmark's Dong Energy was its preferred developer for a 700MW offshore wind farm. The project is to be delivered in 2023.

In Norway, Swedish wind developer Eolus Vind bagged permission to build a 330MW farm – Norway's largest. Bloomberg New Energy Finance expects global onshore wind installations to peak at 55GW in 2015, as policy uncertainty impacts build-out. Details of the forecast for the onshore and the offshore wind market can be found in our note: Q4 2014 Global Wind Market Outlook.

In the solar sector, Chinese developer Sky Solar managed to raise $44.2m in an initial public offering after twice delaying listing in the US. The company – now listed on the Nasdaq – initially sought to raise as much as $150m.

In Egypt, the government unveiled plans to invite bids to construct 2GW of solar PV projects of 0.5-50MW each and 2GW of wind farms of 20-50MW in its first auctions for clean energy subsidies. The targets for the next three years also include 300MW of smaller solar plants.

*All figure are in US dollars.

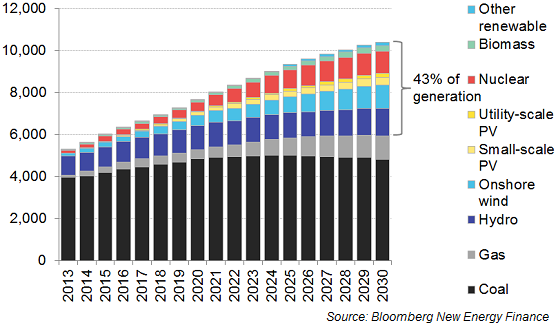

Graph of the week: Finance expects renewables and nuclear to make up 43% of total power generation in 2030.

Originally published by Bloomberg New Energy Finance. Reproduced with permission.