Heading into a market rebound

| Summary: Australia’s economic performance has been weak compared with other markets, including our major trading partners. But with our markets and currency both downtrodden, while China and other nations continue to power ahead, the domestic slowdown should bottom within months. |

| Key take-out: Domestic markets, and the dollar, are set to rise strongly over the course of 2013 and into 2014. |

| Key beneficiaries: General investors. Category: Economy. |

The Australian economy is slowing sharply, and this has been a developing trend for several years. Rather than an outperformer relative to OECD nations, the tables have fully turned and Australia is now an underperformer in an outperforming world.

Australia is an island of decline, adrift in a sea of prosperity! Paradoxically, this creates surprising opportunity in stocks and the currency.

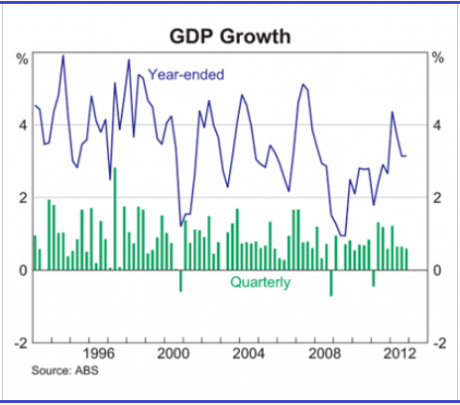

Australia’s GDP was shown this week to have dropped to just 0.6% in the first quarter, and just 2.5% for the year. This is a rather poor performance, especially as we do continue to live in the midst of an ongoing resources boom. In fact, if it were not for the mining industry, the domestic economy would be headed for recession.

We have been a nation hiding under the bed sheets of aggregate GDP data for too long. It has been patently obvious for some time that Australia had become the great “underperformer of Asia”, and now that reality is becoming clearly visible on a much larger stage. Australia’s economic performance is sliding down a slippery slope so quickly that even the US economy is strengthening beyond ours, as has Japan’s.

Through the GFC and since, all around us our Asian economic neighbours have been doing better than us. Yet for some reason our leaders, political and of the Reserve Bank, have chosen to focus on aggregate data which includes the resources boom, a function of well-run economies in China and broader Asia mind you. Meanwhile domestic economic growth has been lacklustre, to say the least.

Yet instead of addressing some very real domestic economic challenges, we as a nation have been patting ourselves on the back. How often do we hear that poor economic outcomes are a function of a negative global environment, and good economic outcomes are of our own making. Now that the global environment has been clearly strengthening for some time, such claims are becoming increasingly transparent.

We are a nation that has been living off the back of Chinese workers.

Even the US is doing better. US Q1 GDP came in at 2.4%, but this included a healthy 11.6% reduction in government defence spending. In Australia, by comparison, our 2.5% Q1 GDP outcome included a historically heightened level of public spending. It is abundantly clear which economy has the more vibrant private sector, and the private sector is always the real lasting engine for growth and prosperity.

The US is now on a path to sustained recovery, whereas Australia is clearly leaning toward domestic recession. This is in comparison to a country with high unemployment that has forced government spending reductions. The US, despite its challenges, is in fact outperforming a resource rich nation of just 23 million people geographically located on the door-step of Asia. One would think, as I once did, that Australia should be the Saudi Arabia of the south by now?

The miner’s success has not been born just of opportunity, but of decades of effort to attain world’s best operating practices. The domestic economy has languished, not entirely of its own fault, and certainly not due as significantly to the strong dollar as many would suggest. The cause has been largely due to ever-more onerous layers of regulation and taxation, as well as a period of confoundedly aggressive monetary policy.

It has been convenient to compare ourselves with the worst teams in the competition. This was always to a degree nonsensical, as the OECD nations, though significant, are not part of our economic region, nor are they our major trading partners. Two-thirds of our exports go to Asia, and Asian nations have in the main significantly outperformed Australia through and since the GFC. For Australia to have a true handle on how it is performing, we must compare ourselves with our economic neighbours with whom we do most of our trade.

Even Japan, with its significant challenges and power-sharing environment in their current non-nuclear age, had Q1 GDP growth of 3.5%. Japan long ago refocussed on China, which has become its largest export market over the US. Australia too has belatedly focussed on China, but seems oblivious to the Russian threat. Russia is similarly resource rich, and can connect by road and rail to Chinese markets. Russia is pursuing aggressive marketing for its resource companies, while in Australia we create greater regulatory and tax hurdles for our miners.

Market implications

Ironically, the market implications of all this are truly exciting!

What we have is a very strong and improving global economy. Even Europe is likely to be achieving positive growth within one or two quarters, the US recovery is sound, and China continues to power ahead. However, in Australia we have had this tremendous overreaction to the idea that the global economy is still in trouble, and then exaggerated the downside in already falling markets with the seeming surprise reaction to the brutal truth of a dire domestic economy this week. This has brought stockmarket values and the Australian dollar back to absurdly low levels. The ASX 200 Index opened at 4,780 today, but fell.

The resources boom is ongoing, with China continuing to import greater quantities of mineral and rural commodities each and every month.

Certainly the domestic situation has been intensified by the forthcoming election. Until now Australian businesses were not prepared to pre-empt the election outcome, not willing to expand and invest, when the regulatory environment is uncertain. Once the election is out of the way, however, Australia should experience a sharp rise in business investment, and perhaps even a sharp rise in consumer sentiment and confidence. So the domestic slowdown should bottom within months.

Subsequently, while the current calendar year may only produce a GDP growth rate of 1.8% to 2.0%, the following year of 2014 may well see a historically unusual sharp acceleration, to 4.5%.

For equity markets, the coming together of a continuing strong global and regional environment, with an unleashing of pent-up domestic investment potential, is likely to see the ASX 200 hit 5,700 by year end. The Australian dollar has likely already bottomed, and is already on its way back to $US1.06, then perhaps early next year $US1.13. Though this last target cannot be ruled out for this year as well.

Clifford Bennet is chief economist of the White Crane Group at http://www.whitecranegroup.com.au/eureka/