Have solar rooftop owners had a windfall gain?

The installation of rooftop solar in Australia has been remarkable in many ways. More than one in eight detached and semi-detached homes now have rooftop solar systems. No other country has reached this level of market penetration. But our systems are also on average the smallest: in Germany – which has the greatest quantity of PV installed in absolute terms and per energy users – systems are typically 12 times bigger than those in Australia.

The rise of rooftop PV in Australia has been remarkably rapid – in just three years from the start of 2010 to the end of 2012 cumulative installed capacity increased from just under 80,000 systems to just shy of a million. The total investment by households in rooftop PV in this period has been more than $9 billion. Rooftop PV, funded and owned by households, not utilities, has attracted more investment than any other electricity generation technology in Australia over the last decade.

Such rapid expansion was almost universally unexpected, at least in government and policy circles. With hindsight, commentators have ascribed the rapid uptake to falling system and installation costs and householders’ response to increases in electricity prices, both of which exceeded the expectations of policymakers and their advisors and which therefore meant that feed-in tariffs and renewable energy certificates became much more effective than expected in stimulating demand for PV.

Such a rapid transformation has ruffled many feathers. In debates, blogs and commentaries there seems to be a perception, possibly widely held, that the owners of the million PV rooftops have enjoyed a windfall gain as a result of feed-in tariffs and renewable energy certificates which have been more generous than they should have been. But is this windfall gain perception valid?

We collected and analysed the data in an effort to find out, focusing on the period from the start of 2010 to the end of 2012 during which the combination of premium feed-in tariffs and renewable energy target certificate multipliers prevailed. We adopted traditional project finance analysis of the 899,017 rooftop PV systems installed in this period.

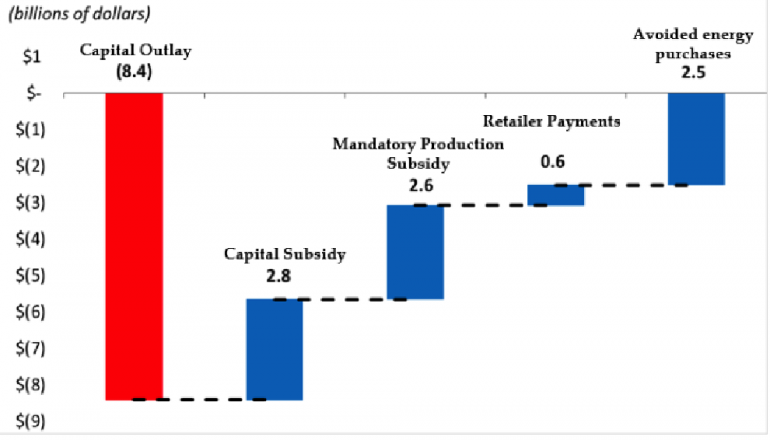

We calculated the income (feed-in tariff payments, renewable energy target certificates, retailer payments and avoided energy purchases) that these systems can be expected to deliver. Then we calculated the discount rate at which the present value of the income would be equivalent to the present value of the investment. The resulting discount rate, known as the 'Internal Rate of Return', is an estimate of the return that the average household in Australia that installed PV during the period from the start of January in 2010 to the end of December in 2012 can expect to achieve

The answer? Almost 10 per cent, post tax. Individual households will do better or worse than this depending on many factors. The chart of the Net Present Value calculation for all 899,017 PV installations, discounted at the Internal Rate of Return is shown below:

The Internal Rate of Return varies from 11.5 per cent in South Australia to 5.5 per cent in Tasmania. These results suggest that households that invested in rooftop PV will, on average, achieve much the same return that a utility could reasonably have expected for the same investment. Rates of return at these levels are not synonymous with windfall gains. It suggests that opposition to the retrospective claw back of feed-in tariffs payments, as attempted in Western Australia and before that in New South Wales, was not unreasonable.

But without feed-in tariffs and renewable energy certificates, returns would have been strongly negative. The next installment looks at things from the perspective of other energy users whose involuntary largesse explains so much of the rise of residential rooftop PV in Australia.

Bruce Mountain is director of Carbon and Energy Markets.

*This article is the first in a four part series based on the chapter Australia’s million solar roofs: Disruption on the fringes or the beginning of a new order by Bruce Mountain and Paul Szuster to be published in Distributed Generation and its Implications for the Utility Industry, edited by Fereidoon P. Sioshansi, published by Academic Press.