Have baby boomers made a big investment mistake?

Could the baby boomers’ love of investment property end in tears? According to Reserve Bank of Australia governor Glenn Stevens, it might be time to diversify your investment portfolio.

Speaking in Adelaide yesterday, Stevens took the opportunity to warn investors about the housing market. Fears that the property market has overheated have increased recently, with the International Monetary Fund voicing concerns a few months ago and The Economist recently publishing an article that showed that Australia has some of the most overvalued property in the world.

“We perhaps have been a little bit over keen on investment property as our retirement plan,” Stevens said. “We may at some point be a little disappointed.”

The Australian property market is worth over $5 trillion and accounts for a majority of net wealth for most households. It’s fair to say that Australians love owning property and, given strong growth in recent decades, property has been a great investment for a long time.

Some of those gains have reflected savvy investment but, for the most part, the high returns to housing reflect banking deregulation during the 1980s, favourable demographics, almost 25 years of uninterrupted growth and a host of inefficient government policies designed to boost prices at the expense of affordability and productive investment.

The Australian tax system, including negative gearing, the first home owner grant and the capital gains reduction, is particularly susceptible to housing bubbles. Combined with the major banks’ preference for mortgage lending, the potential for irrational exuberance should be obvious.

The big questions right now are: have property investors gone too far? Have the banks been greedy? And are current house prices sustainable in the long-term?

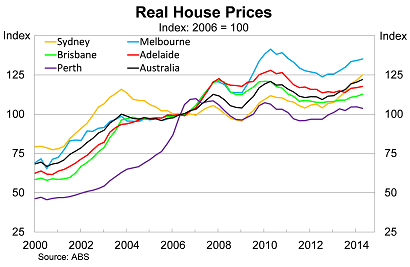

The last time investor demand was this high in Sydney, it kicked off a price crash that saw real house prices decline by 16 per cent peak-to-trough. It also took a decade before prices regained their peak. It’s hardly a surprise that Stevens is a little concerned about investors.

As for our banks, mortgage lending has accounted for the entire increase in credit outstanding since the onset of the global financial crisis. By comparison, lending to businesses has actually declined over the past six years.

Loose lending by banks has recently gained the attention of David Murray and the financial system inquiry. The discussion has now shifted beyond a simple concern about household wealth towards the more important issue of systemic risk and our bank’s management of that risk (Murray must address the moral hazard in housing, July 16).

Stevens also touched on another important factor that will influence house price growth over the next few decades. Demographic shifts are set to have a large impact across the Australian economy and the housing sector will be no exception.

An ageing population will result in a significant shift in the composition of the Australian workforce, as what has historically been our largest cohort (the baby boomers) retire. Structurally this will weigh on income and real GDP growth -- points made recently by both the federal Treasury and RBA deputy governor Philip Lowe.

The real problem for ‘baby boomers’ will arise when they either decide to downsize their current home or free up wealth by selling their investment properties. Who will buy these properties? Unfortunately for the ‘baby boomers’ it will largely be the households who, by virtue of being born at the wrong time, haven't had the opportunity to accumulate housing wealth and cannot afford to buy property at existing prices.

The balance of power in the Australian economy will subtly shift away from the baby boomers towards younger and poorer households. With competition for prime real estate easing, particularly once the labour force begins to decline, there will be no need to take on as much debt or pay the housing multiples that are currently considered normal.

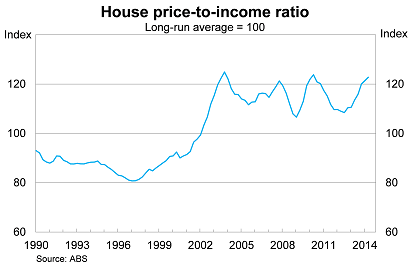

Even if that scenario doesn’t eventuate, the best case scenario for housing is that it simply fluctuates around household disposable income, as it has done for much of the past decade. Certainly investors shouldn’t expect the market to replicate the debt-fuelled boom that characterised the 1980s and 1990s.

An ageing population places a greater burden on the labour force to support the broader economy and will encourage a shift towards lower income growth. A recent paper by the RBA suggested that under those conditions, house prices could be overvalued by around 20 per cent (The great Australian housing rip-off, July 15).

Unfortunately when it comes to an ageing population, there is a lot of speculation. The simple fact is that the only real precedent we have is Japan and they have been stuck with 0 per cent interest rates and falling house prices for the best part of 25 years. According to The Economist, real house prices in Japan have declined by 44 per cent since 1990, in stark contrast to most of the western world.

As far as ageing populations go, Japan is decades ahead of where Australia is and it certainly doesn’t have our strong population growth or immigration intake. As such, the impact of ageing on our economy and the housing sector is unlikely to be as severe but it remains an issue that investors should factor into investment decisions.

House price growth has been strong over the past couple of years -- albeit focused in Sydney and Melbourne -- but the potential systemic risks of a prolonged housing downturn are very real. But the more interesting developments are occurring below the surface and are subtly shifting the composition of the market. The retirement of the very wealth baby boomers presents a unique challenge for the housing sector and Stevens may well be right: the ‘baby boomers’ have relied too much on investment property.